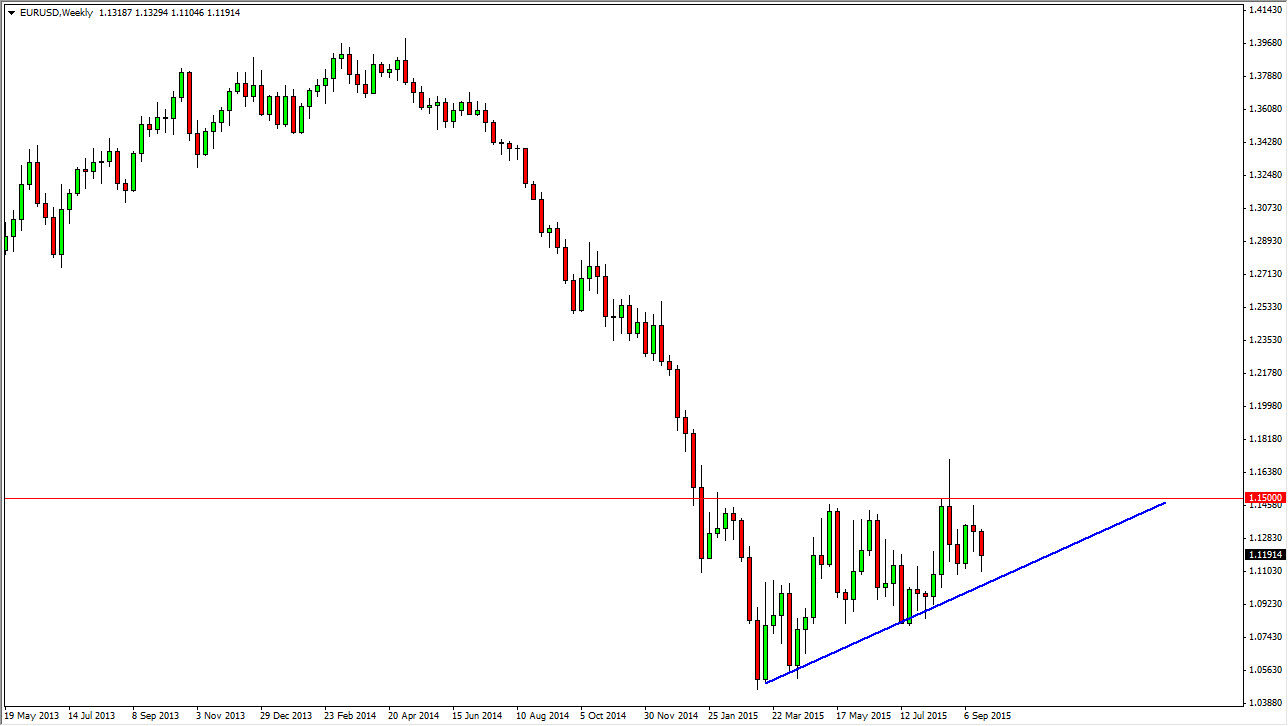

EUR/USD

The EUR/USD pair fell significantly during the course of the week, but as you can see we did bounce a bit towards the end. I think that at the end of the day the one thing you have to pay attention to is the uptrend line that sits just below. This is essentially an ascending triangle waiting to happen, and that normally means that the buyers will take over eventually. If we can break above the 1.15 level, I think this market goes much higher. I do have an upward bias, but I also recognize in the meantime it’s probably going to be very choppy as we stick between the 1.11 level on the bottom, and the 1.13 level on the top.

