Gold prices fell for a second day and settled at $1124.56 per ounce, losing $8.53, as strong gains in the U.S. dollar helped draw investors away from the precious metal. Although the Fed's decision to leave rates unchanged pushed prices higher last week, gold failed to maintain those gains as the economic growth picture in China remained in question. Federal Reserve Chair Janet Yellen is scheduled to speak on Thursday, and she may provide more clarity as to whether interest rates will increase this year.

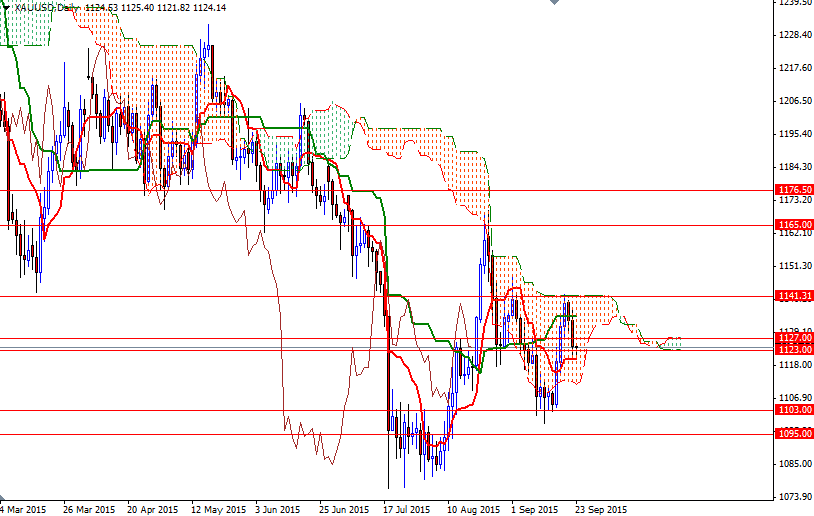

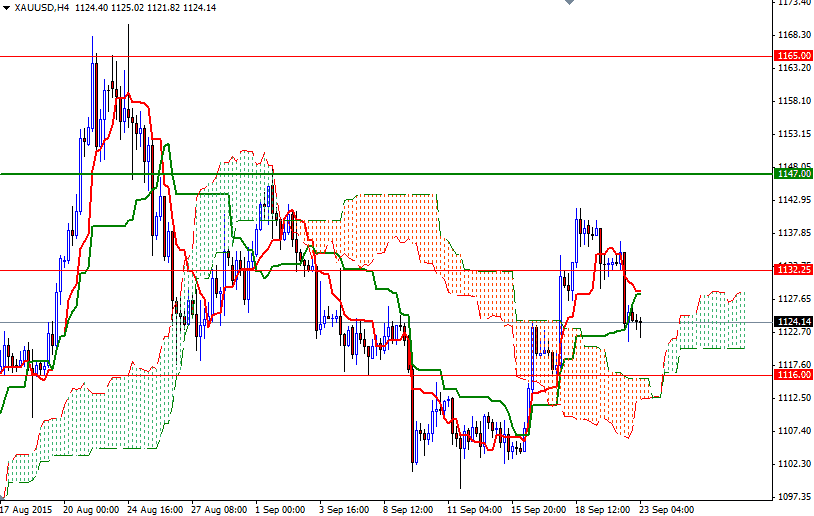

Technical selling was also behind gold's 0.75% decline yesterday. Not surprisingly, failing to hold above the 1132.25 level caused very short-term charts to realign with longer-term bearish inclinations and as a result the XAU/USD pair pulled back to test the supports at 1127 and 1123. As you can see on the daily chart, the XAU/USD pair is trading within the borders of the Ichimoku clouds and both the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) are completely flat - indicating the market will be range bound over the short-term.

To the downside, the initial support stands in the 1123/0 region. If the market dives below the daily Tenkan-Sen line, then prices will probably fall to the 1116 level before finding some support. Once below that the bears will be aiming for the 1111.55 level which happens to be the bottom of the daily cloud. However, if the bulls successfully defend the 1123/0 region and prices start to rise, we could see a test of the 1132.25 - 1129 resistance zone. The bulls will need to pass through there so that they can challenge the bears waiting at 1141.31.