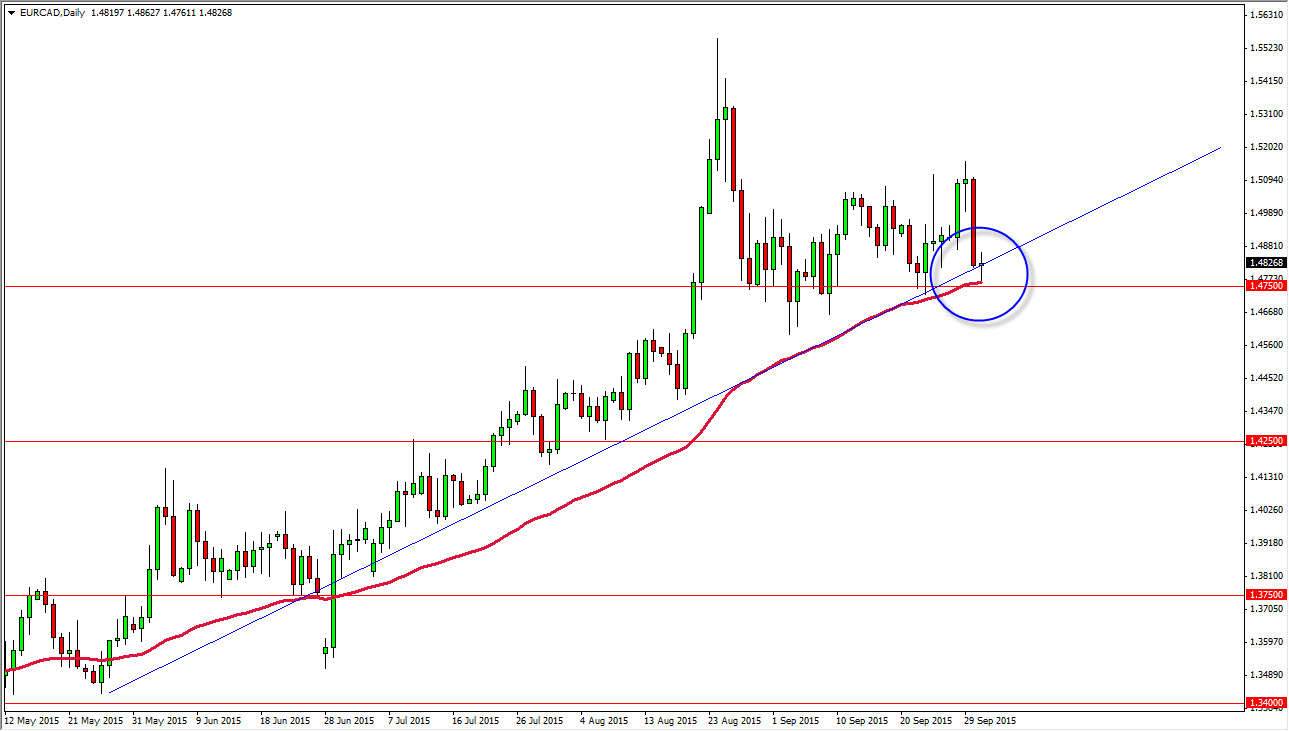

The EUR/CAD pair initially fell during the course of the session on Thursday, but found enough support near the 1.4750 level to turn things back around and form a nice-looking hammer. With that being the case, the market looks as if the buyers are going to continue to find interest in this area. On top of that, you can see that I have a nice uptrend line marked on this chart, as we have seen so much buying pressure over the longer term. However, the reality is that it is a market that is a steady in slow mover, but it is a mover in one direction over the long-term nonetheless.

The 50 day exponential moving average is just below, and the bottom of the range for the session touched the line itself. That being the case, the market looks to be attractive longer-term money as well, as so many of the long-term traders out there paying attention to the 50 day EMA.

Following the trend, being patient

I believe the following the trend overall is the way to go going forward, as it is with all things Forex related. I like the way this market looks, and the fact that we have seen so much positivity in this area suggests that it is an area where the market should continue to find enough interest to make it worth a longer-term trade.

From what I see, I am not interested in selling until we get below the 1.4650 level, which at that point in time I feel that the pair could very well fall apart. We would fall at least to the 1.4250 level, and possibly even lower than that. On the other hand, if we rally from here I would anticipate that the market should reach towards the 1.50 level first, and then eventually the 1.52 level. After that, the market goes to the 1.55 handle given enough time. I do believe that eventually we go higher, so if the market doesn’t move as quickly as I would like, I am going to hang onto the trade.