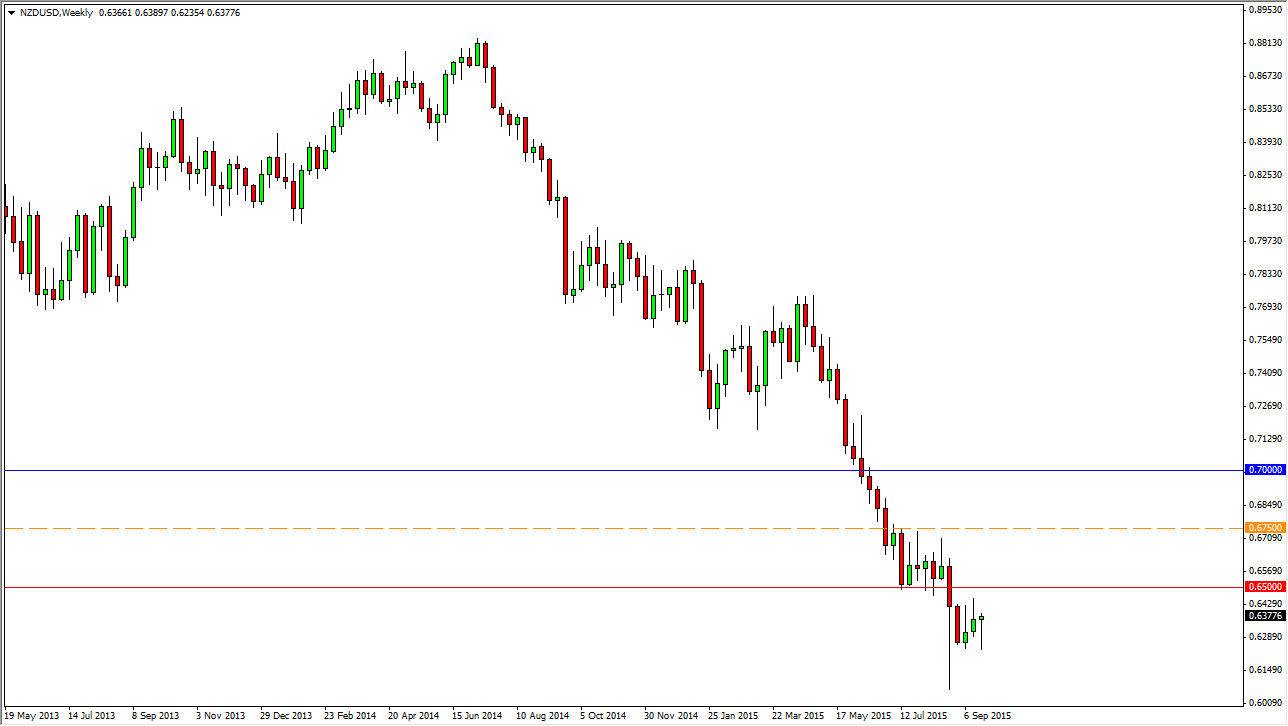

NZD/USD

The NZD/USD pair fell initially during the course of the week, but as you can see bounced enough to form a massive hammer for the weekly candle. However, I think that there is a significant amount of resistance at the 0.65 handle, and as a result I think it’s only a matter time before the sellers get involved. On the weekly chart I have the dashed orange line at the 0.6750 level, which is where we need to get above for me to be comfortable buying. In the meantime, I will continue to sell weakness.

