EUR/USD Signal Update

Last Thursday’s signals gave a profitable short trade off the bearish reversal from 1.1315 with an inside bar break that was good for a profit of about 50 pips.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered from 8am to 5pm London time.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1315.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of the ascending trend line currently sitting at about 1.1410.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

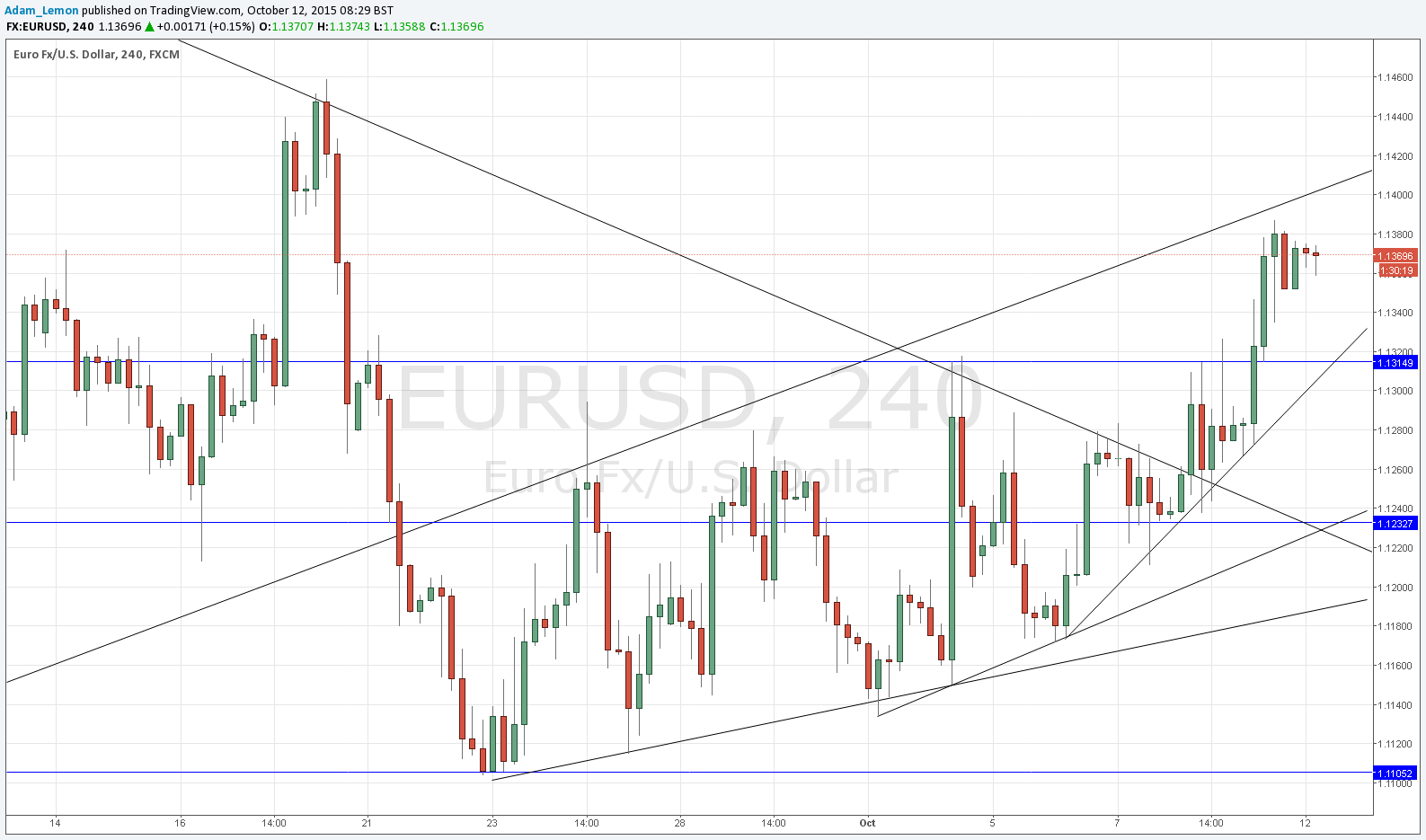

Over the past few days this pair has started to look more bullish. The price is above its levels from both 1 month and 3 months ago, and a key indicative bearish trend line which could have capped a ranging price was broken to the upside at the end of last week.

We have had continually ascending trend lines for about 3 weeks now, which is also bullish, but watch out for a break down below the steepest supportive trend line. Of course, the trend line above at around 1.1410 is also quite likely to hold the price. These two trend lines will be key to watch in determining the likely next move.

It is probably going to be very slow after about 1pm London time as there is a holiday in the USA today, so it is quite probable both the trend lines will hold until the Asian session tonight at the earliest.

There are no high-impact releases due today concerning either the EUR or the USD. It is a public holiday today in the USA.