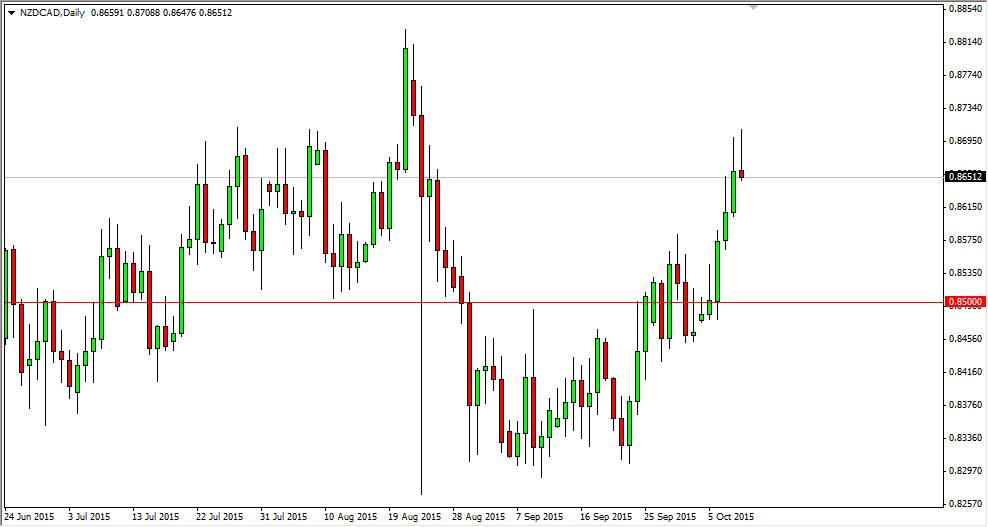

The NZD/CAD pair broke higher during the course of the session on Friday, but turned back around near the 0.87 level to form a shooting star. The shooting star of course is a very negative candle, and I think that the New Zealand dollar at this moment in time is a little overbought. When you look at the NZD/USD pair, it looks almost identical and it is sitting just below significant resistance. Ultimately, the market has no interest whatsoever in buying the New Zealand dollar at this point, as Friday might have been a stretch too far.

This is essentially an “Asia versus North America” type of play. With that, it’s probably only a matter of time before we get some type of break down as North America is of course favored. If we break down below the bottom of the Friday candle, the market should then reach towards the 0.86 level next.

Commodities

Both of these are commodity currencies, but because of the fact that the world seems to be facing quite a bit of uncertainty, you then have to look at overall strength of the regions that these currencies represent. With that, I think that the New Zealand dollar will be shunned based upon the fact that it is starting to show signs of weakness against other currencies, and the fact that this pair does tend to mirror what’s going on in the NZD/USD pair most of the time.

Ultimately though, if we break above the top of the shooting star that would be an extraordinarily bullish sign, and the market should then reach towards the 0.88 handle. With that, I feel that the market could take off at that point, simply because it would be such a breach of resistance.

I think that if we do break down though, it probably won’t be much farther than the 0.85 level in the end. That is an area that has a pretty significant cluster, and although the Canadian dollar does have the relative safety of North America behind it, the truth of the matter is that neither one of these currencies are ones that people are going to want over the other.