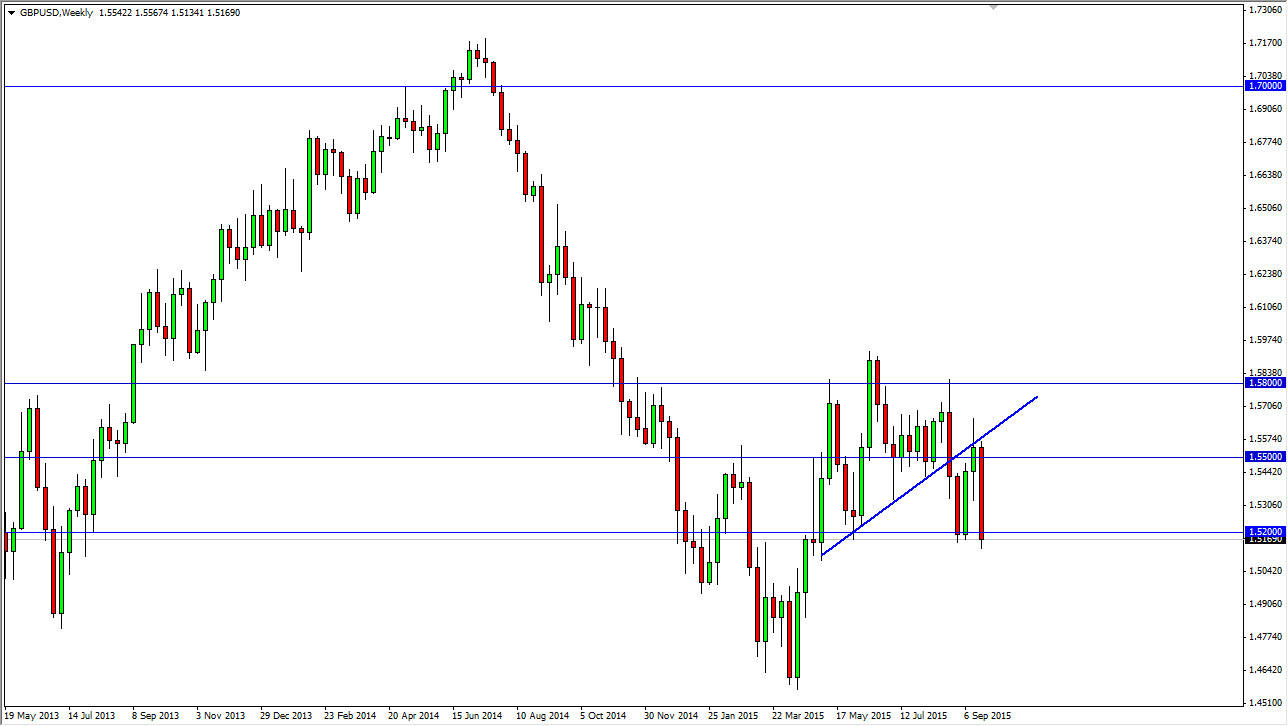

GBP/USD

The GBP/USD pair broke down significantly during the course of the week slamming through the 1.52 level. It is because of this that I think it’s only a matter of time before we break down, and the rally should offer selling opportunities. If we can break down below the bottom of the range for the week, I am a seller. On the other hand, if we rally from here and form some type of resistant candle, I am a seller. I have no interest whatsoever in buying this market at the moment.

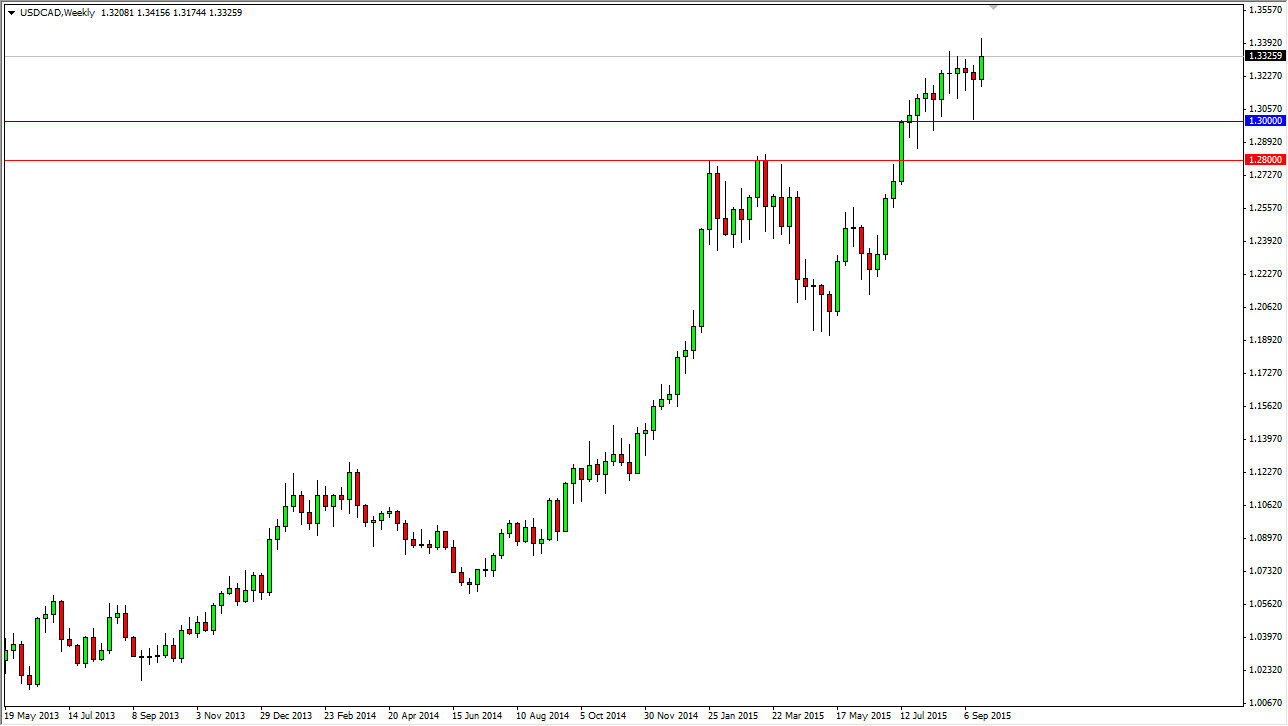

USD/CAD

The USD/CAD pair broke higher during the course of the week, slicing to fresh new highs. However, the market pulled back a little bit so at this point in time I think it will continue to be a bit volatile, but most certainly we are in a significant uptrend. If we pullback from here, look for short-term supportive candles in order to start going long as we should then go to the 1.35 handle, and then higher than that given enough time.