Gold prices rose 2.25% on Friday, posting the first gain in five sessions, and settled at $1139.59 an ounce as U.S. jobs data fell short of market forecasts. The Labor Department reported that the economy added 142K jobs in September, well below consensus estimates of 201K, and average hourly wages stagnated. The jobless rate held at 5.1% but revisions cut a total of 59K jobs from payrolls in the previous two months. The news not only buried any hopes for an October rate hike but also cast a shadow on the U.S. economy.

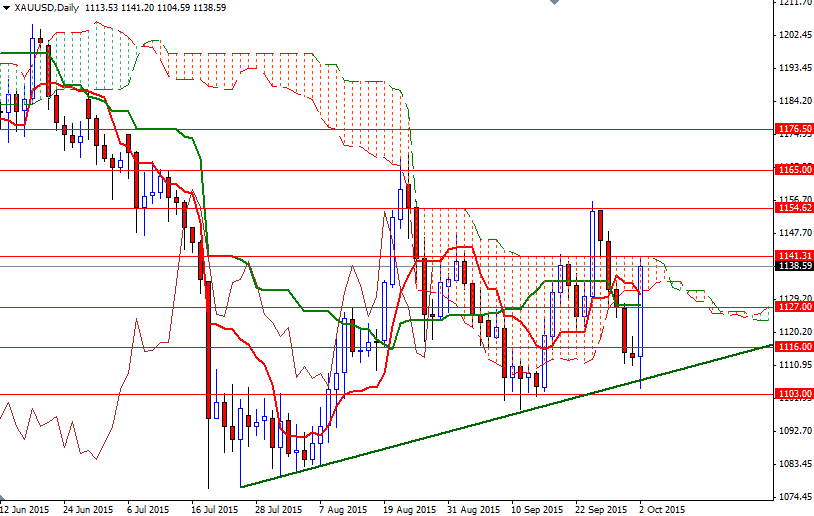

The XAU/USD pair was able to cleanly break the anticipated resistance at $1127 and as a result the market ended up challenging the top of the daily Ichimoku cloud at $1141.31. From a technical point of view, there were a couple of bullish signs which occurred Friday. The market bounced off a key support around 1106 and close around the top of the daily range. The short-term charts are slightly bullish at the moment, with prices above the positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. In addition to that, the daily Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

However, in order to confirm that this bullishness here has much further to run, prices will have to climb and hold above the daily cloud (i.e. 1141.31). If the bulls are able to maintain control and penetrate this barrier, it is likely that XAU/USD will test 1154.62 afterwards. Closing above 1154.62 would imply that the market is ready to advance to the 1176.50 level which established itself as an important level in late 2014. If XAU/USD encounters heavy resistance and starts to retreat, the initial support sits at 1130.60, followed by 1127/3. A successful break below 1123 may extend losses and take us back to the 1116 level.