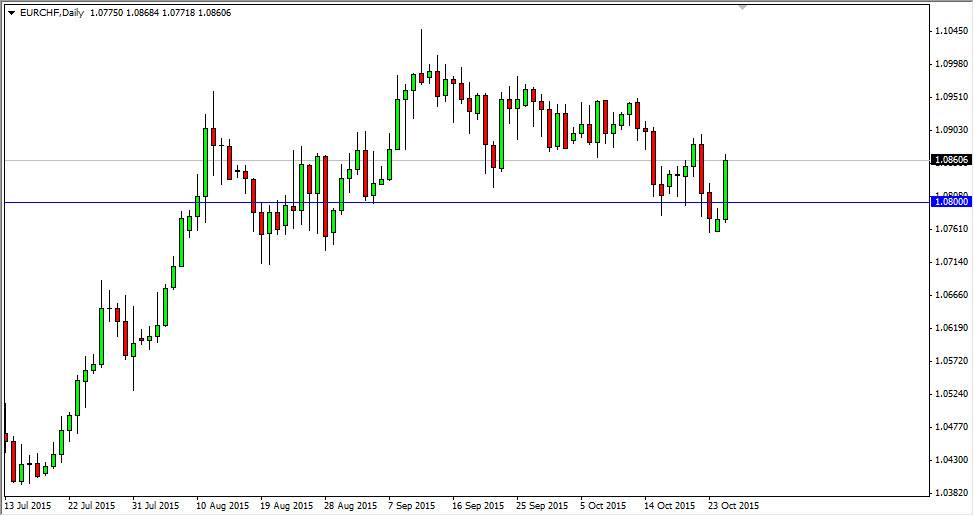

The EUR/CHF pair broke higher during the course of the session on Monday, breaking well above the 1.08 level again. Because of this, I feel that the market will continue to go higher, and of course the fact that we close towards the top of the range for the day. That normally means that we will see some type of continuation, and as a result I think the odds favor a move higher.

Nonetheless, I recognize that with the impulsive green candle, the market should continue to find buyers on short-term pullbacks, especially considering that the 1.08 level has been so reliable in general. There’s also a significant amount of support just below that handle, so I think this point in time selling is basically something that you can’t do.

Swiss National Bank

Recently, the Swiss National Bank released its financial statements suggesting that the central bank has been selling off the Swiss franc. It also suggests that it has picked up quite a few Euros, and that means that this pair was how they did it. With this, I feel that it’s only a matter of time before buyers step back into this market and then it reaches towards the 1.10 level. That level of course is massively resistive, and I think the real struggle is to get above there. Once we do, I don’t see the reason why this market does and continue to go all the way to the 1.20 level, which of course was where the currency peg had been defended. There is essentially nothing but “empty air” between the 1.10 level and the 1.20 level, so having said that the move could be rather quickly.

This move will be exacerbated if the EUR/USD pair continues to show strength as well. It did bounce a bit during the session on Monday, so having said that it could just add more fuel to the fire in this market going forward.