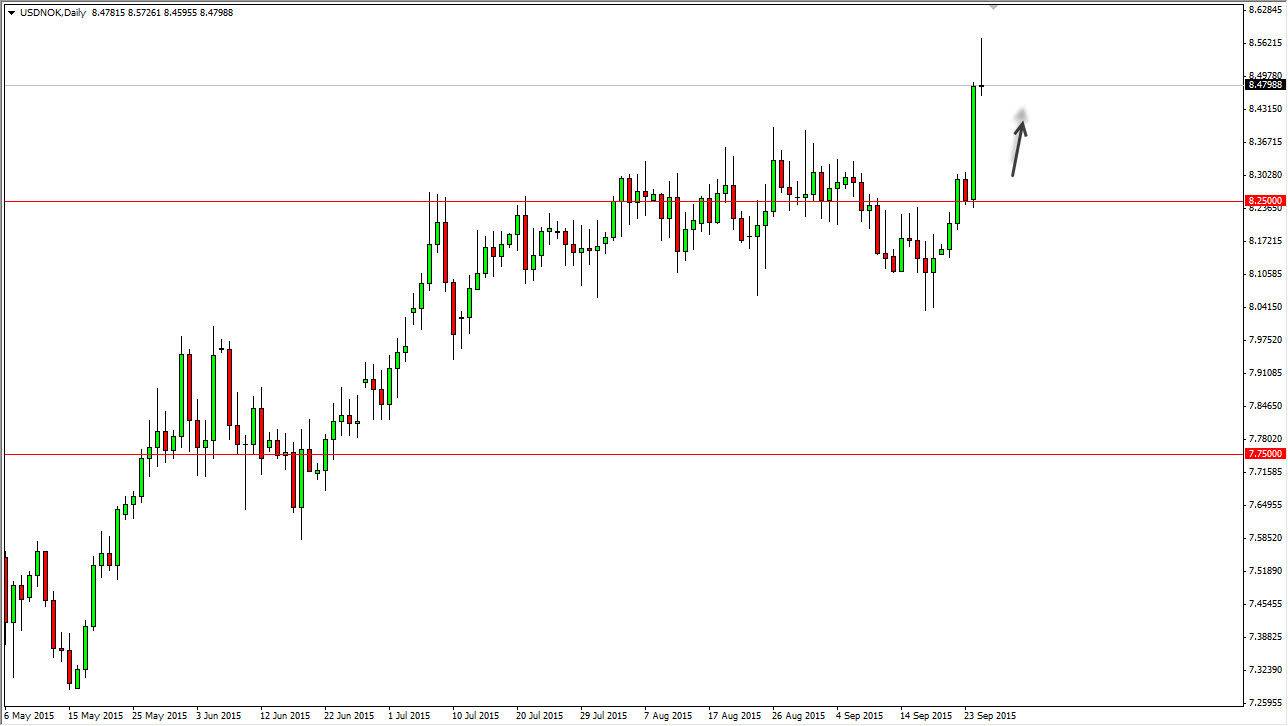

The USD/NOK pair initially went much higher during the course of the day on Friday, cracking above the 8.56 handle. However, we found enough selling pressure in that area to turn this market around and form a beautiful shooting star. Quite frankly, this is about as perfect as it could possibly be as far as the shape is concerned, so it will almost undoubtedly attract sellers. For myself, I think this will simply offer value at lower levels. If we break down below the bottom of the shooting star, that of course is a very negative sign in the classical sell signal. Ultimately though, I think there is so much in the way of noise below, and that we have such a massive green candle proceeding it, I think that maybe we simply have gotten ahead of ourselves. This pullback offers value in the US dollar as far as I can tell.

Without the oil markets, the Norwegian krone finds trouble

With the oil markets looking so soft, it is difficult to imagine that the Norwegian krone is going to go higher. After all, why would the Norwegian central bank raise interest rates without oil prices going much higher? Quite frankly, the Norwegian economy is very sensitive to oil, although it isn’t the only thing that makes it move. However, as far as currency traders are concerned, it is. So as they think, so it is.

I think that a pullback from this area should offer value that I think will make itself very well known. I would love to see a pullback all the way to the 8.30 handle, but truthfully we may only go as low as a .35. I am willing to buy a supportive daily candle somewhere in that general vicinity. On the other hand, if we break above the top the shooting star that form during the day on Friday, that is an extraordinarily bullish sign, and at that point in time I would be willing to buy as well. I have no interest whatsoever in selling this market currently.