Gold ended the week down nearly 1% at $1164.53 an ounce as strength in the dollar and stock markets sapped demand for the metal. Increasing demand for the greenback and the risk on attitude across global markets tend to weaken the appeal of commodities such as gold but doubts over whether the Federal Reserve will press ahead with a rate hike in December are limiting the down side.

The U.S. central bank will be in focus again this week as a two-day meeting of its policy-setting committee kicks off Tuesday. Although expectations for a hike have shifted to next year in recent weeks amid concerns about turbulence on financial markets, modest global growth and falling energy prices, I think it is too early to rule out a move in December. We are going to have lots of data from now until the December meeting so the situation may change.

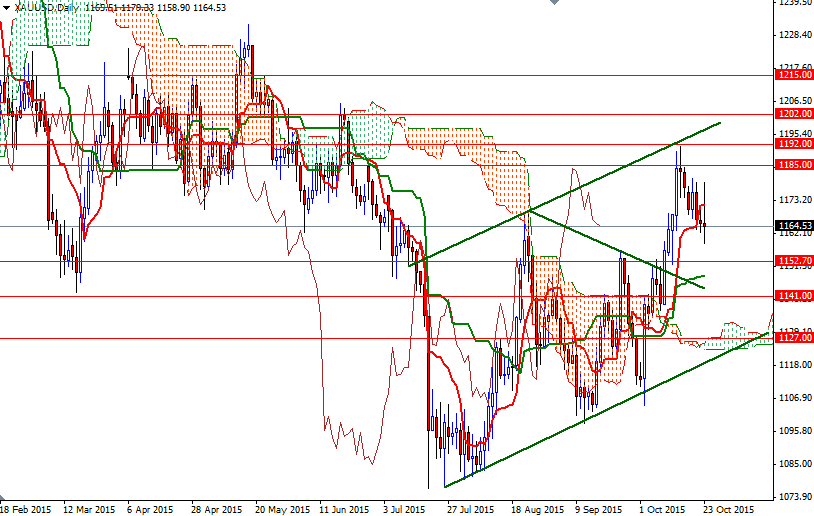

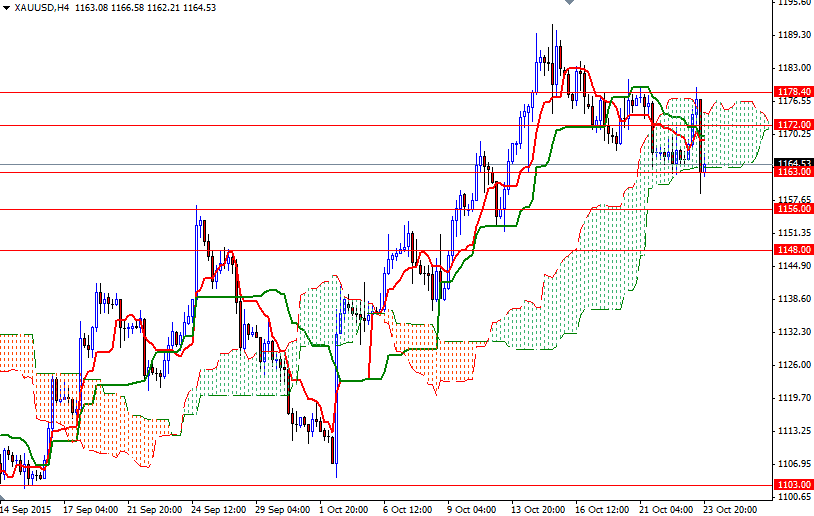

Speaking based on the charts, I expect the XAU/USD pair to continue its movement within the ascending channel the market has been respecting for quite some time. The medium-term outlook is bullish while prices reside above the daily Ichimoku clouds and the Tenkan-sen (nine-period moving average, red line) moves above the Kijun-sen (twenty six-period moving average, green line). However, as you can see, we have (almost) an opposite picture on the 4-hour time. If the market fails to climb above the 1165/3 region, then we may see prices approaching the 1156/2.70 region where also the weekly Kijun-sen sits. A break below 1152.70 would open up the risk of a move towards 1148 and perhaps a retest of 1141. The first important hurdle gold needs to jump is located at the 1172 level but the cloud on the 4-hour chart currently occupies the area until 1178.40. Therefore we will have to pay attention to this region rather than specific levels. Once beyond that, the bulls will have another chance to tackle the 1185 resistance.