EUR/USD Signal Update

Last Thursday’s signals accurately forecast the resistance holding at 1.1200 but the reversal there did not occur until after the London session had ended.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time.

Long Trade 1

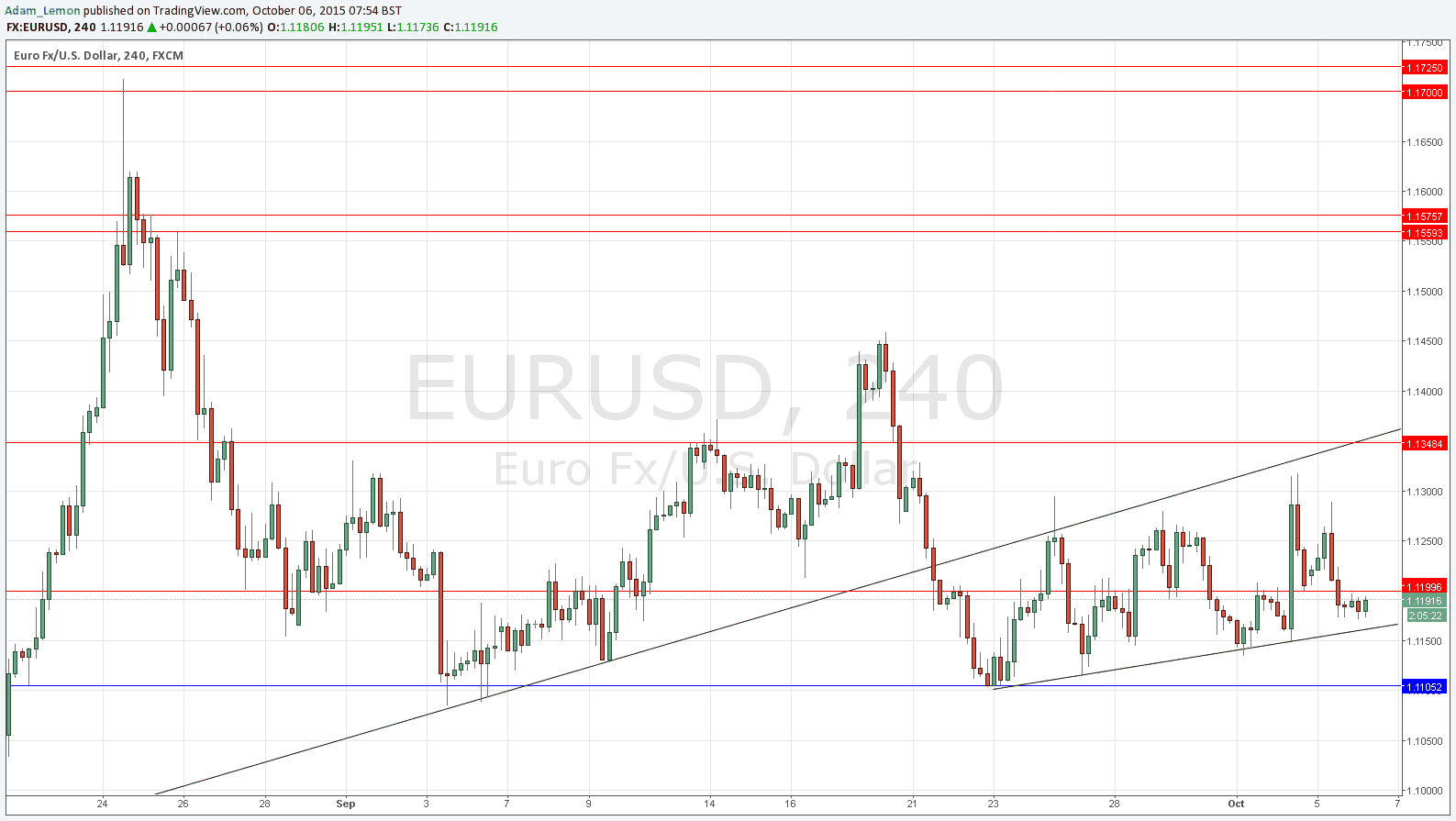

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the supportive trend line currently sitting at around 1.1165.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1105.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1200.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

A look at a long term chart shows that this pair really is stuck right in the middle of a long-term consolidation, and currently looks to be going nowhere. However it can be seen that the area at around 1.1100 previously acted as resistance for many days, and has now flipped to become support, so as long as the 1.1100 area holds, that will suggest that the next movement will be upwards. There is resistance close to the current price however, confluent with the round number at 1.1200. If this resistance holds it could be a good short entry, but you then really do have to watch out for that support kicking in even as high as 1.1150, so this pair is probably not going to give a lot of pips. On the other hand, a strong break above 1.1200 would seem to have room to reach 1.1275 quite easily, so there seem to be more pips on offer today on a probable long trade.

Concerning the USD, there will be a release of Trade Balance data at 1:30pm London time. Regarding the EUR, the President of the ECB will be speaking at 6pm.