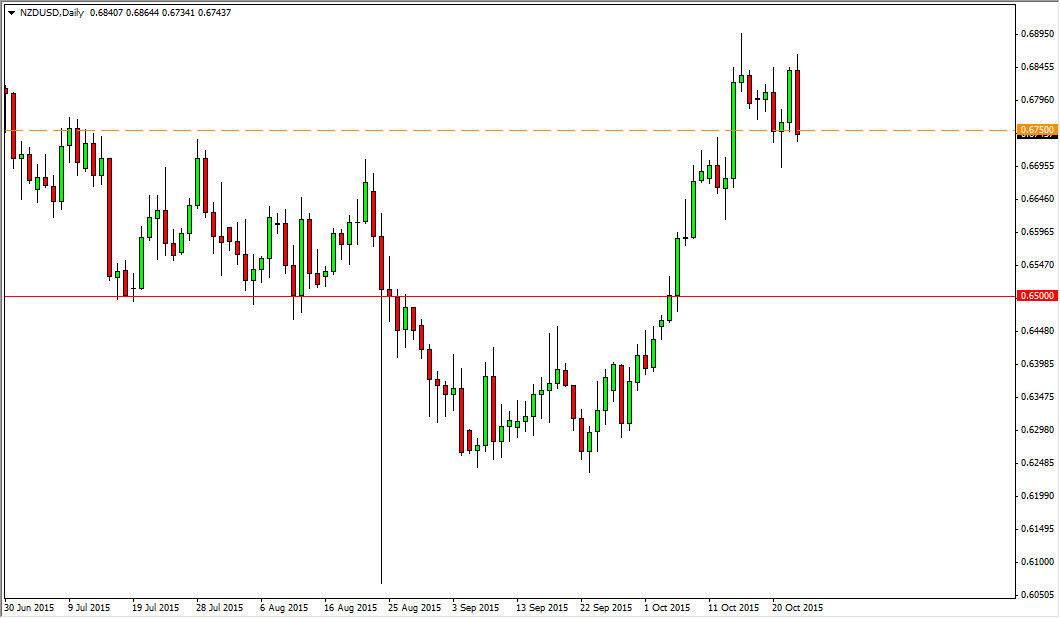

The NZD/USD pair fell during the course of the session on Friday, testing the 0.6750 handle. This is an area that has previously been resistance, and now appears to be offering quite a bit of support. However, the one thing that I am paying the most attention to is the hammer from Wednesday at that level. If we can break down below that hammer, I feel that this market will probably drop all the way down to the 0.65 handle. Ultimately, any type of supportive candle in this general vicinity should be a buying opportunity as the recent breakout should be followed up by momentum in theory. However, the US dollar continues to strengthen in general, so it could be difficult to see the New Zealand dollar continue to strengthen. This is part of a “knock on effect” as the European Central Bank looks to add stimulus to the economy, which of course in effect may the US dollar strengthen overall.

Looking for support

Even though we ended up closing at the bottom of the range for the session on Friday, the reality is that I see quite a bit of support just below. Any type of supportive candle would be reason enough to start going long, at that point time I would anticipate a short-term move back to the 0.6850 level. Ultimately, I do think that the market could very well bounce but keep in mind that the strengthening US dollar works against the value of commodities, and of course the New Zealand dollar is very sensitive to the attitude of commodity markets in general. With this, keep in mind that there should be a lot of volatility so I wouldn’t be hanging on to trades for any real length of time anyway.

All things being equal, if we can break above the 0.70 level the market should then break out to the upside and change the overall trend. In the meantime, expect a lot of bouncing.