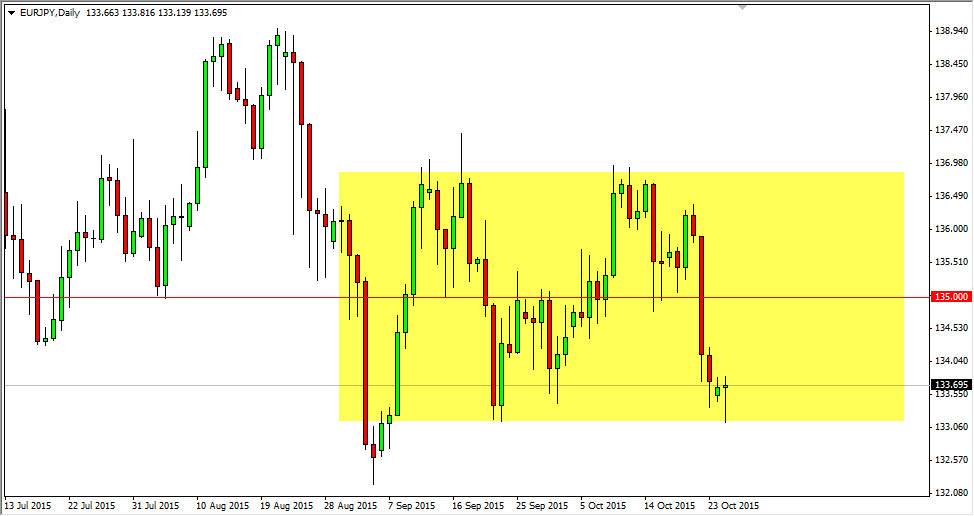

The EUR/JPY pair fell initially during the course of the session on Tuesday, but found enough support near the 133 level to turn things back around and form a hammer. The hammer of course is one of the most bullish candlesticks that you can get on a chart, and the fact that it comes right where you would anticipate to see support has me very interested. Because of this, I feel that we will continue the consolidation that has been featured in this market for some time now, and as a result I have no interest in selling. I believe that if we can break above the top of the hammer for the session on Tuesday, the market will probably head towards the 135 handle first. After that, we will more than likely reach towards the top of the consolidation area which I see as the 137 level. I recognize that the 135 level is somewhat important though, simply because it has been supportive and resistive at different times.

Continuation

I believe that based upon the hammer that we have seen for the day on Monday, we are simply going to continue the consolidation that we have seen for some time now. I really do not believe that the market is ready to break out to the downside, and as a result I think that the bounce makes the most sense. On top of that, you have to keep in mind that the Euro itself seemed to show significant strength as we bounced off of the uptrend line in the EUR/USD pair. That of course will have an effect on the Euro everywhere, and with that it’s probably only a matter time before we see reactions in other pairs such as this one.

This market is highly sensitive to the risk appetitive traders around the world. Because of this, and the fact that the stock markets all look like they’re ready to go higher as well, I believe that this market will find itself higher by the time we close business today.