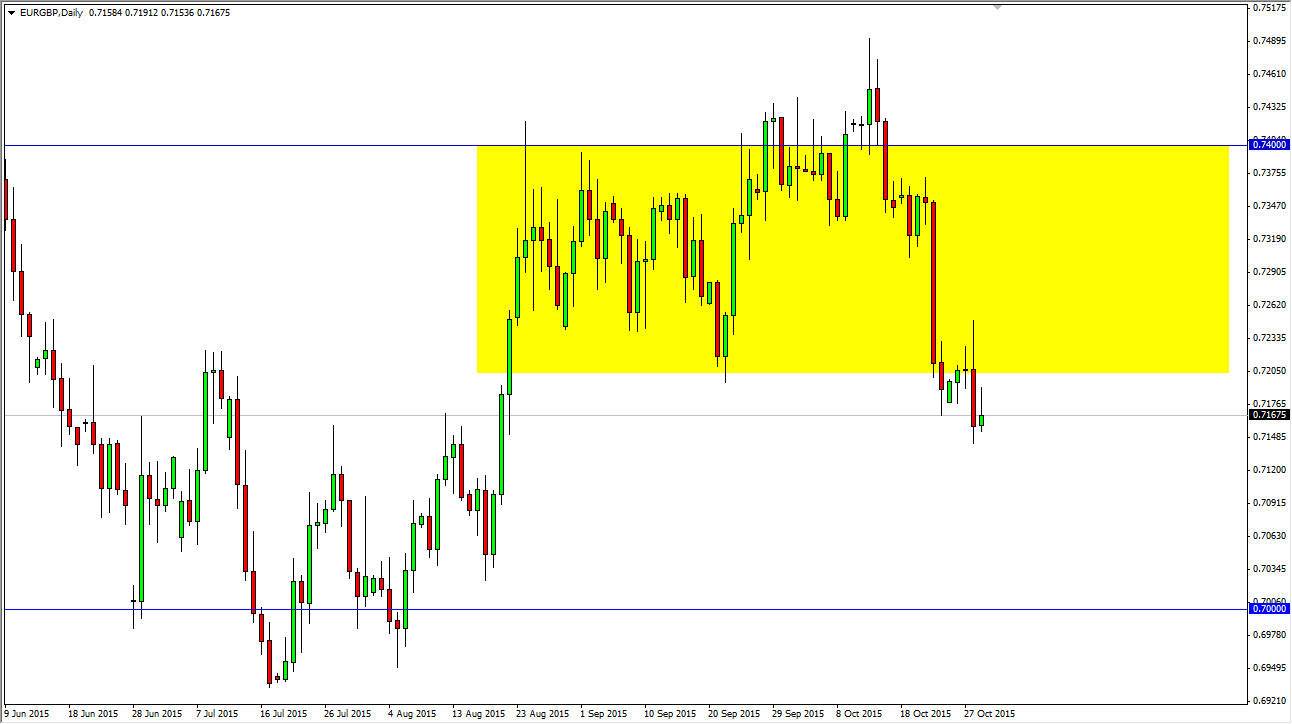

The EUR/GBP pair tried to rally initially during the course of the session on Thursday, but struggled at the 0.72 level and fell far enough to form a bit of a shooting star. The shooting star sits just above the 0.7150 handle, an area that I see as support. If we can break down below there, the market should then start heading down towards the 0.70 handle next. Because of this, I believe that we are going to fall, but I also recognize that this pair tends to chop around quite a bit for a couple of different reasons.

One of the first reasons that this market does tend to chop around as the fact that the pip value is much higher than other markets. Because of this, it takes quite a bit less in the way of movement to move money from one account to another. If we gain 1% in this market, it looks a lot different than others. Another reason that this pair tends to move in a very choppy way is the fact that the 2 economies are so highly intertwined. After all, they are number one trading partners with each other, and of course that means that a lot of money flows back and forth across the English Channel.

Selling rallies

I would love to see rallies on short-term charts in order to continue selling this pair. At one point in time, it seemed as if this market was going to break out to the upside but now it appears that the longer-term downtrend is trying to take over again. The 0.70 level below is going to be massive support, so when we get down there I would anticipate seen some type of bounce or at least supportive candle. On the other hand, if we break down below the 0.69 handle, we go much lower at that point in time as the market would essentially be broken.