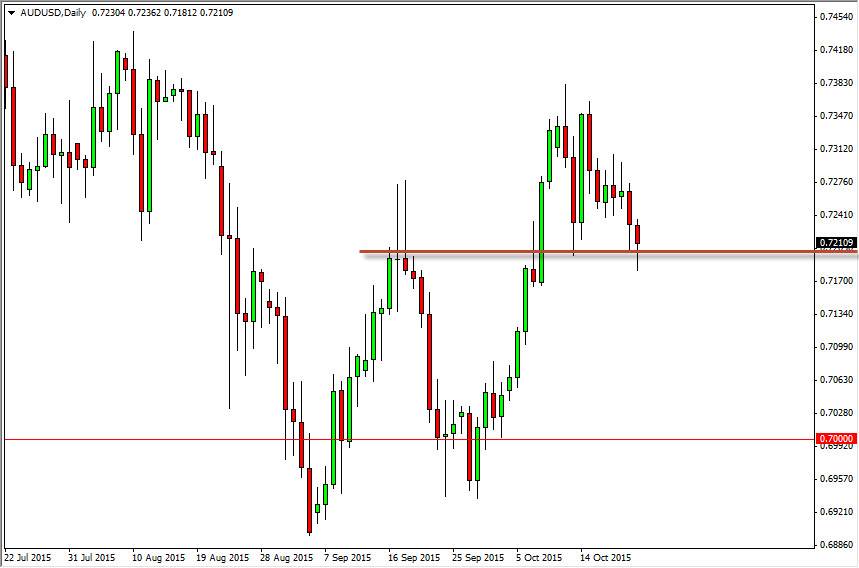

The AUD/USD pair initially fell during the course of the session on Thursday, breaking below the 0.72 level. However, the market turned back around and bounced enough to form a bit of a hammer. This hammer is of course bullish, and the fact that the 0.72 level was previously resistance makes me sit up and pay attention to this supportive looking candle. On a break above the top the hammer, I am a buyer of the Australian dollar but recognize that it is more than likely just going to be a short-term buying opportunity. I don’t think that there is enough room to move in either direction at this moment without serious momentum, and I don’t think we have it at this point in time. Because of this, it’s very likely that short-term traders will continue to trade the Australian dollar back and forth, as the range is so well defined.

Gold markets

Gold markets have been trying to break out to the upside for some time now, but quite frankly there is a lot of noise in that market at the same time. Obviously, gold has quite a bit of influence on the Australian dollar and of course will move the market itself. On top of that, you have the strengthening US dollar against the Euro as the European Central Bank suggested more stimulus is on the way. Although these are not direct correlations, do not forget that there are certain “knock on effects” in the currency markets.

At this point in time, I would not be interested in selling this market until we broke down significantly below the 0.7150 level, which could leave this market to reach towards the 0.70 handle. Ultimately though, I do think that the uptrend continues that we’ve seen over the last couple of weeks, as we have just recently broken above the top of a “W pattern.” Regardless, keep to the short-term charts.