Gold prices ended Monday nearly unchanged after a quiet session as investors turned their focus to the Federal Reserve's two-day policy meeting for signs on when the central bank may pull the trigger on its first rate hike since 2006. The U.S. central bank will not provide new economic projections and there is no press conference so we will have only the official statement. The minutes of the latest meeting had indicated that the policy makers wanted to take a little more time to see how the economy reacted to the recent troubles in overseas economies.

The economic data that has come out of the U.S. lately hasn't been very positive. Disappointing growth in the U.S. jobs market along with signs of stagnating inflation and retail sales dented expectations the U.S. Federal Reserve will begin normalizing the stance of monetary policy this year. The XAU/USD pair traded as high as $1169.58 an ounce yesterday after the Commerce Department said sales of new homes sank 11.5% to an annualized pace of 468K from 529K but the metal failed to hold on to the gains and retreated to the $1165/3 region.

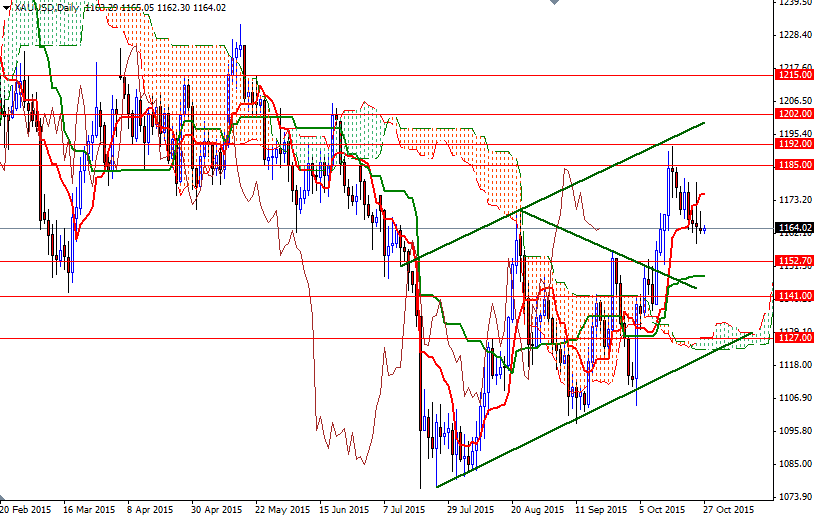

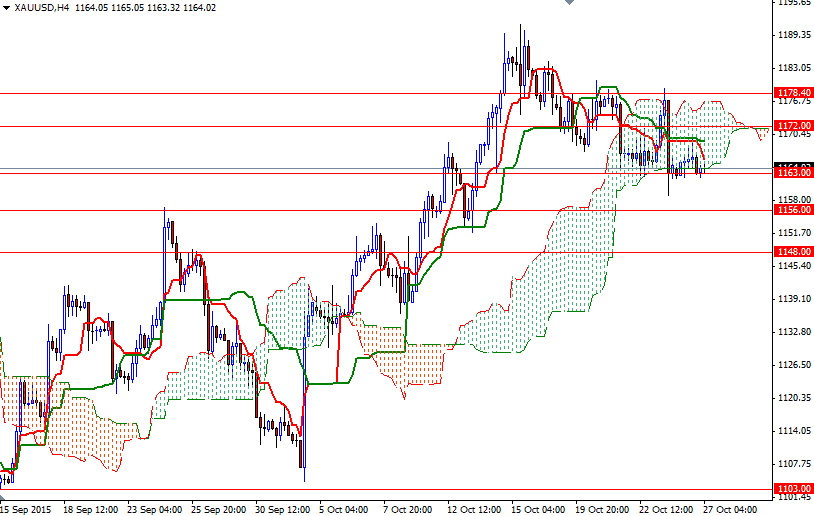

It appears that we will tread water until the Fed announcement. However, today sees the release of durable goods orders and consumer confidence data so expect to see some volatility in the market. From a purely technical standpoint, the odds favor a range bound movement as the charts paint a mixed technical picture. Although XAU/USD is beyond the daily Ichimoku cloud and there is a positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross, the 4-hourly cloud is right on top us and the Tenkan-sen is below the Kijun-sen. The initial support level stands at 1163, followed by 1161.80. If the bears take over and drag prices below 1161.80, it is likely that we will see the pair testing the next support in the 1156/2.70 zone. Falling through 1152.70 would imply that the market will be aiming for 1148 afterwards. The upward potential is likely to be limited by the resistance in the 1172/0 region, so we need to climb above there in order to march towards 1178.40. If the bulls gain more traction and successfully break through, then we are likely to proceed to 1185.