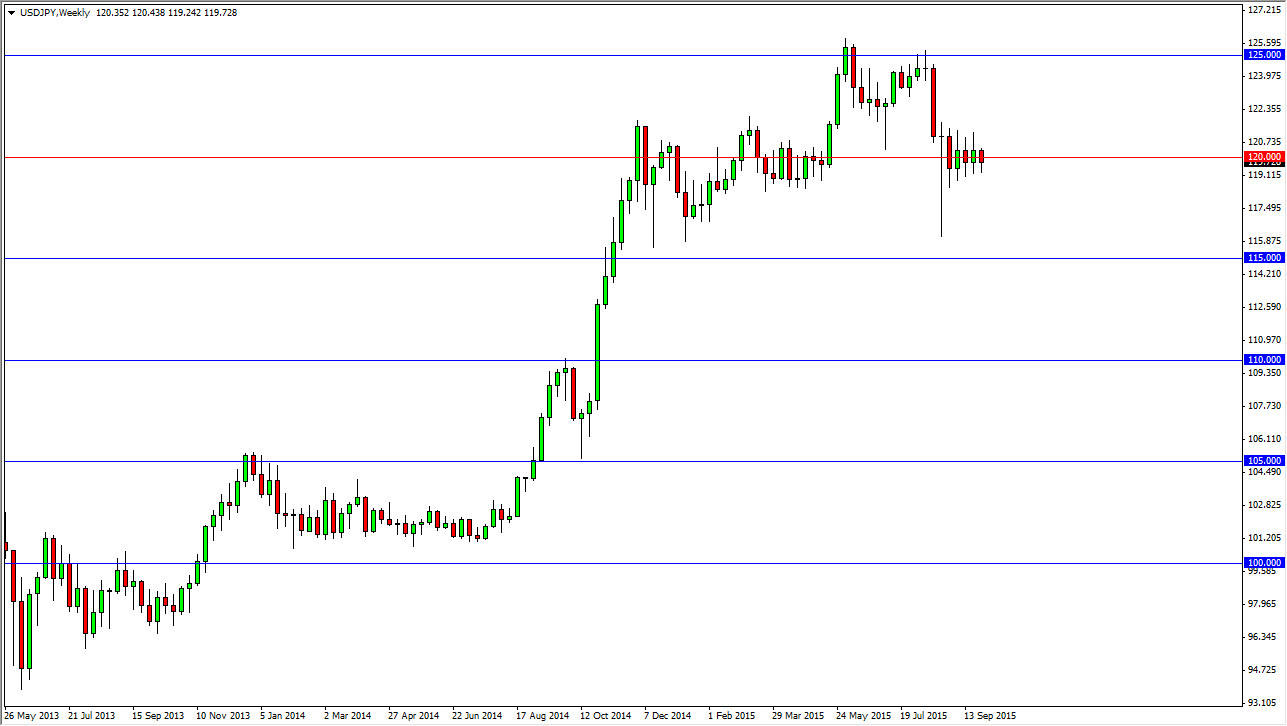

The USD/JPY pair has done almost nothing for quite a bit of time, as we continue to focus on the 120 handle. That being said, I believe that the market will eventually go higher, as the market has simply been hanging about this area. I feel we are trying to build up enough momentum to go higher, but there are a couple of different forces that move this market.

One of the first things that you need to keep in mind is that this market does tend to be very sensitive to risk appetite. After all, when stock markets around the world fall, this pair tends to as well. However, even as the markets have fallen all over the planet, the pair has simply sat still. That tells me that there is a significant amount of support below, and that it will of course continue to fight to go higher.

121

I believe that if we can get above the 121 handle, we should continue to go much higher, reaching towards the 125 level. Ultimately though, I believe that this is what’s going to happen. There are massive amounts of buy orders below, so I feel that any type of pullback should find enough buyers below to push the market back higher. In fact, I believe that there is a massive amount of support all the way down to the 115 level, and as a result I have no interest whatsoever in selling this market.

The other reason and external forces that you have to keep in mind with this pair is the fact that the Federal Reserve is much more likely to raise interest rates in the near future than the Bank of Japan is. That of course continues to drive money into this market to the upside, and I believe that will continue to be one of the main drivers. Ultimately, we are in a significant uptrend that should continue.