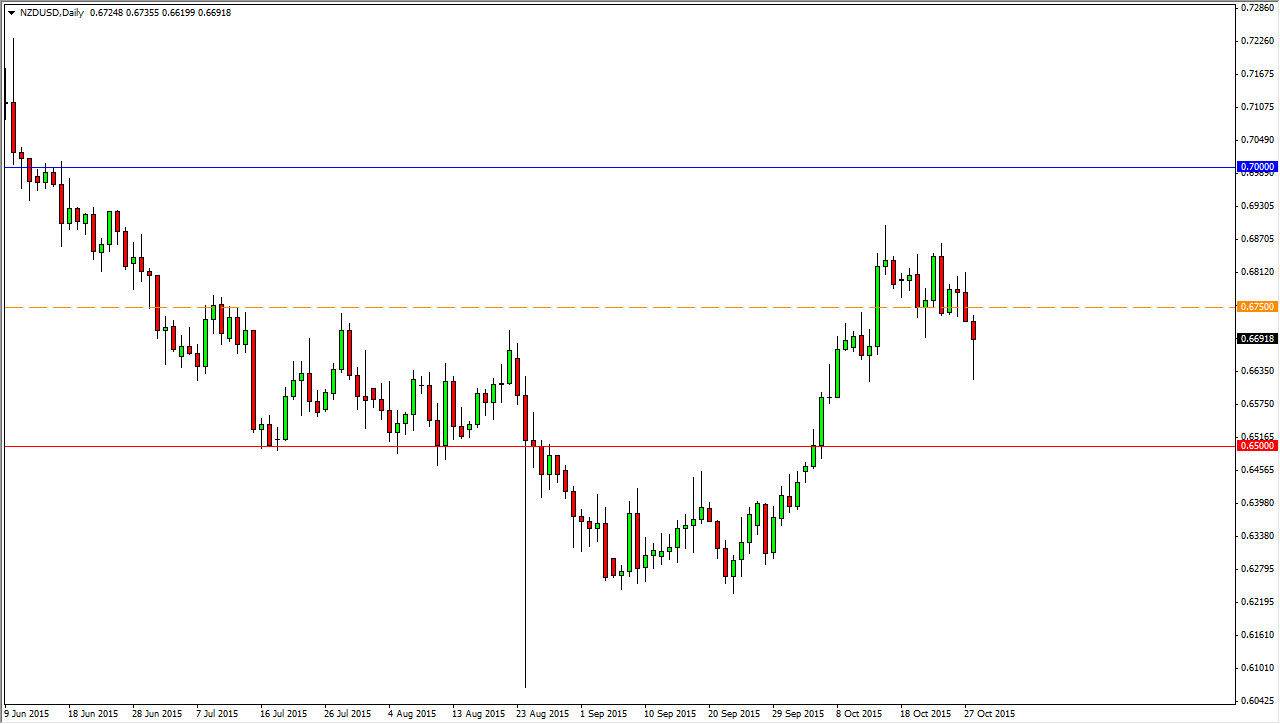

The NZD/USD pair fell significantly on Wednesday but found enough support near the 0.66 level to bounce and form a nice-looking hammer. The hammer of course is a very bullish sign and probably one of the most positive candle sticks you can find. I believe that if we can break above the 0.6750 level, which is represented by the orange dashed line on my chart, we will continue towards the 0.69 handle again. Above there, we should then reach towards the 0.70 level, and above there am willing to officially call this a trend that has changed.

I recognize that the hammer could be partially due to the fact that the FOMC Statement came out yesterday, but at the end of the day I think this simply shows that there is support below, and the path of least resistance is higher. The New Zealand dollar has been a bit difficult to trade lately, but at the end of the day I think that it is far oversold more than anything else.

Don’t forget commodities

Commodities of course have a great influence on the New Zealand dollar, as it is considered to be a commodity currency. However, this pair tends to reflect the general attitude of commodities, not a specific market itself. After all, only the psychos trade some of the commodity markets that New Zealand is known for, mainly milk and cattle. Those are very illiquid markets, and not where you want to be speculating. Because of this, this pair tends to move in more or less a general attitude of the markets, and not those futures contracts.

Even if we break down below the bottom of the hammer, I think there is a significant amount of support at the 0.65 waiting. Because of this, I’m not necessarily looking to sell at this point in time, although I’m not necessarily thinking that the markets can break out and explode to the upside anytime soon. I think a slow grind higher is the most likely of events.