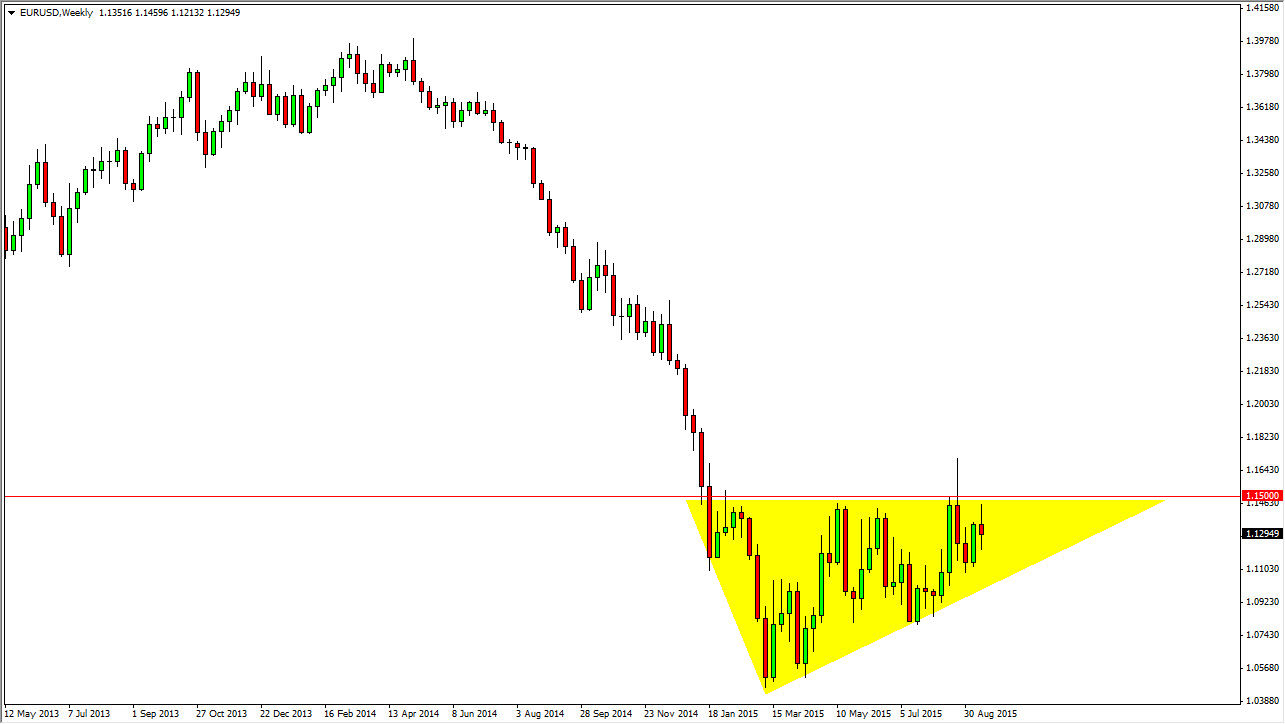

EUR/USD

The EUR/USD pair went back and forth during the course the week as we continue to bang up against the 1.15 handle. With this, I feel that the market will be rather confused, and truthfully you’re probably better off leaving it alone. I also have marked on the chart a triangle that could offer support, so really at this point in time it’s not until we get well above the 1.15 level that I feel comfortable buying, but I certainly don’t feel comfortable selling at this point either. The Federal Reserve made a real mess out of this pair.

