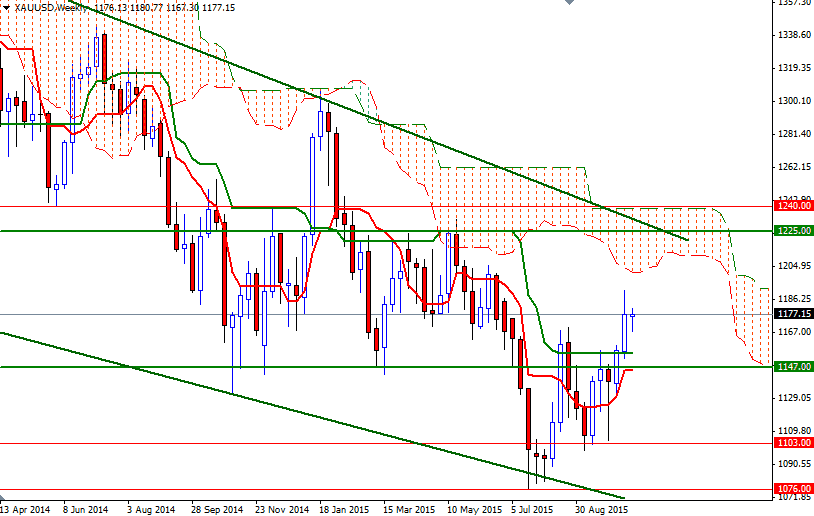

Gold prices rose 0.5% on Tuesday, snapping a three-day losing streak, and settled at $1175.89 an ounce as a softer dollar lured investors back into the market. Yesterday's U.S. data were mixed with building permits falling sharply in September but construction of new homes rising to the second-highest level in eight years. The precious metal has advanced nearly 5.5% since the beginning of the month and it appears that the market has gotten ahead of itself and needs to consolidate the recent gains.

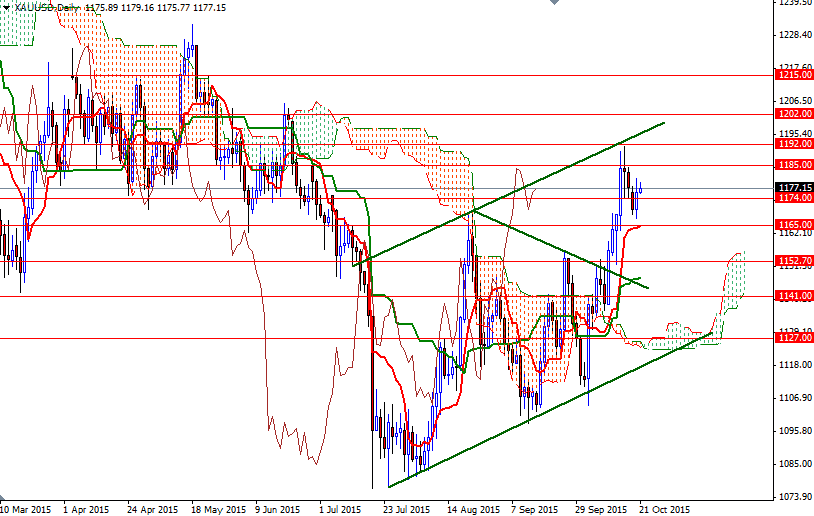

The XAU/USD is currently trading at 1177.15, slightly higher than the opening price but as you can see we are stuck in a relatively narrow range of around $20. Technically, trading above the Ichimoku clouds (on both the daily and 4-hourly charts) gives the bulls an advantage. However, 1185 will be the key level for the bulls to pass in order to challenge the bears at the 1192 battle field. Penetrating this barrier would suggest an extension to the upper trend-line of the short-term ascending channel.

The initial support stands in the 1174/3.75 region where the bottom of the Ichimoku cloud on the 30-minute chart sits and then nothing stands out until 1165/3. The bears will have to capture this strategic camp and maintain prices below the daily Tenkan-Sen (nine-period moving average, red line) in order to gain more momentum and test 1154/2.70. A break below the 1152.70 would indicate that the bears won't give up before the market visits the 1147 support.