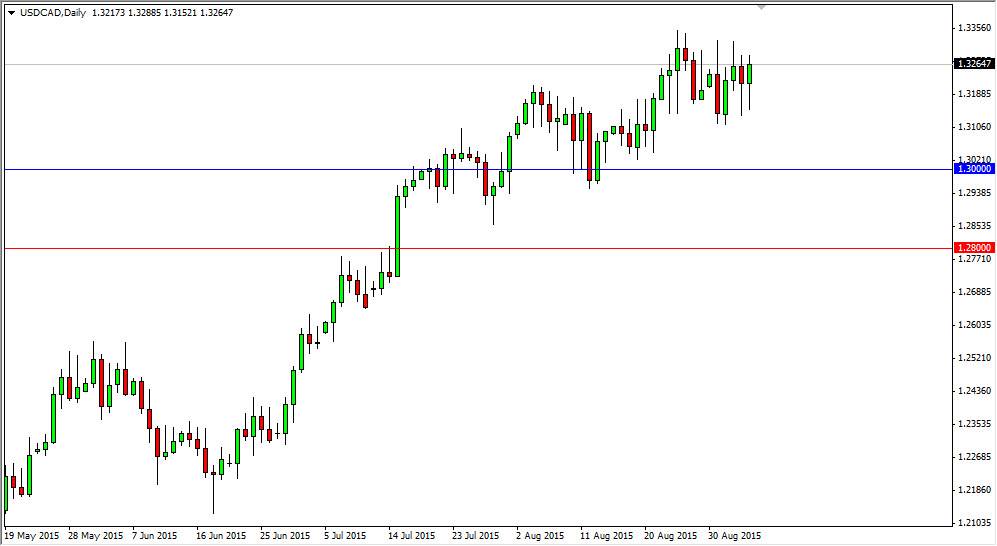

Looking at the USD/CAD pair, you can see that we fell initially during the course of the session on Friday, testing the 1.31 handle. However, there is more than enough support below to turn this market around anytime we fall. I feel that this pair will continue to go much higher, as the hammer that formed on Friday of course signifies quite a bit of bullishness. We also found quite a bit of bullishness in the form of a hammer on Thursday. With that, it appears that the market is going to continue going higher, as we have two very bullish candles in a row.

On top of that, oil markets failed a bit during the course of the week as we initially surged higher, but as you look at the markets you cannot help but notice that we failed to continue the rally. The oil markets of course have a massive effect on the Canadian dollar, and with the Canadian dollar being so soft and the oil markets doing the same, it makes sense that we continue this move.

Jobs numbers

The US jobs numbers missed the market a bit, but underlying numbers in the announcement were reasonably strong. With that, it appears that the market had a knee-jerk reaction initially, but then parsed the information for a longer-term stance. On top of that, the Canadian numbers although stronger, also showed a very negative unemployment rate percentage as well. So in other words, it was mixed and we have to keep in mind that the Canadian economy in general has been struggling, so having said that I believe that this trend continues. I think that the 1.30 level below continues to offer support, and I believe that the support range should run down to the 1.28 level.

With this, I look at pullbacks as value, and I continue to buy them on short-term charts. I think that this pair probably stall a little bit in this area, but ultimately should continue towards the 1.35 handle given enough time.