Gold prices hit their highest level since June 6 during today's Asian session as investors continued to price in diminishing prospect of an interest rate hike from the Federal Reserve this year. The latest signs of sluggishness in the U.S. economy stoked speculations that the timing for the lift-off could be delayed to December or even to March and apparently the bulls are taking advantage of the sentiment. Cautious comments from Federal Reserve officials who wanted to wait until it is clear that the turmoil abroad will not throw the U.S. economy off track also have helped gold in recent sessions.

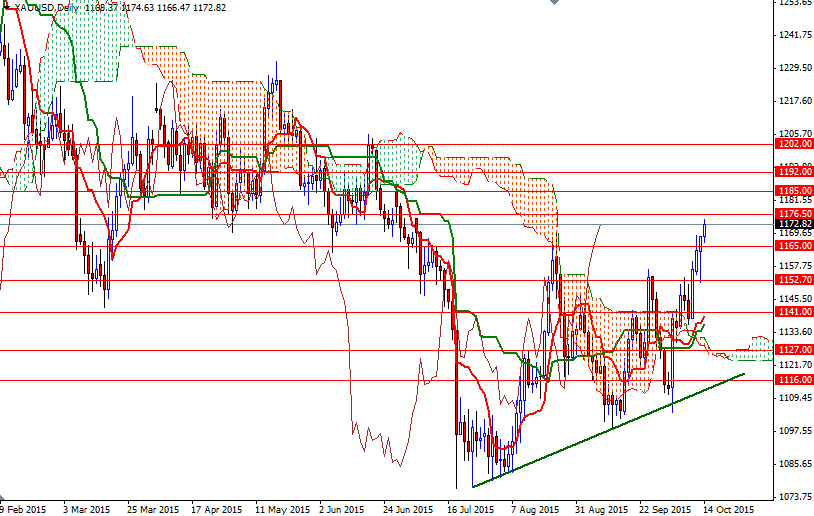

Gold prices initially fell on Tuesday but with the help of the support around the $1152.70 level, the market resumed its upwards trend and eventually broke through the 1165 resistance level. Not surprisingly, closing above this level triggered more buying and pushed prices towards the next barrier at 1176.50 as expected. The area between 1176.50 and 1185 had played an important role in the past so it makes sense to expect some sort of pull-back.

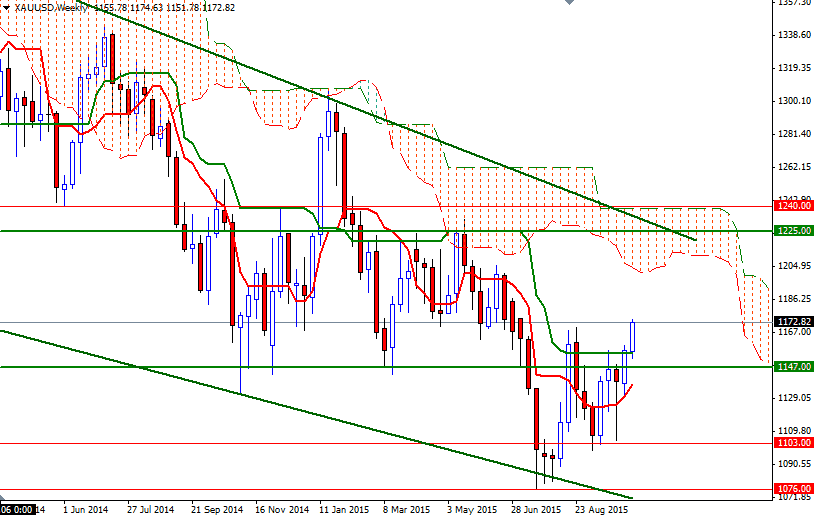

Beyond 1185, there are a few significant resistance levels prior to the weekly Ichimoku cloud. However, if the bulls capture the 1185 level, we could possibly see the bulls make a run for 1192. To the downside, the initial support stands in the 1167.50 - 1165 region. If the bulls run out of gas and the XAU/USD pair falls through, then it may be possible to see prices testing the next supports at 1158 and 1152.70. Once below that, the bears will be aiming for 1146.40.