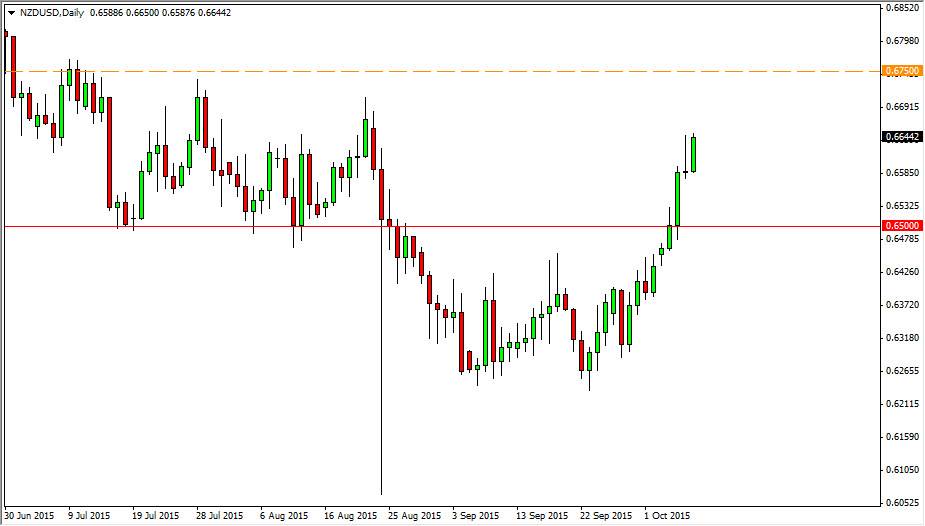

The NZD/USD pair broke higher during the course of the session on Thursday, testing the top of the shooting star that formed during the Wednesday session. That being the case, it is very likely that we are going to go higher this point in time although it is against my better judgment. I think at this point in time, the market will try to reach towards the 0.6750 level, which I of course marked with an orange dashed line.

A break above the top of the range for the session on Thursday would be reason enough to start buying, but I recognize that the move to that level above will be very difficult. On top of that, you have to keep in mind that the New Zealand dollar is very sensitive to the commodity markets in general, so pay attention to those.

On the other hand…

On the other hand, if we break down below the bottom of the shooting star for the Wednesday session, I believe that shows enough softness to push this market back down to the 0.65 handle. That is an area that could be supportive, so I would be willing to take my profit pretty quickly as we approach that level. Having said that though, we would also have to see quite a bit of strength in the commodity markets for me to feel comfortable buying this pair, and of course the exact opposite for me to feel comfortable selling.

The New Zealand dollar isn’t necessarily move by any one particular commodity market, so it’s difficult to measure any type correlation, unlike the Australian dollar and gold. So having said that it’s more or less going to be a “barometer” of the risk appetite in general. Because of this, the New Zealand dollar tends to be very volatile, but I think it’s only a matter time before we have to make a significant move. It has been rather strong to the upside lately, and they do feel that it is very likely overextended. Because of this I do not anticipate the 0.6750 level to be broken.