Gold edged higher on Friday, recovering a portion of the previous day’s losses, after minutes from the Federal Reserve's latest meeting cast further doubt on the central bank's plans to raise rates in the coming months. Some participants judged that "the downside risks to the outlook for economic growth and inflation had increased. In their view, although the time for policy normalization might be near, it would be appropriate to wait for information, including evidence of further improvement in the labor market, confirming that the outlook for economic growth had not deteriorated significantly and that inflation was still on a path to return to 2 percent over the medium term", according to minutes of the September 16-17 session of the Federal Open Market Committee.

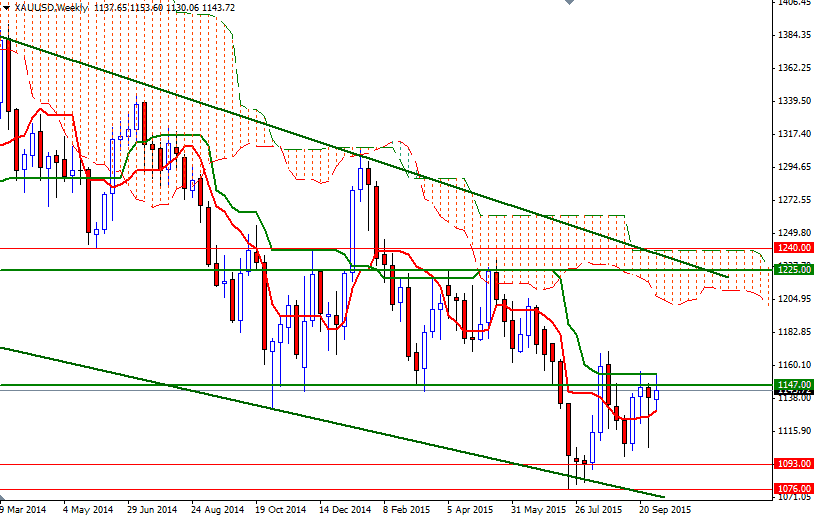

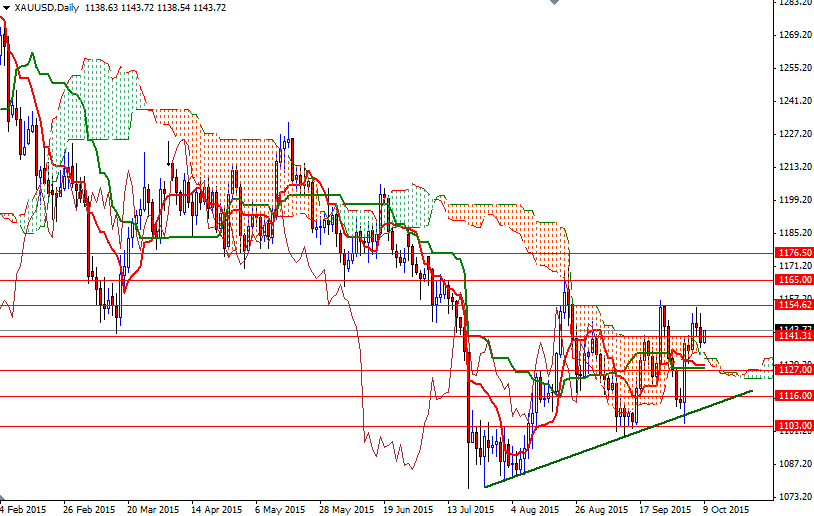

From a technical perspective, climbing back above the 1141.31 level implies that the bulls don't intend to give up. If they can hold the market beyond this level, they could make a fresh assault on the 1147 level which also happens to be the top of the hourly Ichimoku cloud. Breaking through this barrier would make me think that, the XAU/USD pair will retest the resistance at 1154.62. A close beyond that point may provide the bulls the extra power they need to tackle the 1165 level.

To the downside, I will be keeping an eye on the 1134 - 1132.50 region where the daily cloud resides. If this support is broken, there is a possibility that XAU/USD will visit the 1129/7 area. The bears will need to capture this strategic camp defended by the daily Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines in order to increase the pressure on the market. In that case, prices will probably return to the 1116 level.