Gold continued to retreat from a three-and-a-half-month high struck last week and extended loses to a third straight session on Monday as the U.S. dollar gained strength on upbeat housing data. The National Association of Home Builders' sentiment index came in at 64, up from the previous month's 61 and above expectations for a reading of 62. The greenback was also boosted by the weakness in the euro, which was pressured on growing perception that the European Central Bank may provide more stimulus to the euro zone economy.

There is a lot of uncertainty in the market over whether the U.S. central bank would hike rates this year and yesterday we had conflicting comments from Fed officials. San Francisco Fed President John Williams said "My own view is that the economy is still on a good trajectory...I do see the time to start raising rates in the near future". New York Federal Reserve Bank President William Dudley, on the other hand, thinks that it is too early to consider a rate hike due to concerns about global economic growth.

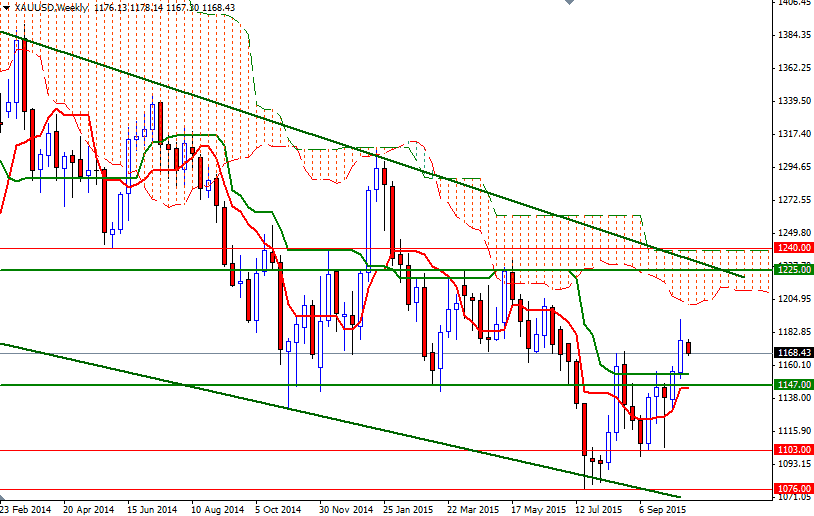

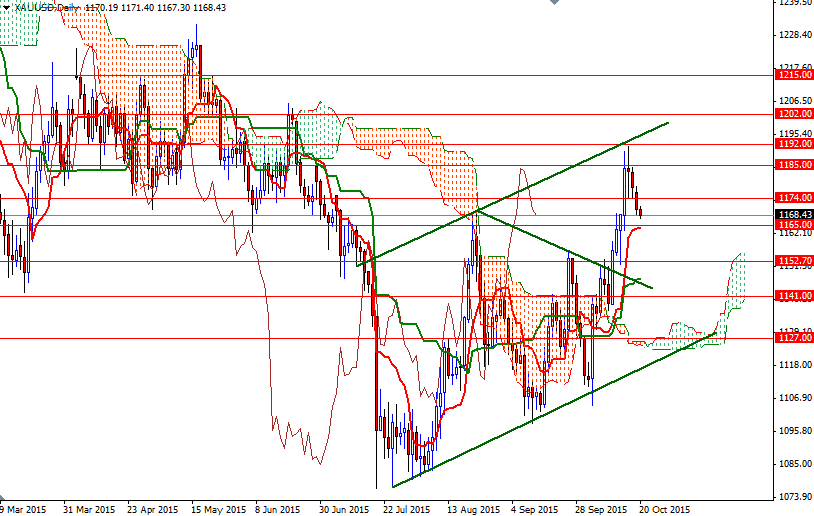

The XAU/USD pair is trading at $1168.43 an ounce at the moment as the exhaustion appeared near the upper trend-line of the short-term ascending channel persisted and because of that I will be keeping an eye on the crucial support area not far below the current price between 1165 and 1163. If the bulls parry the bears' attacks and defend their ground, then the market will probably revisit the 1174 and 1178.40 resistance levels. They will need to push prices beyond 1178.40 so that they can start a journey to 1185. However, if sellers increase the downward pressure and the 1165/3 support area where the daily Tenkan-sen (nine-period moving average, red line) sits falls apart, 1154/2.70 will probably be the next port of call. Falling through 1152.70 could open the way down to a further move to the 1147 level.