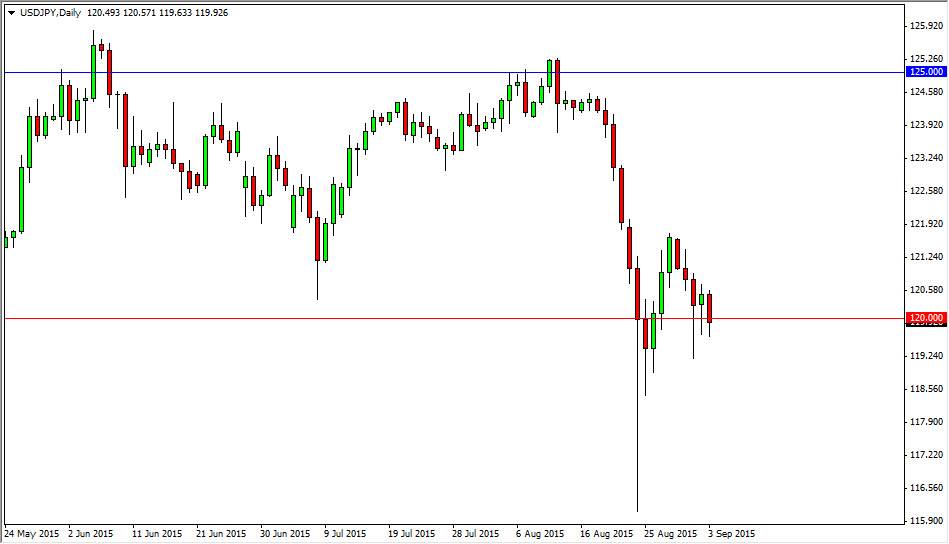

The USD/JPY pair fell during the course of the day on Thursday, cracking the 120 handle. That being the case, the market looks as if it is testing serious support, and the fact that it is the Nonfarm Payroll Numbers announcement today, there is a good chance that we will have quite a bit of volatility. With that being the case, the market looks as if it is going to continue to go back and forth, and that of course will make it difficult to hang onto this trade. However, I recognize that the pair tends to be very sensitive to the jobs number out of the United States, and as a result I think today will be a very big day.

Going forward, I feel that a break above the top of the range for Thursday would be reason enough to start buying. I believe at that point in time we will then head to the 122 handle, which has been resistance. If we can break above there, I feel at that point in time the market then will head to the 125 handle.

Interest-rate expectations

Interest-rate expectations will bring this market in one direction or the other, and you have to keep in mind that one quantity is already known, the fact that the Bank of Japan is light years away from raising interest rates. On the other hand, the Federal Reserve is anticipated to raise rates later this year, but that has come into doubt lately, and that of course has caused a lot of volatility in this particular market.

However, the jobs number will be a great influence on whether or not the interest rates are increased anytime soon. That being the case, if we get a strong jobs number this pair should continue to go much higher. Ultimately, I do believe that this pair goes higher but quite a bit of volatility will probably be the case in the meantime.