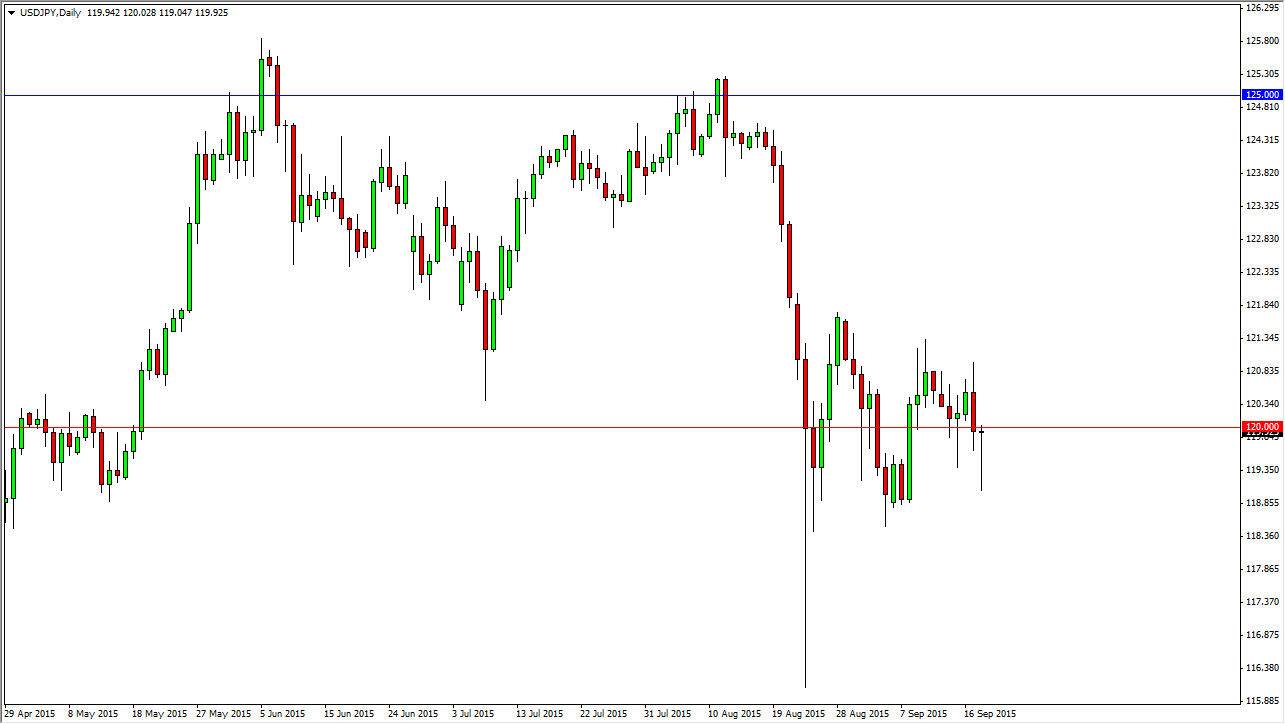

The USD/JPY pair initially fell during the course of the session on Friday, but found enough support near the 119 level to turn things back around and form a hammer. This hammer of course suggests that the buyers are coming back into this market, and with that we feel that we will continue to bounce around in consolidation. Because of this, we feel that buying above the 120 handle is what we do in order to take advantage of what is obvious market movement. Once we get that breakout to the upside, this market should then reach towards the 121.50 level.

Any pullback at this point in time should have some type of support, as the hammer shows that the buyers have been around. A short-term chart could be used in order to start going long, but we need to see hammers or other type of supportive candles below on pullbacks in order to go long if we do not break out to the upside.

Sideways

The Federal Reserve of course hasn’t made the situation any better, simply because they failed to raise interest rates and show just how confused they are about the economic situation. Ultimately, I think that this pair goes higher over the longer term, but it’s probably going to be a pretty significant fight. Do not think for a second that the Bank of Japan is ignoring the situation, and that they are above getting involved in this market. Any short-term selloff should be thought of as value in the US dollar. If this pair was to drop significantly, I firmly believe that the central bankers in Tokyo will get involved in this marketplace and start shorting the Japanese yen yet again.

A break above the 122 level sends this market looking for the 125 handle. With that being the case, I feel that it’s only a matter of time before we get that move, but it is going to be a significant fight.