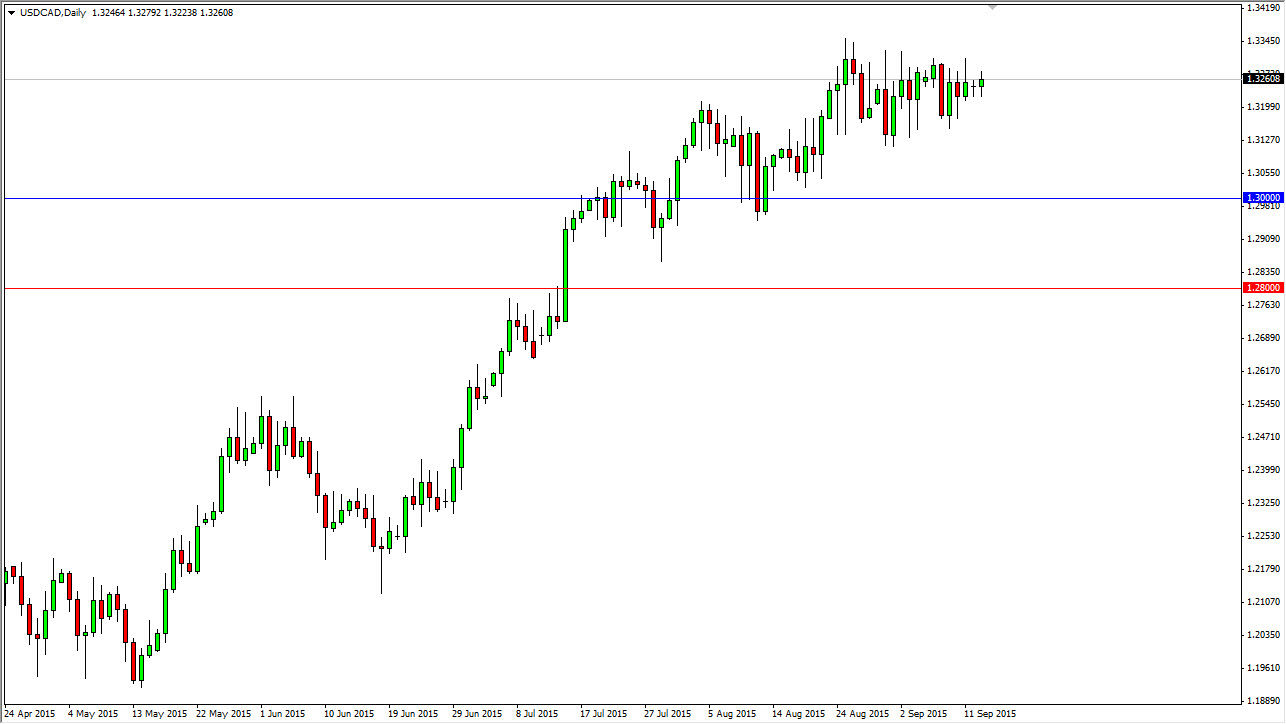

The USD/CAD pair went back and forth during the course of the session on Monday, as we continue to simply grind away to the side. With this being the case, it looks as if the market is waiting, and I believe that it is waiting on the Federal Reserve announcement during the Thursday session. The real interest will be paid to the statement, as people will try to discern as to whether or not the Federal Reserve will raise interest rates more than just once. On top of that, they may not raise interest rates at all, which of course would be a bit of a shock to the market.

The oil markets have been soft for some time now, and with that the 1.30 level needs to be paid attention to, as it was such a massive resistance barrier for quite some time. Ultimately, the fact that we broke above that level is of course a significant event, as it was the top of the market during the financial crisis. With that being the case, I believe that the market will focus on that area as support going forward.

Buying dips

I believe that buying dips going forward will be the way as this market should continue to punish the Canadian dollar. After all, the US economy is stronger than the Canadian one, and there is no real strength in the oil markets are now. Don’t get me wrong, I believe that the oil markets will go higher given enough time, but we are not quite ready to make that move yet. On top of that, you have to keep in mind that part of the dynamic has changed as so much of the petroleum consumed in the United States now is being found domestically. With this, it will be interesting to see what the dichotomy going forward as, but the easiest way to play this market is to simply follow the trend, and that appears to be upwards.