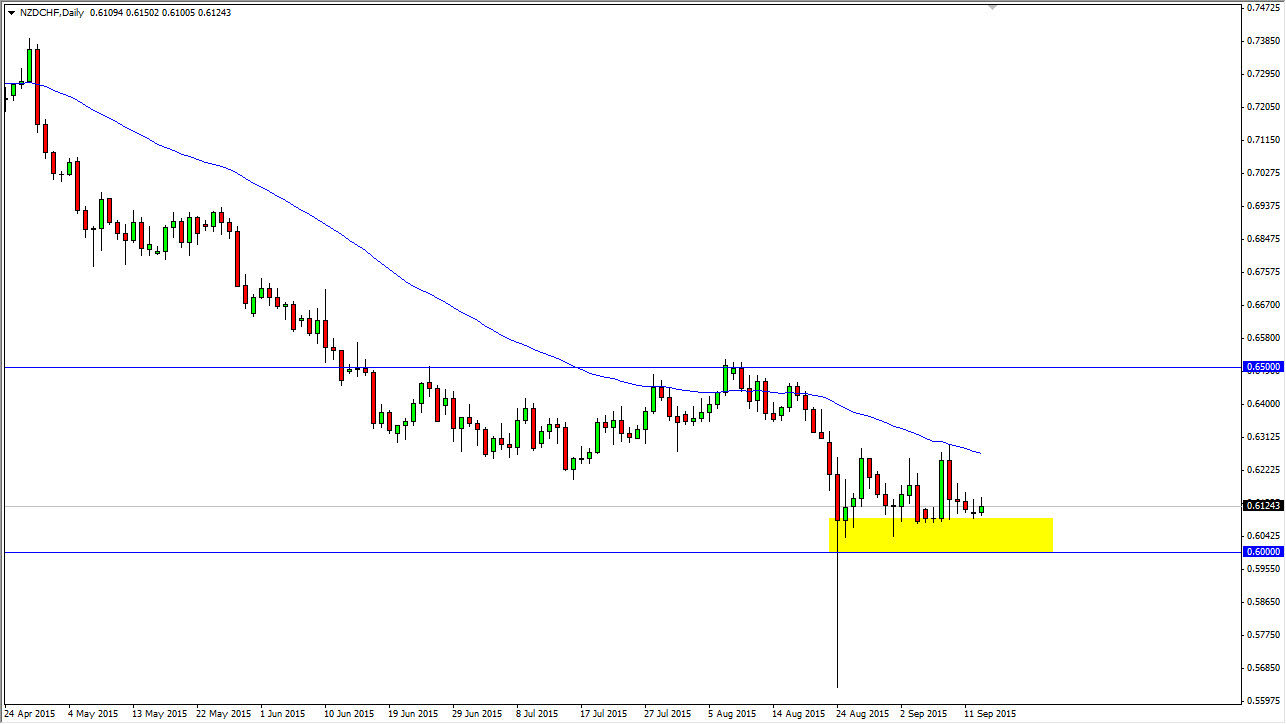

The NZD/CHF pair initially tried to rally during the course of the session on Monday, but as you can see pulled back. However, what I find most interesting about this chart is the fact that we continue to find support somewhere near the 0.61 handle, and that suggests to me that we may have a bit of a zone going at the moment. After all, I would anticipate the 0.60 level to offer support as well, and the fact that the massive selloff from a couple of weeks ago bounced back above that level and formed a massive hammer suggests that the market will in fact continue to find buyers in this region.

Keep in mind that this pair is highly sensitive to risk appetite around the world. Mainly because the Swiss franc of course is considered to be one of the “safest” currencies in the world. On the other end of the spectrum you have the New Zealand dollar, which of course is very highly correlated to risk appetite as the commodity markets will have such an effect on the Kiwi itself.

Asia

While I see a massive amount of support below, you have to keep in mind that growth in Asia is slowing, and that of course has people concerned about owning the New Zealand dollar anyway. With this, I think that rallies will probably be the best way to play this market, and of course selling them will be the thing to do. Any supportive candle in this region will probably have buyers involved, but at the end of the day I think the longer-term traders will continue to follow the trend.

As long as we are below the 50 day exponential moving average which I have plotted on the chart, I have no interest whatsoever in buying this pair. If we did manage break above there, and more importantly the 0.65 handle, at that point in time I feel that the trend would start to change. Ultimately though, if we can break down below the 0.60 level, this market should really start to fall apart again.