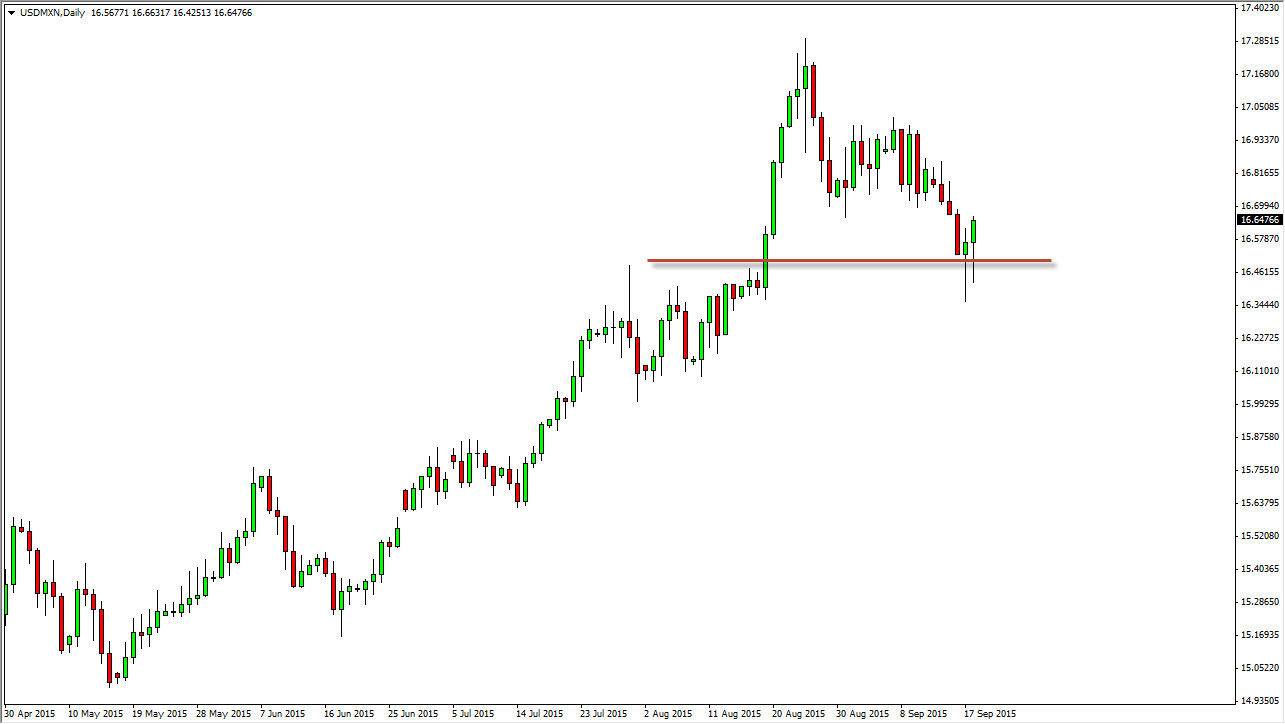

The USD/MXN pair fell initially during the session on Friday, but turned back around to form a hammer again. We had formed a hammer on Thursday as well, so I would like to look at this chart. This makes sense as the oil markets continue to soften, and the US dollar in general continues to strengthen. The US dollar is certainly a much safer currency than the Mexican peso to own in times of uncertainty, and on top of that you could make an argument that the uptrend line in this area should continue to push the US dollar higher.

We turned back around at the 16.50 level in order to show the significance of a large, round, psychologically significant number. This should continue to attract the buyers, as emerging economies are continuing to see softness.

Trouble above?

I believe that there is trouble above, as there is a lot of noise between here and the 17 handle. However, the longer-term uptrend should continue to push this market higher, and as a result I am bullish. Yes, I recognize that there will be a lot of volatility, but that’s not necessarily out of the norm for this particular pair. Keep an eye on the Mexican peso as it is a sign of what goes on in Latin America, and that of course is an area that people will shun as economic trouble strengthens.

The oil markets continue to look kind of soft, and as a result the Mexican peso will get sold off as it is highly leveraged to the oil markets. The Gulf of Mexico is full of Mexican oil rigs, and as a result it makes sense that traders tend to use the Peso for a proxy for crude oil trading. Ultimately, I believe that this market not only goes higher but then reaches towards the 17.25 level, and then possibly even higher than that. The longer-term uptrend should continue to show strength.