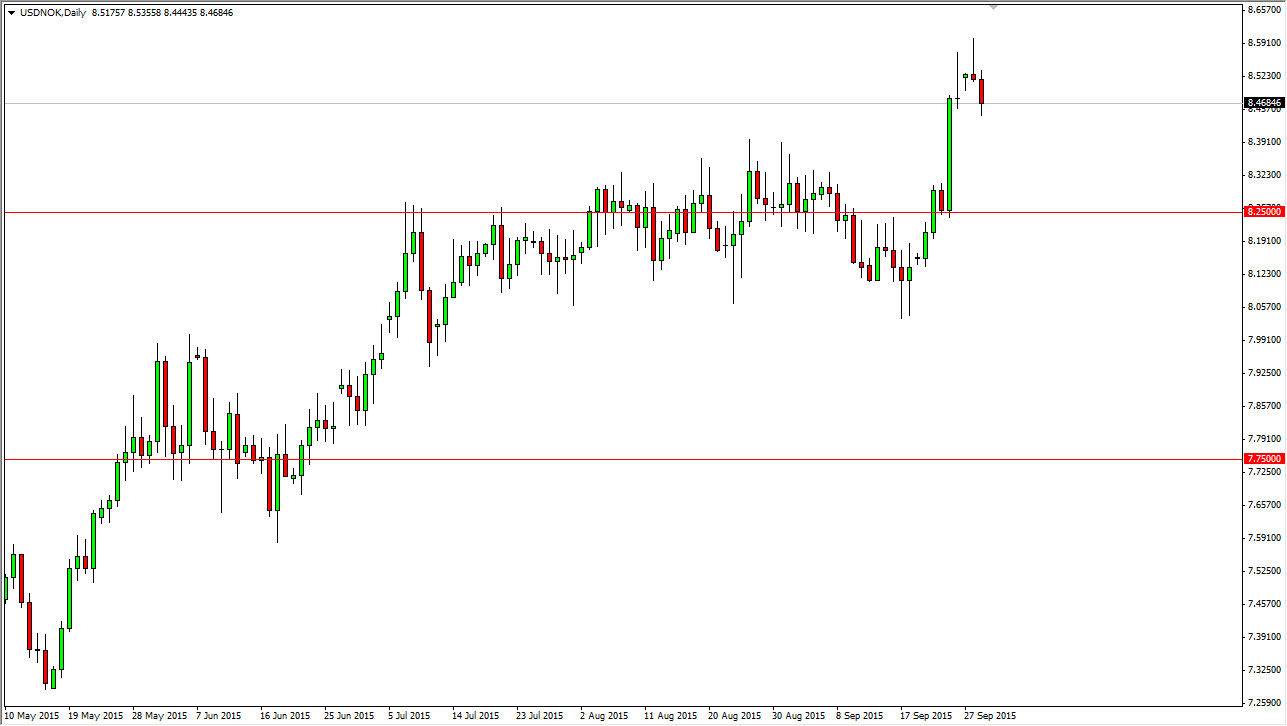

The USD/NOK pair fell during the course of the session on Tuesday, as we broke down below the bottom of the shooting star from Monday. That being the case, the market looks as if it is ready to continue going a bit lower, but quite frankly I find that this market should eventually find buyers. I think the massive green candle from last week should continue to mean that buyers will be involved, as breaking above the 8.35 level would have been very bullish. Keep in mind that the Norwegian krone is extraordinarily sensitive to the crude oil markets, as Norway exports much of the Brent that comes out of the North Sea.

With that being the case, the market looks very much as it will pay very close attention to the crude oil markets in general. That of course is the norm of this market, unless of course something specific is happening in Norway. I believe that the uptrend will continue to be the main theme of this market, and that this simple pullback will be an offer of value in the US dollar.

Waiting for support

Because of this, I am not willing to sell this market right now, and I believe that any signs of support near a large, round number is reason enough to start going long. I think that the 8.40 level will more than likely be very supportive as well, and we could very well find ourselves going to that general vicinity. Ultimately, it’s very likely that this market will continue to go much higher over the long-term, and with that I have no interest whatsoever in selling as I think that the overall trend can continue at a moment’s notice.

The oil markets have been very soft for some time, but then again the US dollar is considered to be a “safety.” I think there are two reasons for this market to continue going higher, which of course include a soft oil market, and of course risk aversion around the world.