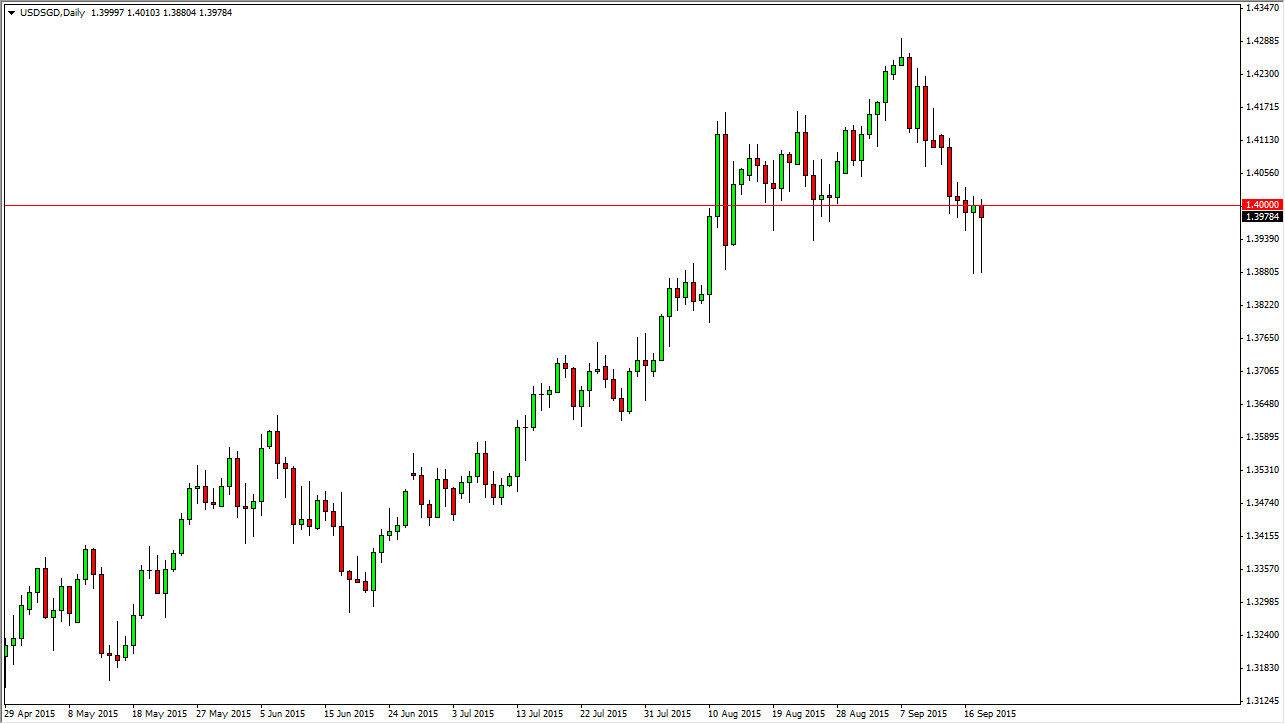

During the session on Friday, the US dollar dropped against the Singapore dollar significantly, testing the 1.39 handle. With that, the market turned back around and buyers got involved. We closed just below the 1.40 level, and just as we did on Thursday, we formed a massive hammer. With that being the case, it looks as if the US dollar will continue to going higher against the Singapore dollar, and on a break above the top the hammer we believe that the market could go all the way to the 1.43 level.

We have been in a nice uptrend for some time now, and as a result we certainly are much more likely to go higher, and I believe that we will go even higher than that as the economies in Asia are starting to slow down. Remember, Singapore itself may be doing okay, but the Singapore banks are the ones who finance a lot of the Asian construction as it happens.

Financial center

While the Singapore banks tend to be the ones who finance a lot of the construction around the Asian economies, the truth of the matter is that the Singapore dollar is also considered to be a bit of a “safety currency” as far as Asians are concerned. However, the ultimate “safety currency” is the US dollar. While the Federal Reserve couldn’t raise interest rates, the reality is they suggested that a lot of the economies around the world are struggling. People know that the Asian economies are slowing down, so that of course puts a knock on the Singapore dollar as well.

As we go higher, keep in mind that the pair tends to grind instead of flight, so it is a market that you have to be careful trading, as it takes patience to be involved. If you are not a patient trader, this will not be the market for you. On the other hand though, if you like things slow and steady, this pair is absolutely perfect.