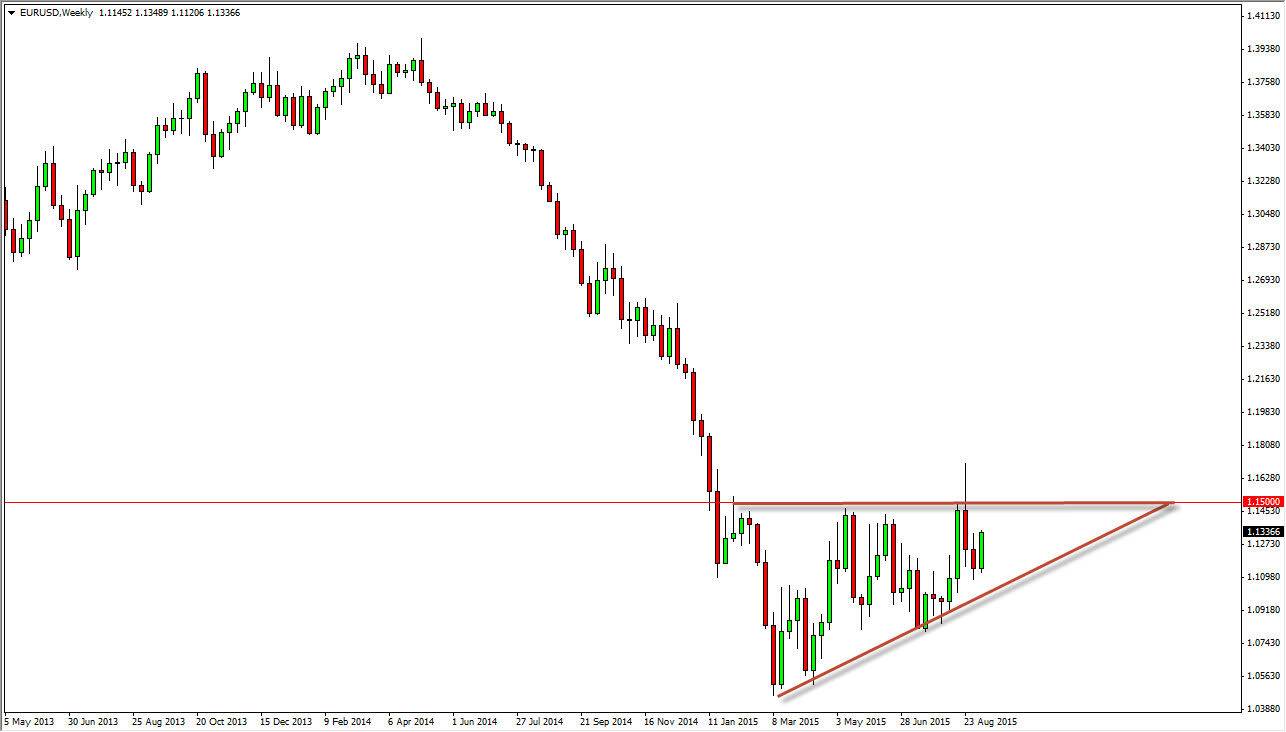

EUR/USD

The EUR/USD pair broke higher during the course of the week, and it now looks as if the market is going to try to reach towards the 1.15 level. However, we have an interest rate decision out of the Federal Reserve this week, and as a result I think that will be the biggest move of this particular pair. If the Federal Reserve looks as if it will not be able to raise interest rates anytime soon, we will break above the 1.15 level and continue to go much higher. At this point in time I am only buying this pair.

