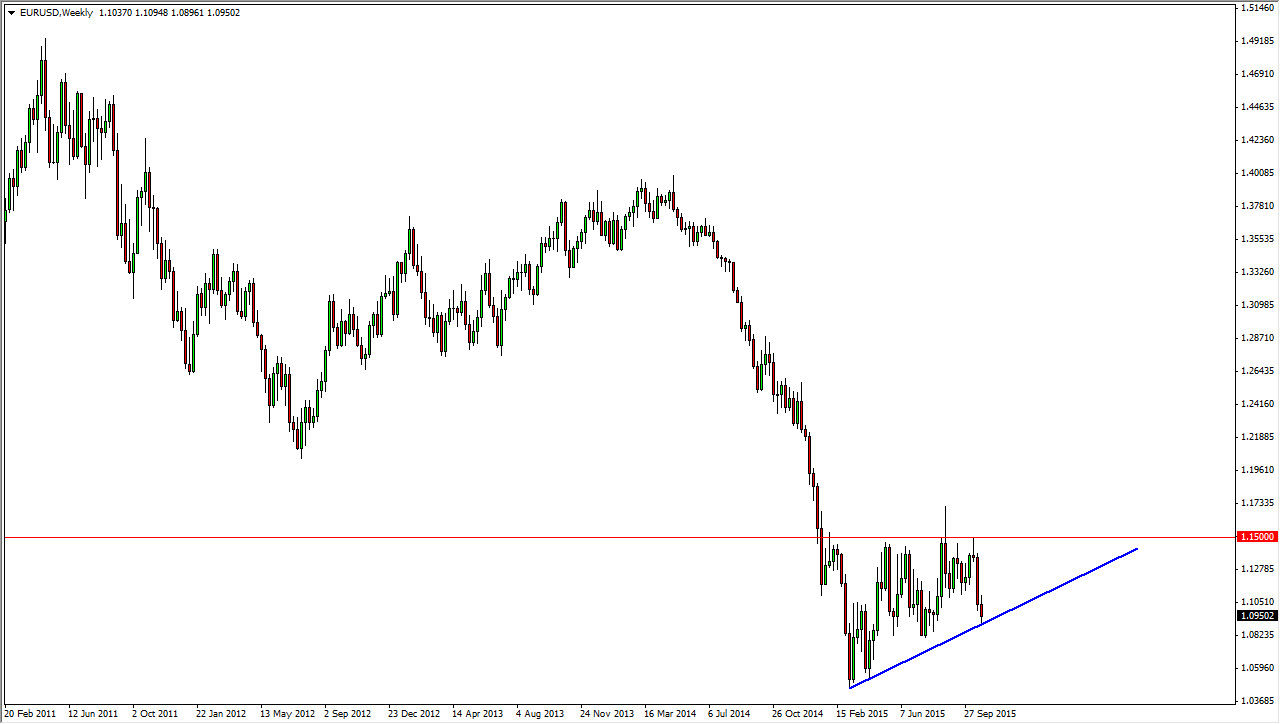

The EUR/USD pair has recently fallen in response to the European Central Bank suggesting further stimulus could be coming. This being the case, at the time of writing we are testing the bottom of a potential ascending triangle. This is a market that features a couple of central banks that are doing whatever they can to avoid stronger currency. The US dollar has been stronger over the longer term, so this point in time you have to draw a line in the sand as it were in order to trade this market.

For myself, I believe that the area that needs to be paid attention to is somewhere around the 1.09 handle. I think if we break down below there, the market will continue to go much lower, perhaps even as low as 1.05 over the course of the next several weeks. On the other hand though, if we bounce from there it’s likely that we will continue the ascending triangle, which means we could go as high as 1.15 based upon some type of reaction in the news.

Realistically speaking

If we do bounce from here, I don’t anticipate a move to the 1.15 level, rather several buying opportunities again and again. I think that we will eventually get to that level if we stay within the ascending triangle, but it’s probably going to happen in December rather than November.

On a break higher, I would be looking for short-term pullbacks and show signs of support in order to go long again and again. I would not hang onto a trade for any real length of time, because quite frankly the only thing that I think you can count on at this point in time is going to be significant volatility in the lot of jawboning by both central banks. I rarely trade this pair anymore, but once we break out of the triangle, I think it will finally show what it wants to do.