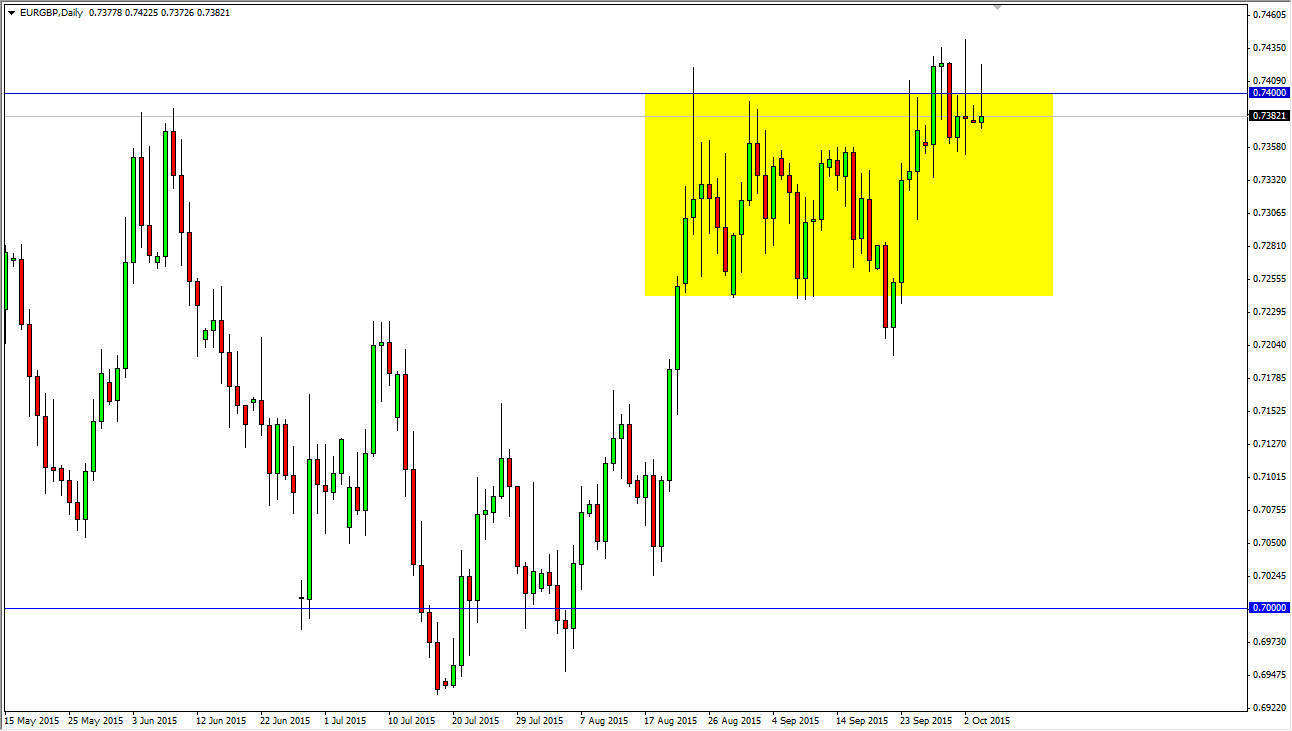

The EUR/GBP pair tried to break higher during the course of the day on Monday, clearing the 0.74 level at one point in time. Ultimately, this is a market that sees that area as a massive resistance barrier, and with that it was not a huge surprise that we struggled. The fact that we formed a shooting star suggests that we are about to get sellers involved in this market. A break down below the bottom of the shooting star should send this market looking for the bottom of the consolidation area, which of course is the 0.7250 level. That area should have plenty of buyers and as it is the bottom of the previous range that the market has been in, so I think that a pullback to that area is a nice buying opportunity. However, I would of course have to see some type of supportive candle in order to get involved.

On the other hand, if we break above the top of the shooting star, it could be a nice buying opportunity as it would show a continuation of upward momentum. With that, the market should then go to the 0.75 level, which is the next major round number.

Overall, I’m still bullish

I believe that this market still is rather bullish, but a pullback may be needed in order to continue to go much higher. A pullback would show quite a bit of momentum building, and ultimately that inertia that the market seems to find in this underlying area will have to be released. A break out above the recent high of the last couple of sessions should be a nice buying opportunity but I recognize that it will be more or less a grind towards the 0.75 level.

That’s not to say that it will be very easy to do, but ultimately it will more than likely be a situation that you will have to “buy the Euro on pullbacks.” Keep in mind that the value of this market is much higher per check than other ones, so having said that the moves will have to be as big to make a lot of money.