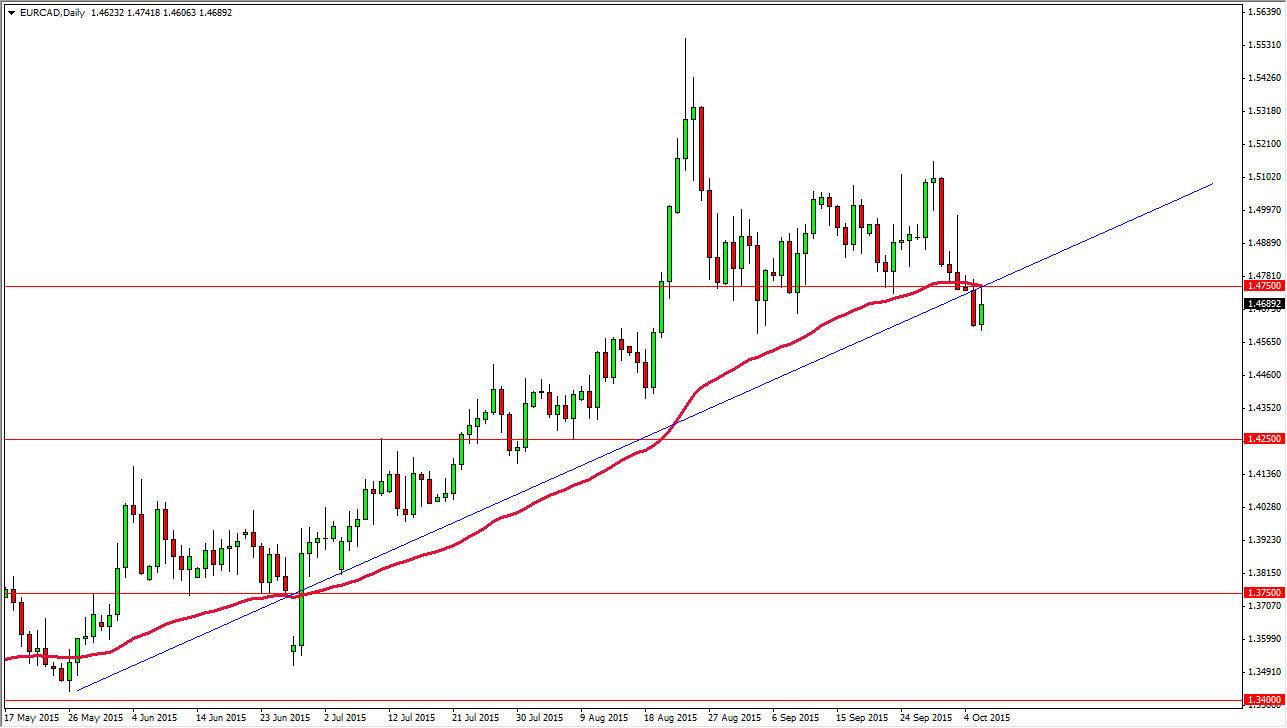

The EUR/CAD pair bounced during the course of the session on Tuesday, which of course was important considering that we had broken down below a pseudo-uptrend line, and of course the all-important 1.4750 level on Monday. On top of that, we broke down below the 50 day exponential moving average, which is quite often used by longer-term traders. All that looked very bearish, especially considering that we had closed at the bottom of that candle. With that being the case, I believe that the sellers are starting to take over again.

During the session on Tuesday though, we did bounce back to the 50 day exponential moving average and the 1.4750 handle. By showing the market resistance at the bottom of the uptrend line, and falling from there, it appears that we could very well be seeing a trend change. A break down below the bottom of the candle for the session on Tuesday would be a very negative sign, and should send this market looking for the 1.4250 level.

Oil

Oil is starting to look strong all of a sudden, and quite frankly on Tuesday we broke a couple of significant levels. With that, we could get a bit of a sympathy play in the Canadian dollar, as it is so highly leveraged to the oil markets. While the EUR/CAD and the USD/CAD pairs tend to move in tandem, keep in mind that a break down in this pair could be much quicker than the other one, as the Americans are drilling more and more oil every day. The Europeans on the other hand don’t have that luxury, and as a result this pair will certainly suffer at the hands of oil much more than the USD/CAD pair well.

At this point in time, I think it’s a little bit premature to call a trend change, but I am most certainly willing to “pay for the information” on a break down. Worst case scenario, I lose 1% of my account, which is of course my risk tolerance, but best case scenario I start trading a trend that could go much lower.