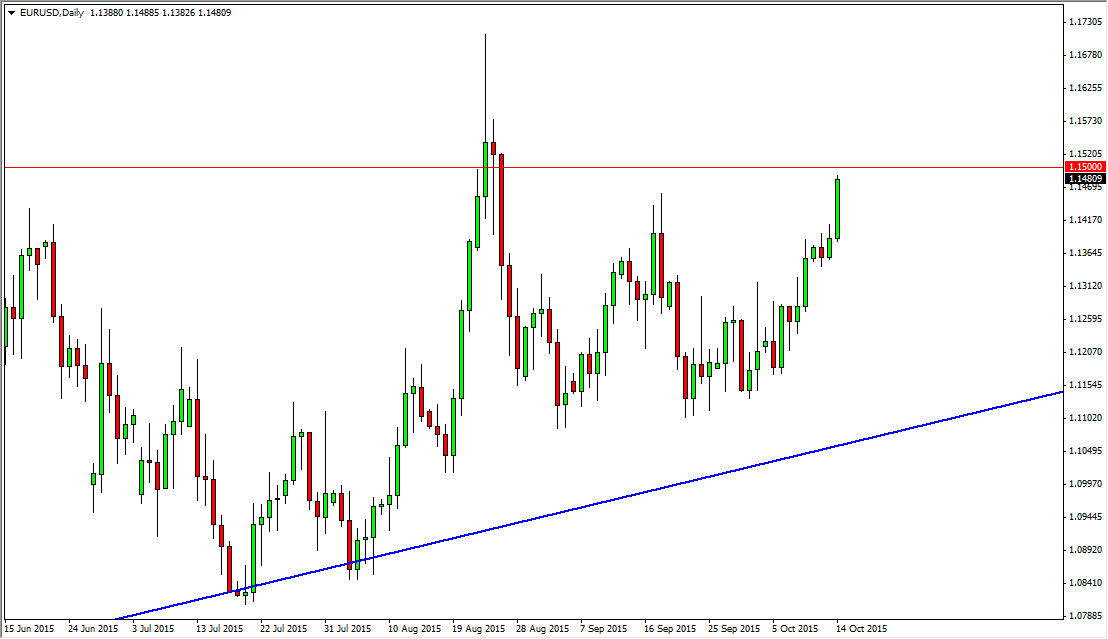

The EUR/USD pair broke higher during the course of the day on Tuesday, as we reached towards the 1.15 level. Quite frankly, if we can get above there I feel that the market is now changing trends. I feel that it’s an inevitability at this point in time, but it could take a bit of work to get above there. After all, that is an area that has been very resistive previously. However, when I look at the daily candle, I recognize that we are closing at the top of the candle, and that of course is a very bullish sign and suggests that the market will continue higher. That’s not to say that the 1.15 level will get broken right away, but I do think it will happen sooner or later. Any pullback at this point in time will more than likely be a momentum building exercise, and as a result I think that pullbacks and show signs of support will be bought.

The calm before the storm

I am a feeling that if we can break above the 1.15 level, this market will break out rather significantly. As I believe it’s a trend change, the next target would be somewhere close to the 1.18 level, which of course has been important in the past. I also recognize that the market will move straight to the upside, so having said that I feel that you will have several opportunities to get involved in this market to the upside. Ultimately, the market will then be a “buy on the dips” type of situation. I think that traders are going to build a larger positions, and make quite a bit of profit from those opportunities.

At this point in time, I don’t really have a scenario in which I would sell this market, but I recognize that a break down below the bottom of the range for the session on Wednesday would be an extraordinarily negative sign. Ultimately, I think that the buyers are going to be rewarded.