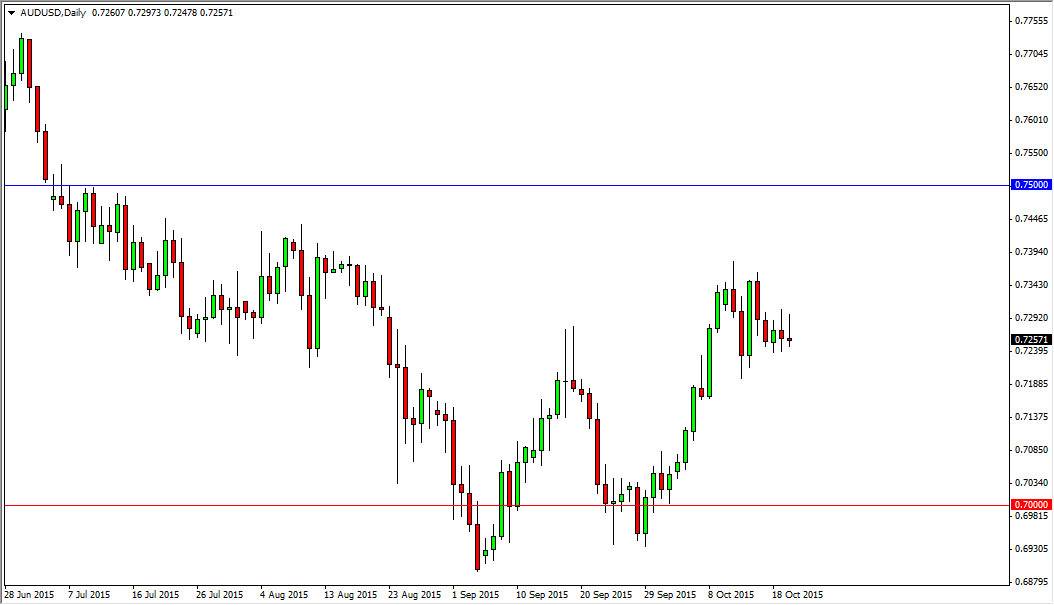

During the session on Tuesday, the AUD/USD pair tried to rally again. However, just like it did on Monday we could not hang onto the gains. I believe that we are currently consolidating between the 0.72 level, and the 0.74 level. With this in mind, even though we formed a very negative shooting star yet again, I do not feel that it’s necessarily going to be easy to sell this pair either. I think that the 0.72 level is massively supportive as it was once massively resistive. With this, I feel that today might be a bit soft in this market, but truthfully the easiest trade to take at the moment is simply shorting the market on short-term charts such as the 15 minute interval.

Gold markets are trying to break out to the upside and I think they will eventually. When you look at this chart, you cannot help but notice that there is a “W pattern”, and if it breaks to the upside things could get very bullish for the Australian dollar in short order.

The significance of the 0.75 handle

I believe that there is a significant amount of upward momentum if we can get above the 0.75 handle. In fact, at that point in time I am willing to call a trend change in start buying only. The meantime though, I think it is going to be very volatile and we need to pick up enough momentum to finally break out above there. That is going to be a messy affair and not something that’s going to be easily done. With this, I actually prefer to buy this pair over the longer term, but I recognize over the course of the next several sessions we may have a lot of sideways action in the aforementioned consolidation area.

I have no plans to sell the Australian dollar long-term at the moment as I believe the 0.70 level will turn out to be the absolute bottom.