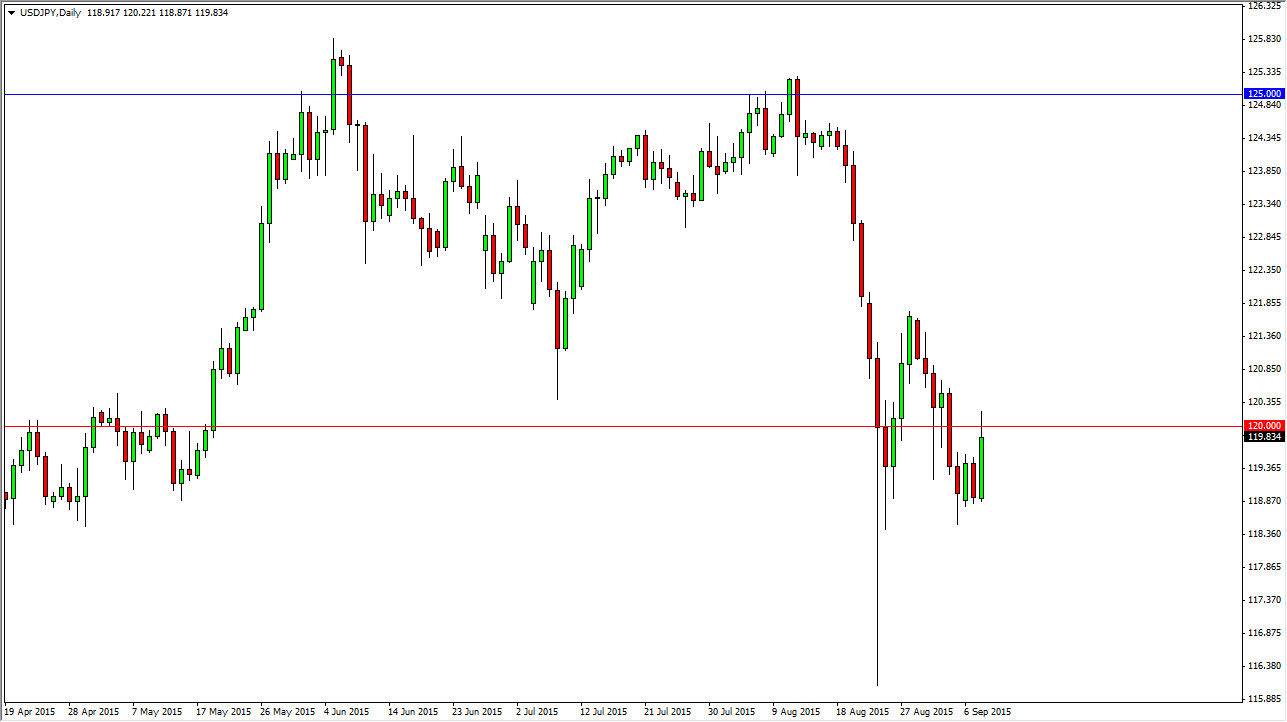

The USD/JPY pair rose during the course of the session on Tuesday, breaking above the 120 level at one point in time. This is an area that I think is pretty important when it comes to this pair, so I’m waiting to see if we can get above the highs for the session or perhaps a daily close above the 120 level in order to start buying. However, that does not mean that I am willing to sell this market if we stay below the 120 level. In fact, I feel that it is only a matter of time before the buyers take over again as sooner or later the market begins the focus on the Federal Reserve raising interest rates long before the Bank of Japan. Any hint of an increase in rates should continue to push this market higher.

Risk aversion and sensitivity

Keep in mind that this pair tends to be very sensitive to risk aversion and risk appetite, so pay attention to the way the stock markets around the world act. If they go higher, this pair will as well. Pullbacks will more than likely find plenty of support below, especially down to the 118.50 level. With this, it’s only a matter of time before we see buyers step back into this market. I think that looking at short-term charts will probably be the best way to trade this market if we do not get the breakout that I would prefer.

I have no interest in selling this market, and simply look at the pair going lower as the US dollar going on sale. It’s essentially like going to the marketplace and finding something for less than it’s actually worth. If we can break to the upside though, I expect we go to the 122 handle, and then possibly the 125 handle given enough time. It won’t be an easy move, but ultimately I think that’s where this pair ends up.