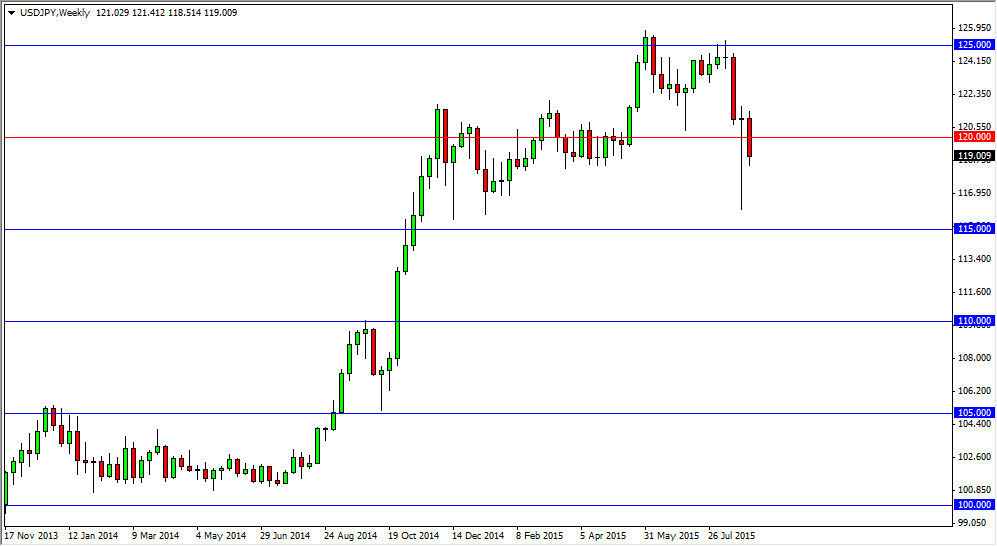

USD/JPY

The USD/JPY pair broke down during the course of the week, as we continued to see quite a bit of volatility in the markets. However, we are still well within the hammer from the previous week, so I believe that it’s only a matter of time before the buyers step back into this market. With that being the case, I think eventually we will get support that is able to be bought as the market recognizes it as value in the US dollar.

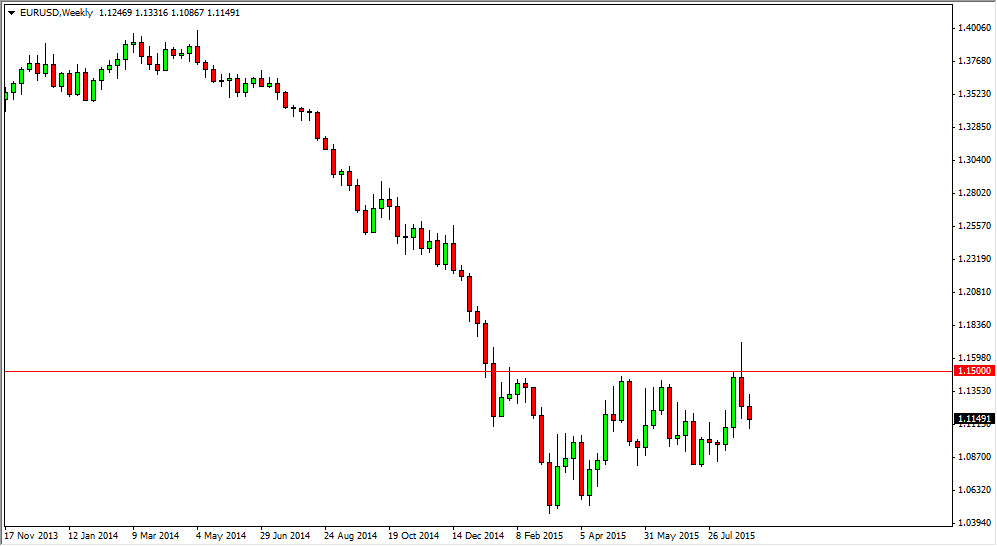

EUR/USD

The EUR/USD pair struggling a bit during the course of the week, drifted just a little bit lower. Ultimately, this is a market that is going to be difficult for longer-term traders to deal with, and quite frankly I think shorter-term traders would probably be best served to leave this one alone. However, I think that we are going to see a bit of negativity, and with that I am slightly bearish.