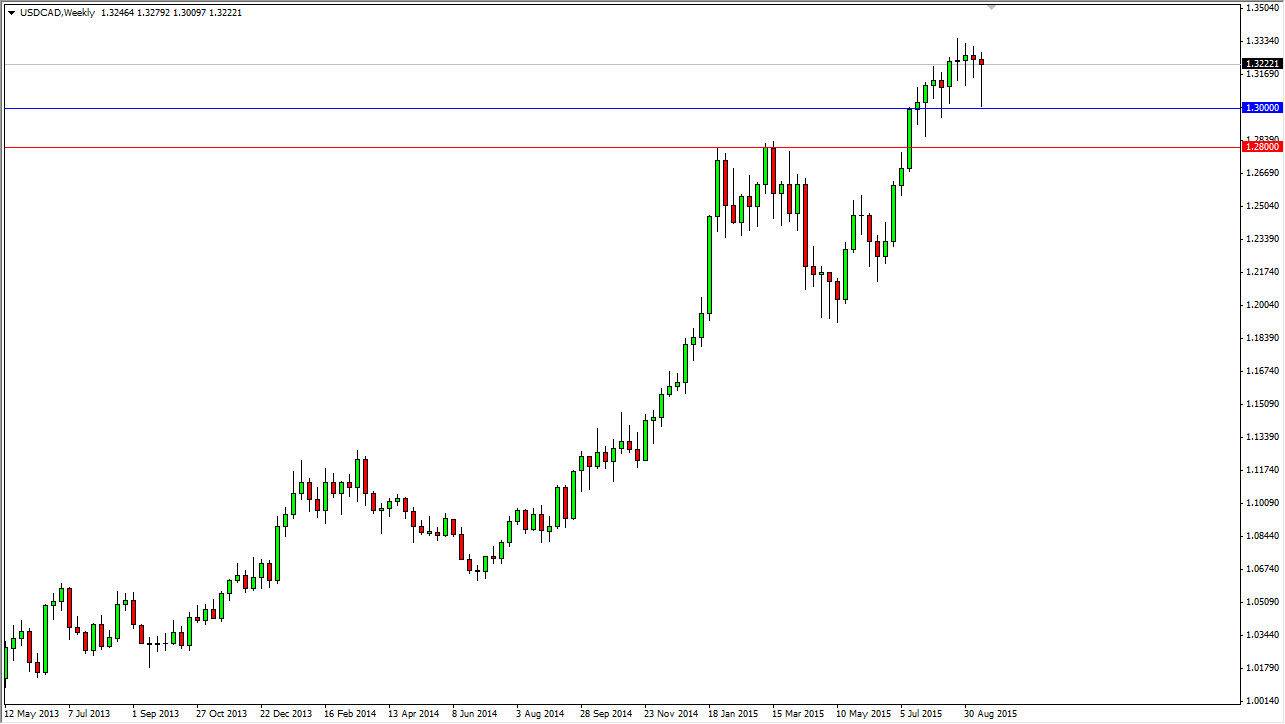

USD/CAD

The USD/CAD pair fell during the course of the week, testing the 1.30 level below. This was an area that was massively resistive in the past, and now that it’s offering support makes a lot of sense that the pair continues to go higher. On top of that, oil markets look a little bit soft, so having said that I believe that this market continues to go higher every time we pullback. I have no interest whatsoever in selling this market until we get well below the 1.28 handle.

