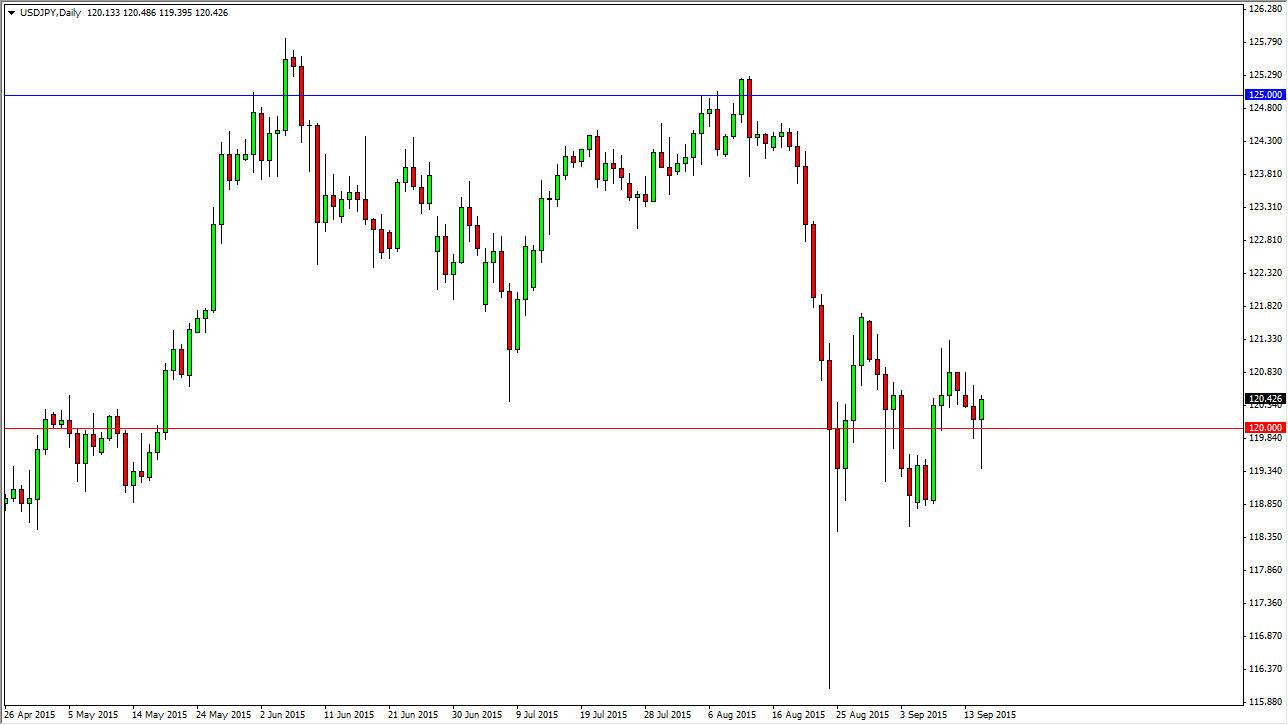

The USD/JPY pair fell initially during the course of the day, dropping well below the 120 level. This is an area that has been important and essentially what I consider to be “fair value” in this market. After all, we have been bouncing back and forth with this essentially being in the middle of the consolidation area. We have recently seen a massive selloff in this marketplace, dropping all the way down to the 116 handle. However, we bounced enough to turn things back around and form a massive hammer. This was right in the middle of all of this consolidation that we’ve seen recently, and as a result I think the market is essentially trying to build up enough momentum to go higher. After all, we couldn’t sell off for any length of time.

The overall longer-term trend has been higher for a while, at least until recently. With this, I think that people are still betting on the US dollar going higher against the Japanese yen, and of course the interest-rate differential continuing to expand in favor of the United States.

Federal Reserve

Keep in mind that Thursday has an interest rate announcement coming out of the United States, and more importantly the following statement. The statement suggests what the Federal Reserve will do next, and with that what will happen with interest rates overall. After all, it looks like the Federal Reserve is going to continue to raise interest rates over a longer-term rate hike cycle, that would be very bullish for this pair and we would continue to go much higher. At this point in time though, for me it appears that the market should continue to go higher based upon technical analysis anyways. In other words, maybe the marketplace is already starting to bet that the Federal Reserve is going to raise interest rates several times over the course of the next couple of years. If that’s the case, this is a career building move to the upside.