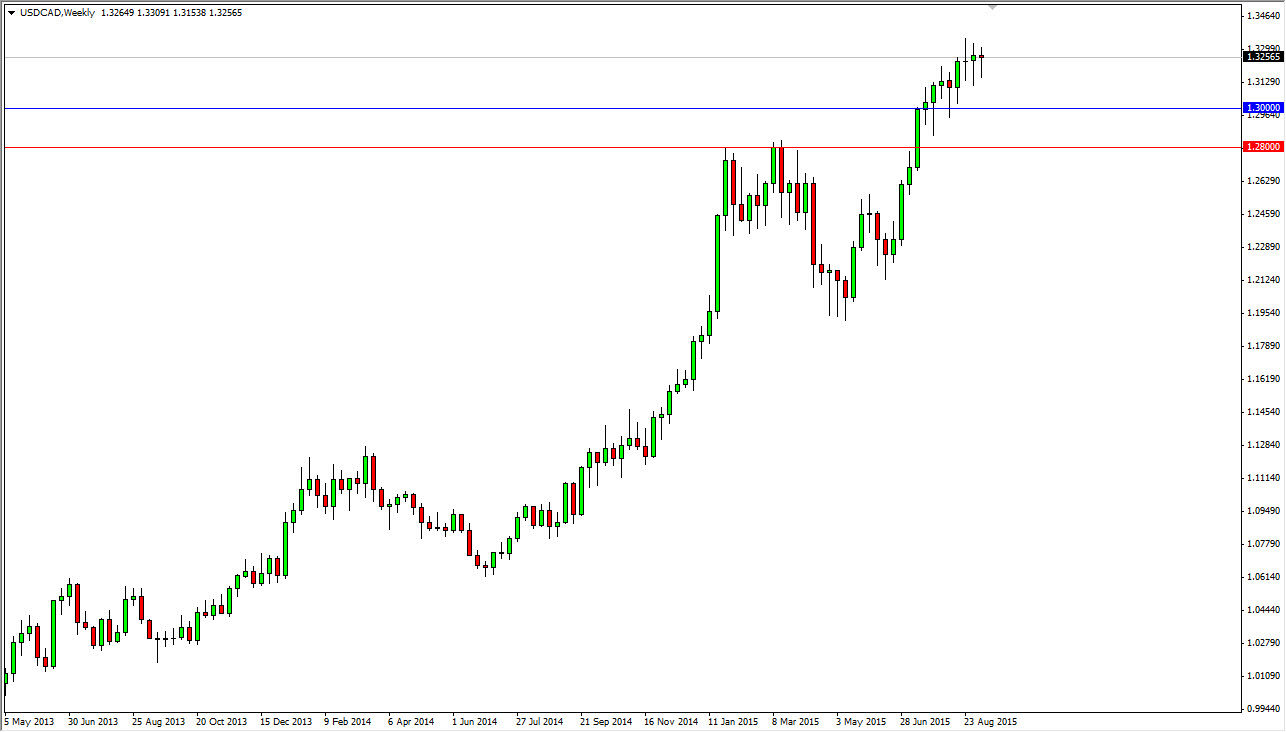

USD/CAD

The USD/CAD pair went back and forth yet again during the course of the week, as we continue to grind sideways. I recognize that this pair tends to be very choppy at best, and it makes sense as the two economies are so intertwined. With this, I feel that the market will eventually break out to the upside and that it is highly supported out the 1.30 level. That being said, the interest-rate decision could have a massive effect on this market. If we see the market move to the upside, we should head to the 1.35 level.

EUR/GBP

The EUR/GBP pair went back and forth during the course of the week, but as you can see we ended up with a hammer. The hammer suggests that we are going to eventually crash above the 0.74 level, and if we can get above there we should then test the 0.75 level. Above there, the market should continue to go much higher. I have no interest whatsoever in selling this market right now. I believe pullbacks will continue to be buying opportunities.

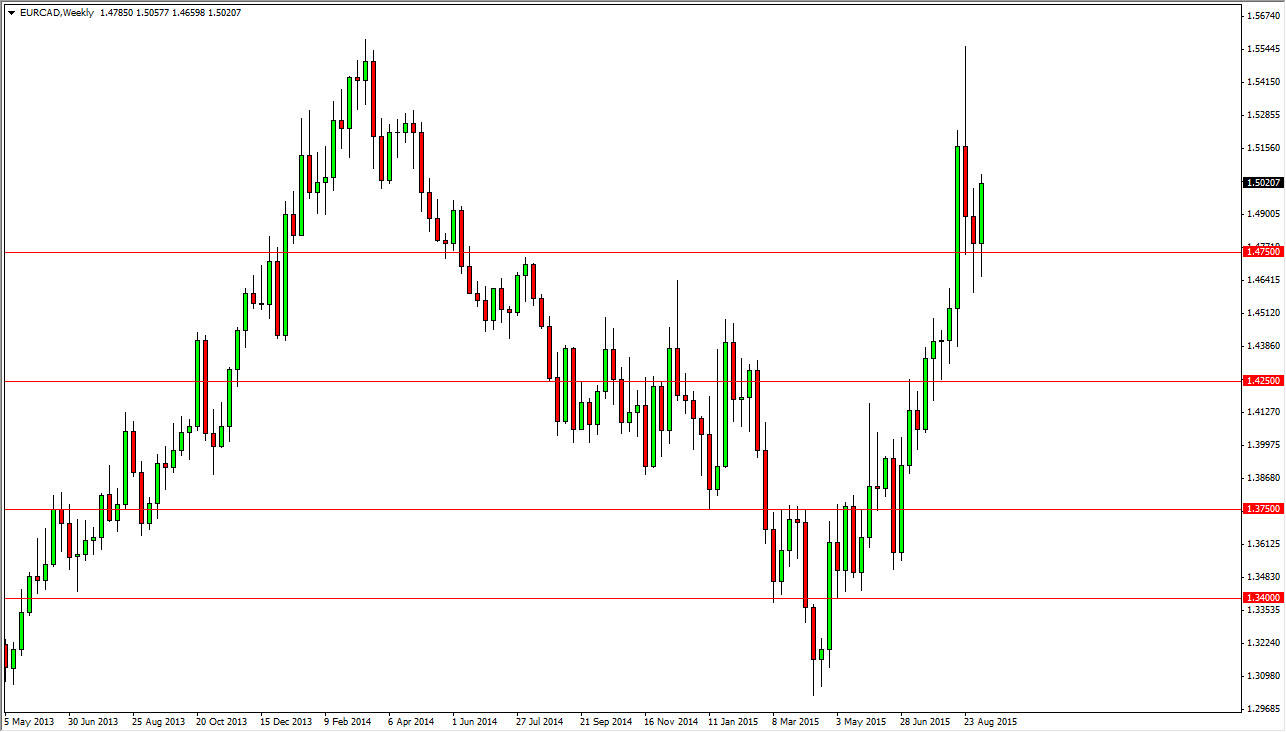

EUR/CAD

The oil markets continue to get very choppy, and as a result the Euro should continue to go higher against it. With this, I noticed that the market closed above the 1.50 level during the course of the week, and as a result it’s only a matter of time before we continue to reach towards the 1.55 level. I believe this market will be one of the more bullish ones out there, and therefore I am willing to buy almost immediately.