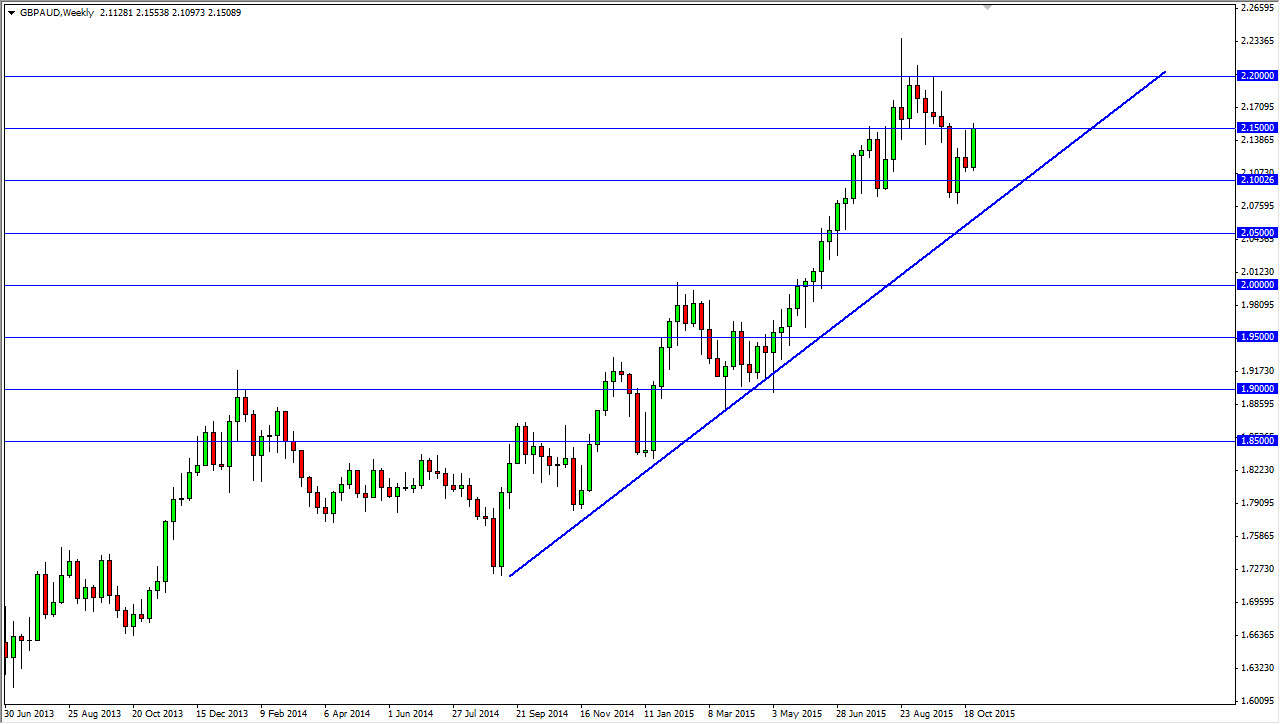

The GBP/AUD pair had a very volatile October, essentially ending where we started though. With that being the case, the market looks as if it is ready to go higher given enough time and we do have a very strong trend line well below current trading. With that being the case, and the fact that the world is essentially shunning commodity currencies in general, I think it makes sense that the pair continues to go higher. After all, people tend to feel “safer” with British assets than they do Australian ones.

Look at the last couple of weeks, we initially tried to break out but then pulled back. However, the last week of the month was very strong and we finally got to the point where we were reaching above the 2.15 handle. It is because of this I feel that the uptrend does continue, and of course it goes with the overall trend which is the best way to trade anyway.

Buying on dips

Because I believe that the Forex markets in general are going to be choppy to say the least, I am going to buy dips in this pair going forward. I believe that we will reach back towards the 2.20 level, which of course was resistance recently. We will break through there given enough time in my opinion, but it isn’t going to be easy to do. In fact, it would not surprise me at all if by the end of November we are still just below that area.

As far as selling is concerned, I don’t have a scenario in which I'm willing to do that, barring of course some type of massive meltdown. I would have to see this market break down below the uptrend line, which is somewhere near the 2.08 level at time of writing. In other words, we are a long way from any type of selling situation in my opinion.