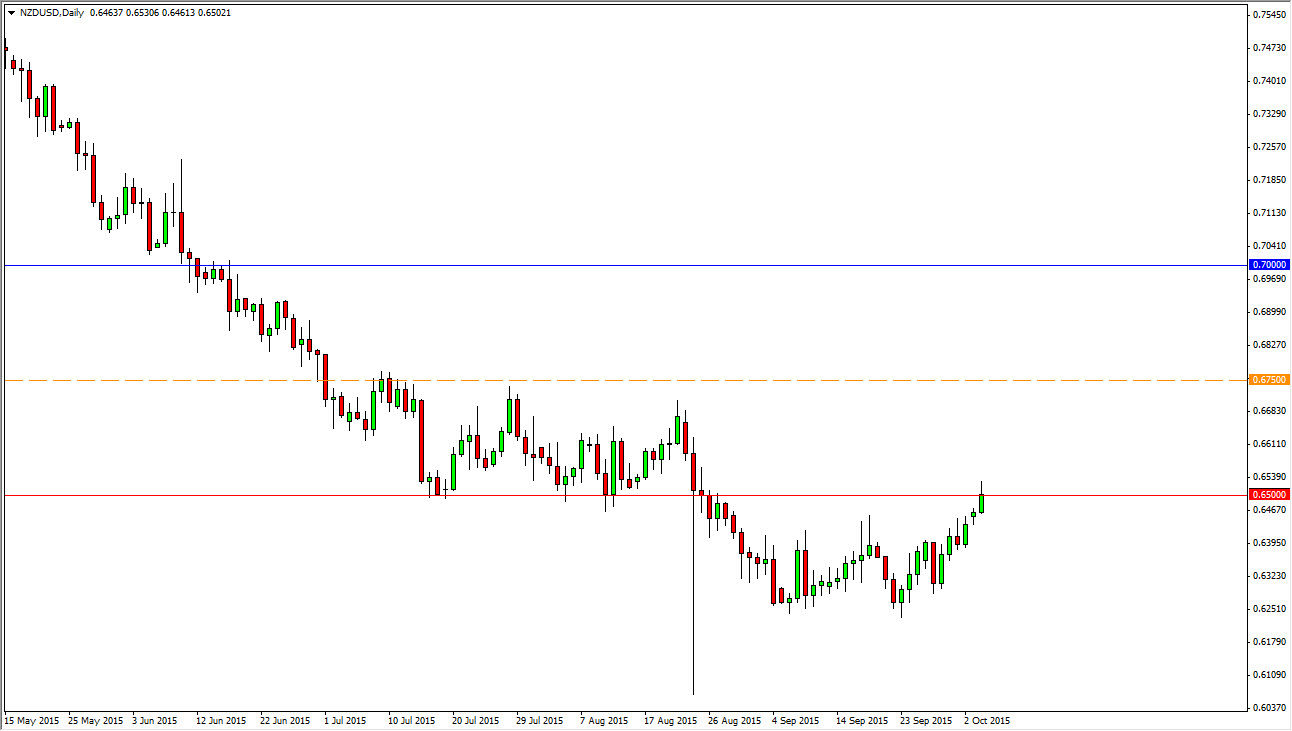

The NZD/USD pair rallied initially during the course of the session on Monday, breaking above the 0.65 handle. This is an area that I have seen as resistance recently, as we pulled back every time we got near it. On top of that, during the month of July we had seen quite a bit of support in that area before the breakdown. Now that we have re-approached that level, it is very likely that we will see quite a bit of resistance at that barrier, and I believe that it goes much higher than that given enough time.

The shape of the candle is a bit like a shooting star, although it isn’t quite perfect. I think that the market will more than likely find quite a bit of resistance here, and with the Reserve Bank of Australia releasing an interest rate announcement and statement, the Kiwi dollar will more than likely move in sympathy as the two currencies tend to be very similar.

No interest in buying

I have no interest in buying this currency pair, at least not until we get above the orange dashed line on this chart, which is at the 0.6750 level. I think that it’s only a matter time before the sellers take over, and quite frankly I would not be surprised if that is today. A break down below the bottom of the candle for the session on Monday is reason enough for me to start selling, as I believe the market will then reach towards the 0.6250 level. Don’t know necessarily that we are going to break down to fresh, new lows, I just think that it is going to be difficult to own the New Zealand dollar over the US dollar at this point in time.

With this, I also believe that a break out above the top of the candle is not a reason to buy. As long as we can stay below that orange line, I believe that selling rallies the show signs of resistance will be the way to go.