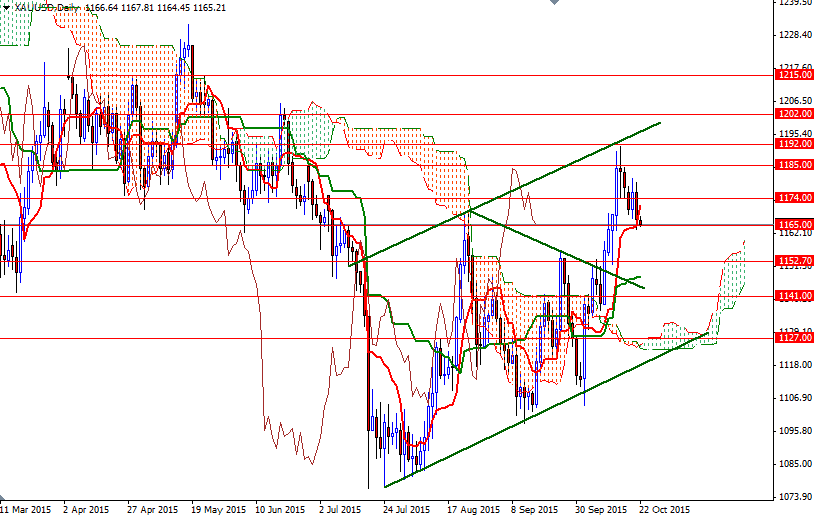

Gold prices closed lower on Wednesday, erasing all of the previous day's gains, and settled at $1166.92 an ounce as the U.S. dollar continued to strengthen. The XAU/USD pair initially tried to pass through the 1178.40 level but found significant resistance and as a result headed back to test the support in the 1165/3 region. Lately, increasing views the ECB will keep the door open for more monetary stimulus have spurred investors' interest in the greenback.

The XAU/USD pair is currently hovering just above the key 1165/3 support but the market has been under pressure since prices reversed at the 1192 level - where the upper trend-line of the ascending channel resided. If prices dip below the 1163 level which also happens to be the bottom of the Ichimoku cloud on the 4-hour time frame, we could see a downwards move aiming for the daily cloud. In that case, I think the 1152.70 will be the first stop. The bears will have to capture this strategic point so that they can test the next support at 1147. Closing below the daily Kijun-sen (twenty six-period moving average, green line) would open a path to the 1141 level.

If the bulls win the battle and prices start to rise, expect to see some resistance in the 1174 - 1178.40 zone. The top of the 4-hourly cloud also sits there, so the bulls will need to push through this area in order to challenge the bears waiting at the next key resistance level at 1185. A daily close beyond 1185 suggests that the bulls are ready to march towards 1192.