Gold prices hit their lowest level since October 9 yesterday as investors continued to price in the increasing likelihood of a rate rise from the Federal Reserve as early as December. U.S. economic reports on Thursday came in weaker than expected, but didn’t spark a great deal of demand for the yellow metal. The Commerce Department said gross domestic product increased at a 1.5% annual rate and a separate report from the National Association of Realtors showed the index of pending home sales dropped 2.3%.

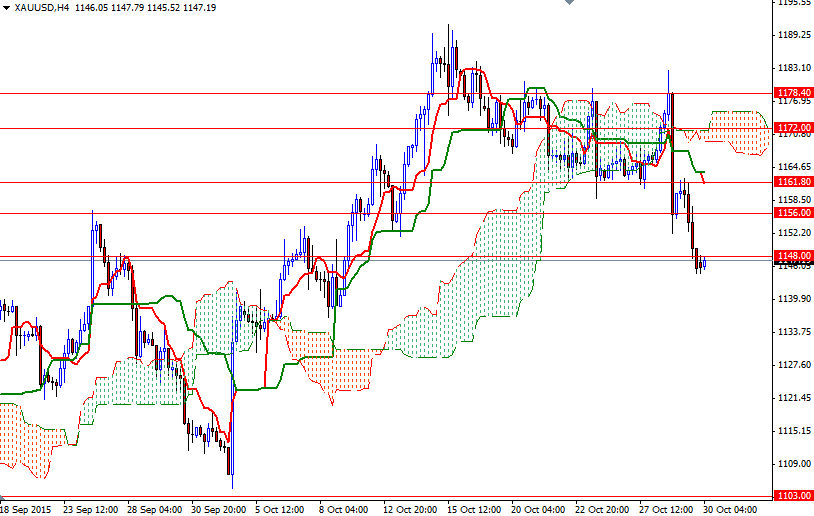

The XAU/USD pair tried to break through the anticipated resistance in the 1163/1.80 zone a number of times during yesterday's session but eventually failed. As a result, the selling pressure increased -especially after the 1156 support level was demolished- and dragged prices lower. The market has been trying to climb above the 1148 level during today's Asian session, so I will keep an eye on this resistance. This level looks to have flipped from support to resistance but I wouldn't be surprised to see some profit taking as we approach a key level at 1141.

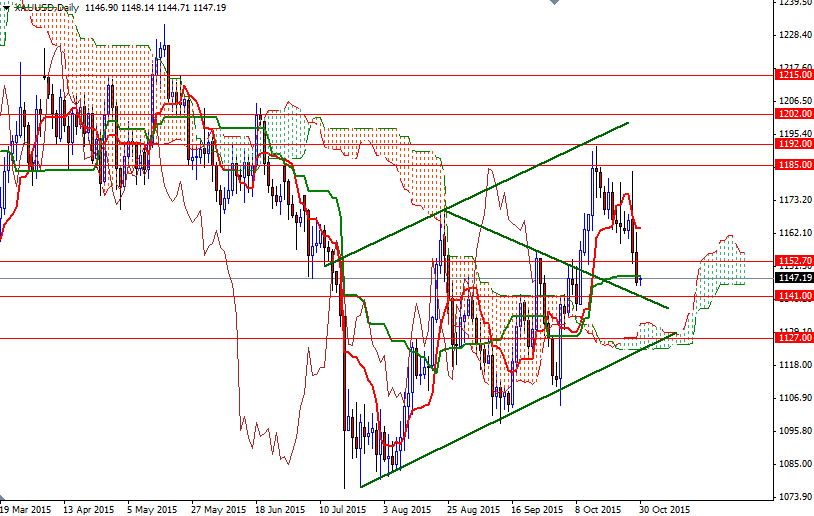

If prices penetrate the initial barrier at 1148, it is likely that the market will proceed to 1153.75 - 1152.70. However, note that there is another hurdle just above this area, at 1156. The bulls have to push prices above 1156 in order to challenge the bears on the previous (1163/1.80) battlefield. On the other hand, if the bears defend their ground increased the downward pressure, expect a move towards the 1141 level. A breakdown below that level should see a further fall, targeting the area where the daily Ichimoku clouds and the lower band of the ascending channel coincide.