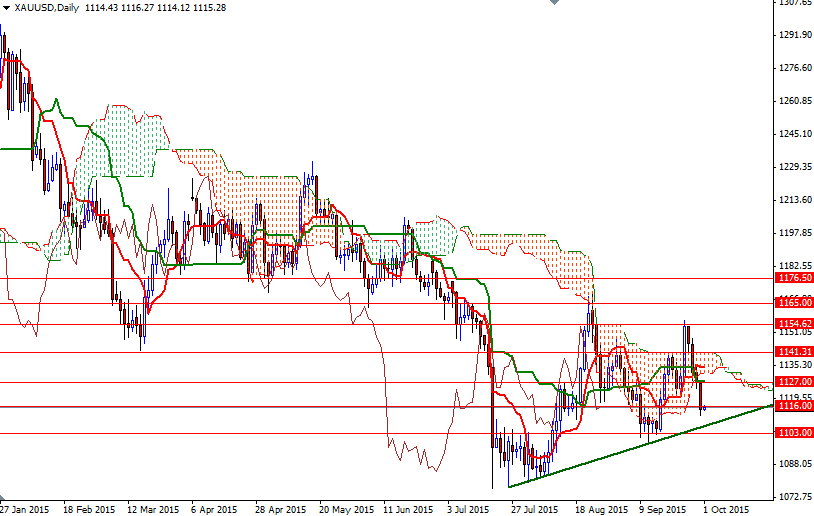

Gold prices ended the month down roughly 1.8% at approximately $1115 an ounce, pressured by a firmer dollar and weak demand. The market started the week on the back foot but with the help of the support around the $1103 level, the market rallied all the way to the $1155 area. However, the bulls gave up after the initial rally faded as buying dried up. The uncertainty persisted about the timing of the lift-off after the Federal Reserve refrained from raising rates last month, though it appears that international financial and market developments are giving investors another excuse to stick with the greenback.

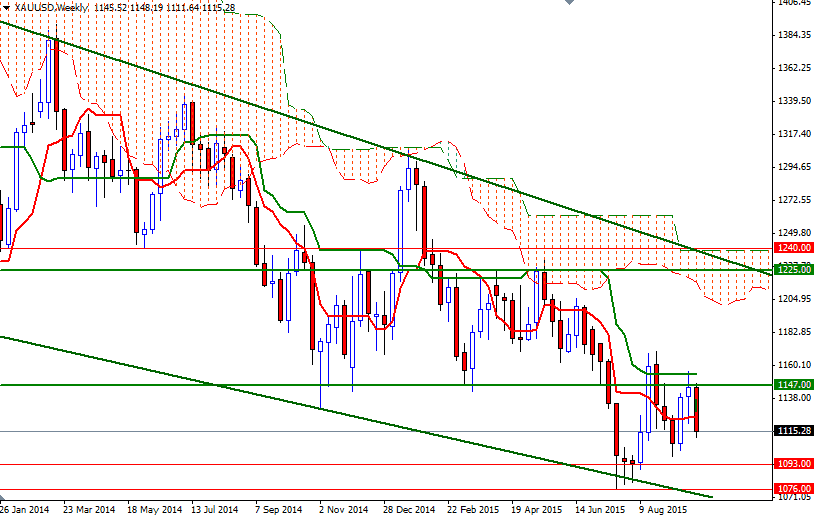

The government's monthly jobs report due tomorrow will likely set the tone for the dollar for the rest of the month. If fresh data provides the Fed more evidence that the economy is strong enough to endure higher rates, investment demand in gold may weaken further. From a long-term perspective, trading below the Ichimoku clouds on the weekly time frame indicates the strong bearishness continues. The downside risks remain will remain negative until the market breaks out of the descending channel, which originates in July 2013, and anchors somewhere above the weekly cloud. The market's inability to hold above the daily Ichimoku cloud also weakens the technical outlook.

Down at 1106 we have a confluence of horizontal support and a short-term ascending trend line - and just below that we have a key support at 1103. Dropping through the 1103 level would suggest that the bears are getting ready to challenge the support at 1093. If this support is broken, the 1083 level will be the next port of call. I think the support around 1076 will play an crucial role going forward because a successful break might drag gold prices towards the 1062.85 level. However, a short term upswing is still possible depending on the market's reaction to the incoming data. To the upside, the bulls will have to push through 1127 area in order to gain enough momentum to tackle the next barrier standing in the way at 1142. A sustained push above the 1147 level attract new buying and will force shorts to cover their positions. In that case, the bulls might have another chance to march towards the 1176.50 - 1165 region.