Gold started the week drifting higher, testing the resistance around the $1170 level, on increasing views the Federal Reserve will not begin the normalization process until next year. Policy makers signaled that it would be appropriate at some point later this year to take the first step to raise the federal funds rate but soft economic data in the last few weeks led many in the market to expect the U.S. central bank to keep interest rates low for the time being. However, a lift-off in December still remains on the table and that may prevent gold from significantly rallying.

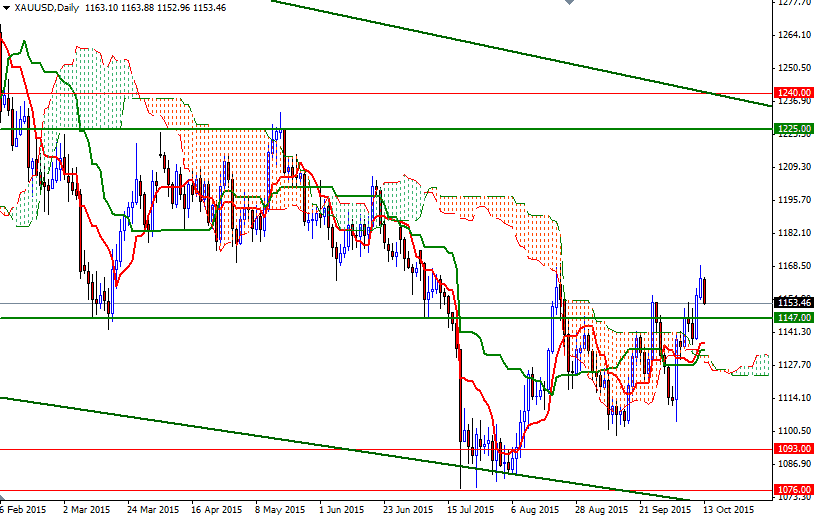

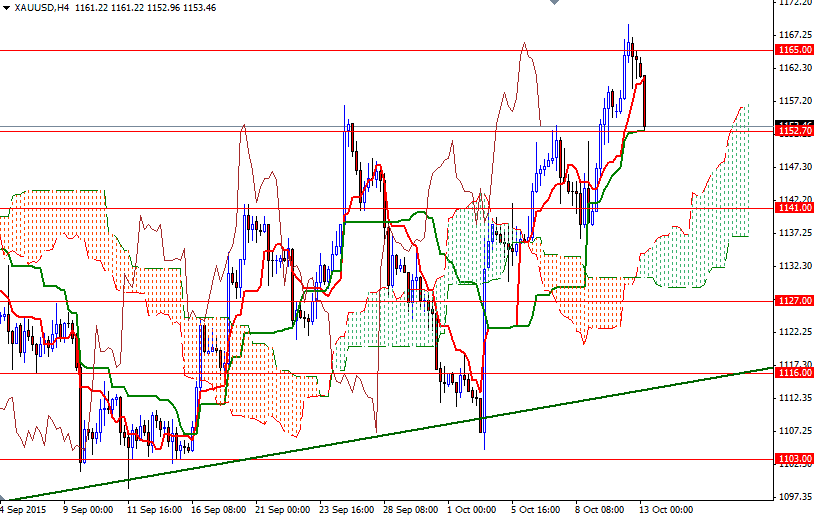

The XAU/USD pair is currently trading around the 1153 level as the anticipated resistance between the 1170 and 1165 levels kicked in and reversed prices. Based on the fact that the market is moving above the daily and 4-hourly Ichimoku clouds, the general technical picture suggests that there is the possibility of further price gains - though we might see a range bound movement with positive bias.

It is possible to see the XAU/USD pair challenging the aforementioned resistance zone (1170/65) if the bulls can defend the initial support at the 1152.70 level where the Kijun-sen (twenty six-period moving average, green line) line sits on the 4-hour time frame. As I warned in my previous analysis, clearing this resistance could extend gains and pave the way towards 1176.50. On the other hand, if the bears can increase selling pressure and shatter the support at 1152.70, it is very likely that the pair will revisit the 1147 level afterwards. A close below this level indicates that prices will have a tendency to retreat towards the 4-hourly cloud. In that case, 1143/1 will be the next target.