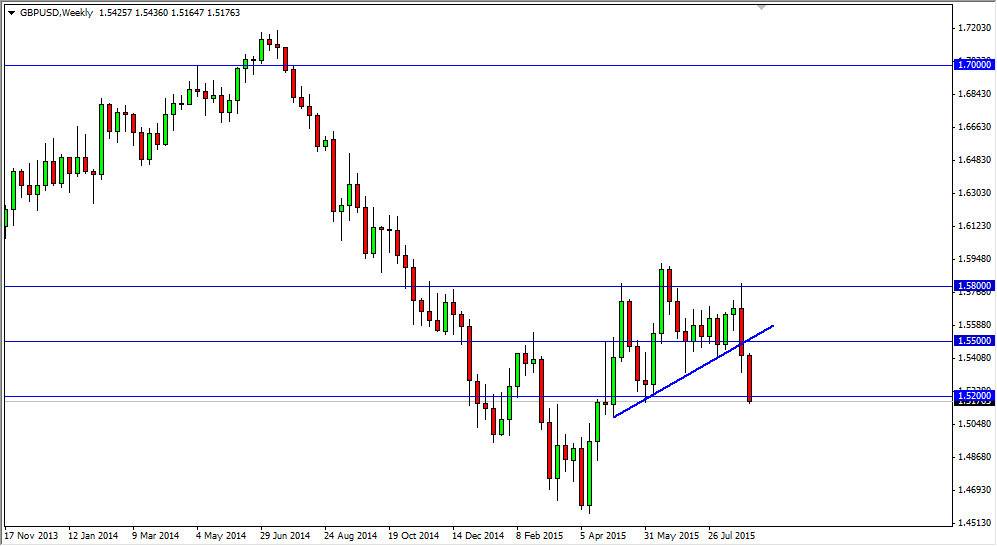

GBP/USD

The GBP/USD pair broke down during the course of the week, crashing through the 1.52 level during Friday. Ultimately, it appears this market is going to continue to fall overall, and as a result I am a seller of rallies on short-term charts. On the other hand, I feel that a break down below the bottom of the range for the week should also be a selling opportunity.

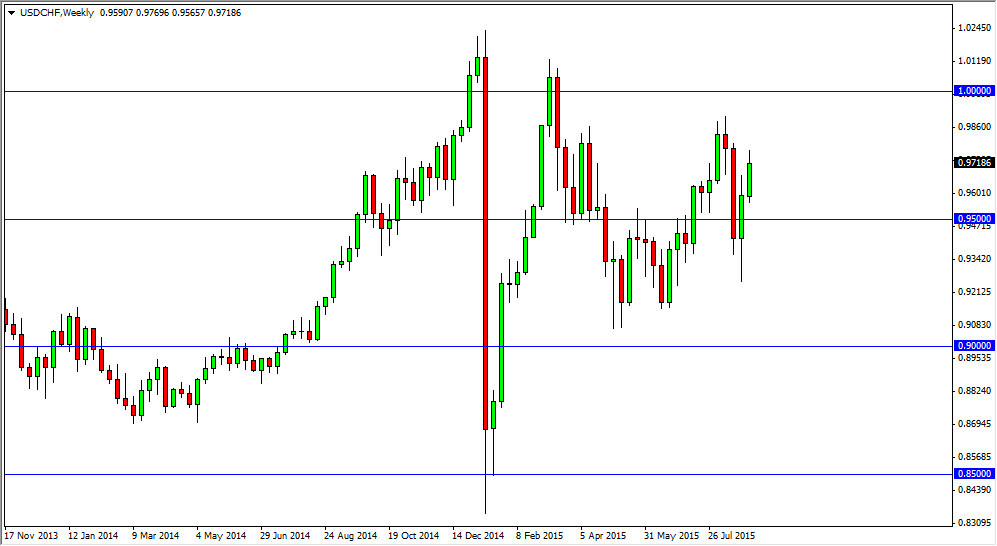

USD/CHF

The USD/CHF pair broke higher during the course of the week, testing the 0.98 level. I believe that we could get a little bit of a pullback, but quite frankly that should be a buying opportunity. Ultimately, a supportive candle on shorter-term charts should show that buyers are coming back into the marketplace. I have no interest in selling this market as long as we can stay above the 0.95 handle as it should represent a “floor” in this market going forward. I also believe that the Swiss National Bank should continue to work against the value of its own currency over the longer term.