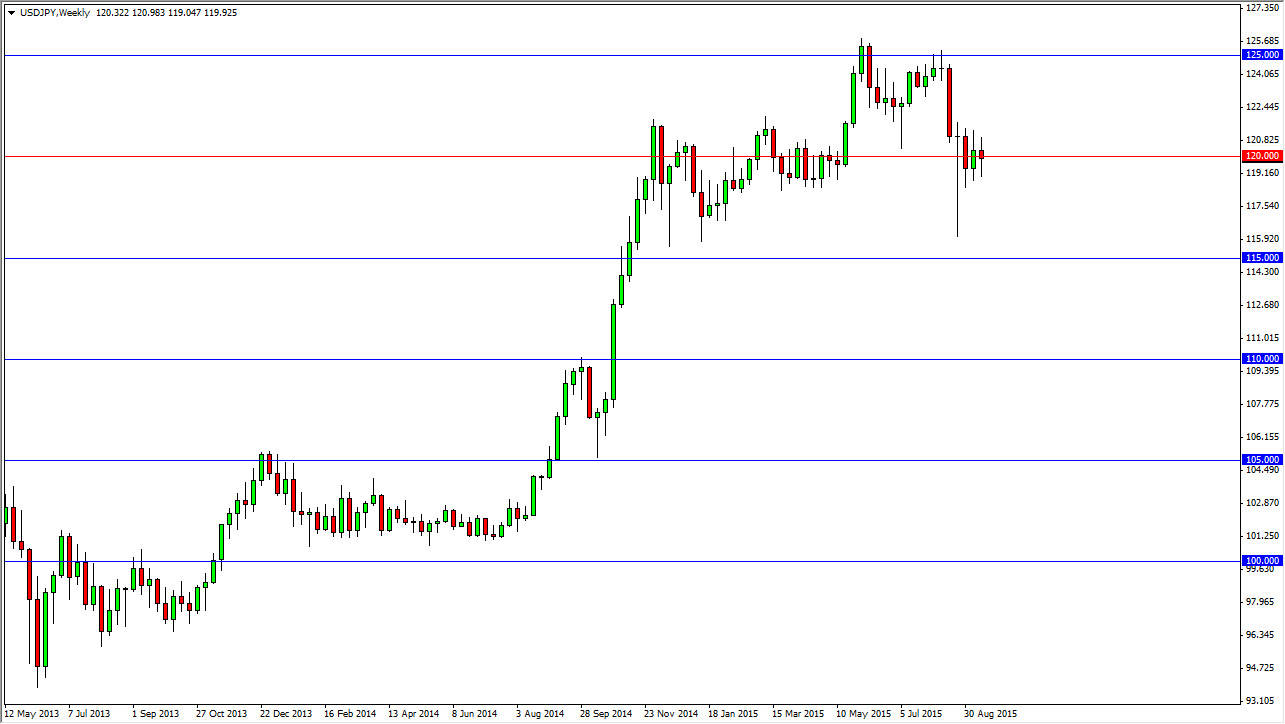

USD/JPY

The USD/JPY pair went back and forth during the course of the week, testing the 120 level on both sides. Ultimately, the market should continue to go higher, and a break above the top of the hammer from a couple of weeks ago should have this market looking for the 125 handle. I have no interest in selling, and I do believe eventually this market goes higher, but we need to see some type of impulsive candle to the upside.

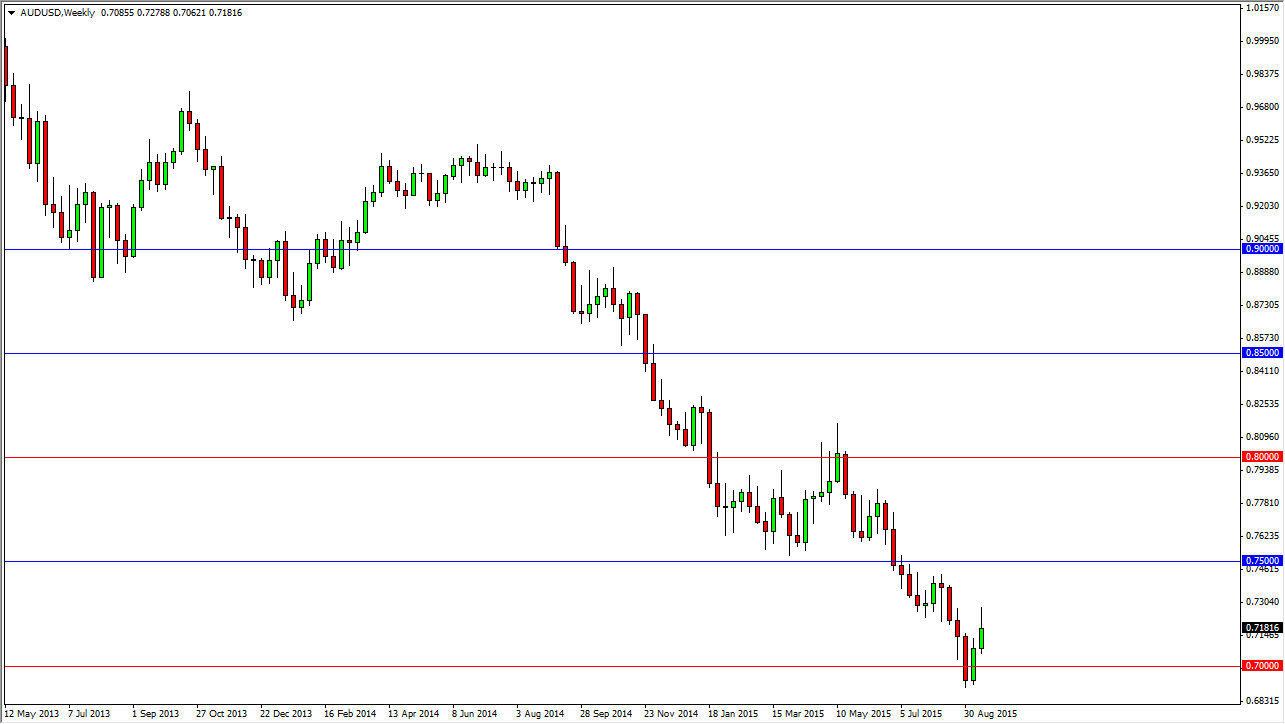

AUD/USD

The AUD/USD pair initially tried to rally during the course of the week, but turned back around to form a shooting star on Friday. Because of this, we ended up showing signs of real weakness, as the 50 day exponential moving average also finds itself in the same area. With that, I believe that the Australian dollar falls during the course of the week and that rallies offer selling opportunities as well.