The WTI Crude Oil markets fell initially during the day on Tuesday, but bounced significantly and ended up forming a hammer. That of course is a very strong sign, and as a result it looks like we are going to try to finally get above the $48 level. I find this interesting, considering that the Crude Oil Inventories announcement comes out today, which of course will tell us what the demand for crude oil in the United States is. With that, I feel that this might be one of the more interesting markets to trade during the session.

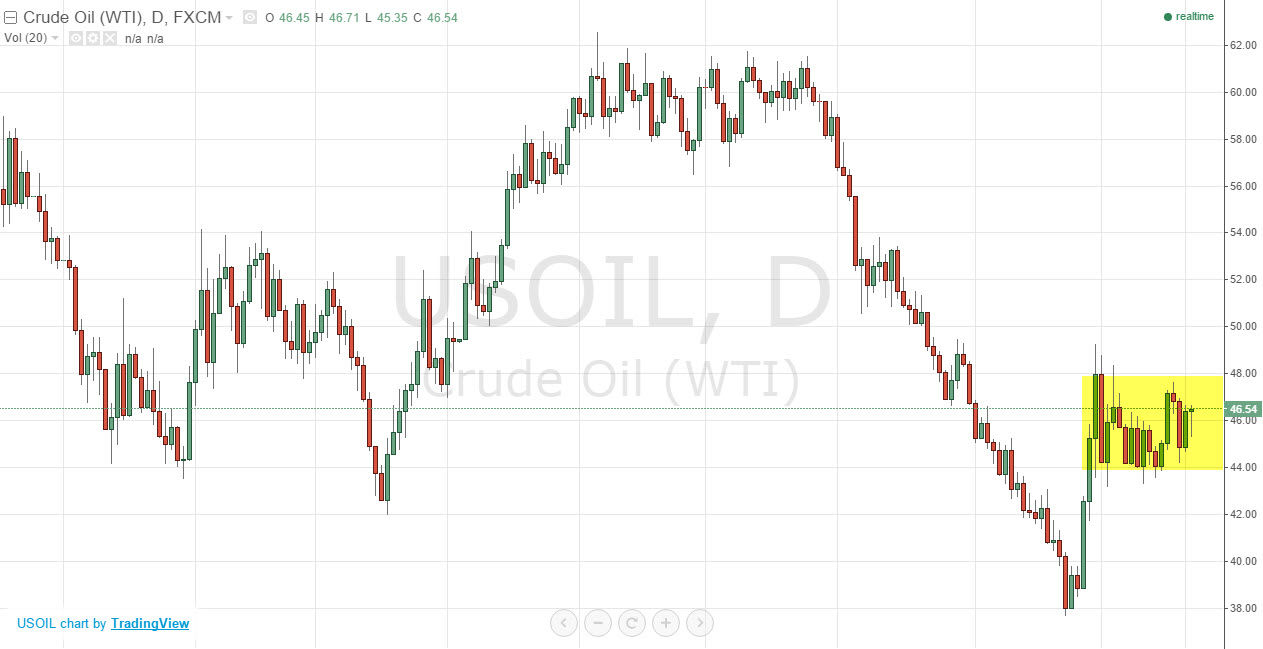

As you can see on the chart, I have highlighted the recent consolidation area which I see as $44 on the bottom, and the $48 level on the top. With these 2 numbers being so clear, I believe that short-term traders will continue to trade this market back and forth.

Buying dips, not selling

I have no interest in selling this market until we break clearly below the support level which I see as starting at the aforementioned $44 level, but extending down to the $43 level. Until we get below there, I think pullbacks will simply represent value in the petroleum markets which by all accounts have been oversold for quite some time. Granted, the demand picture isn’t necessarily the strongest at the moment but with the Federal Reserve not been able to raise interest rates, money is going to have to go somewhere and it might as well go into “things.”

On top of that, the recent impulsive move at the end of August was dramatic, and those moves typically signal the beginning of a trend change. I think that’s what we are seeing right now, and with those trend changes you often get quite a bit of volatility. However, it looks as if the $44 level is essentially the “line in the sand” of the bullish traders out there, and with that I feel that it’s only a matter time before we go higher anyway. On top of that, petroleum prices of this loan do not work in most petroleum producing economies, meaning that sooner or later something has to give.