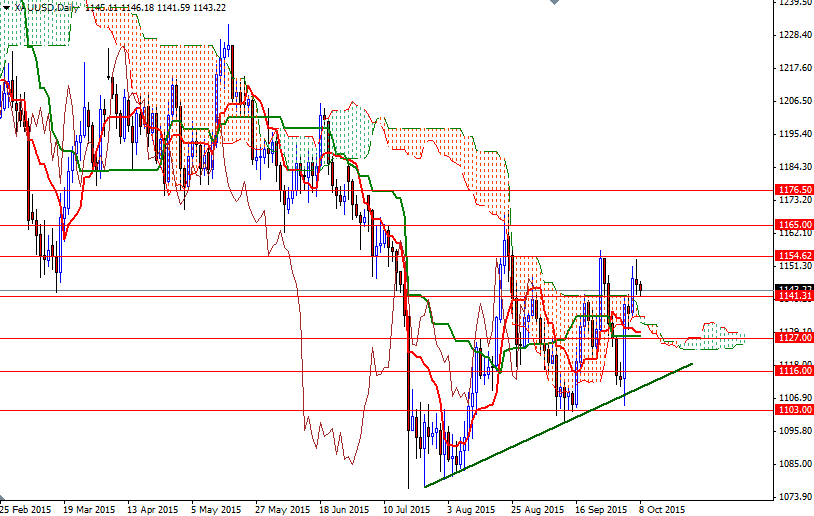

Gold prices settled slightly lower on Wednesday after shuffling between gains and losses, as investors waited for the minutes of the Federal Reserve's September 16-17 meeting to gauge the central bank's outlook on the economy and rate policy. The XAU/USD pair initially advanced yesterday but encountered resistance around the 1154 level. As a result, the market returned to the previous resistance now flipped to support at 1141.31. The Fed had refrained from hiking rates at its last policy meeting, citing the turmoil in emerging markets and sluggish inflation.

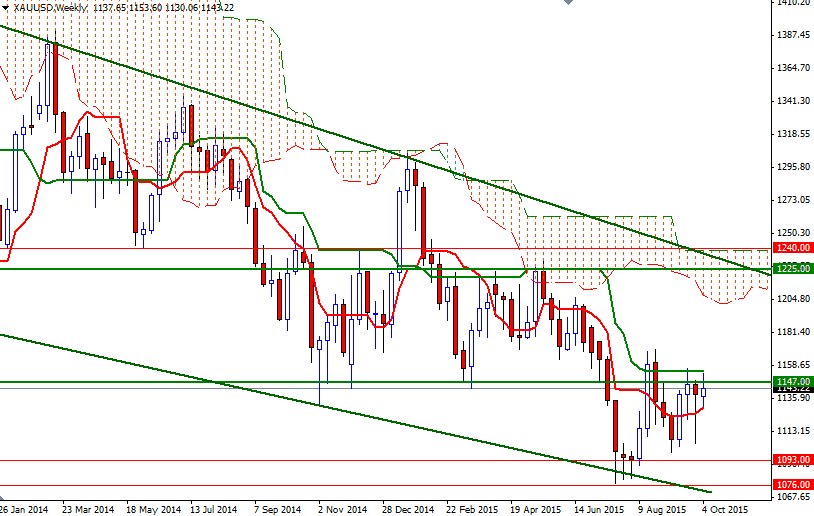

The market is stuck in a narrow range during today's Asia session and currently trading close to the 1141.31 support. The FOMC minutes, due later today, could be either the support that prices need to climb above the 1154.62 level or the catalyst to test the 1129.79 - 1127 zone. A break above the weekly Kijun-sen line (twenty six-period moving average, green line) sitting at 1154.62 could trigger a push up to 1165.

As mentioned earlier, below 1141.32, there is an anticipated support zone that stretches from 1129.79 to 1127. Since the weekly Tenkan-sen line (nine-period moving average, red line) and the daily Ichimoku clouds converge in this area, the bears will have to capture this fort if they intend to stay in the game and find another chance to tackle the support at 1116.