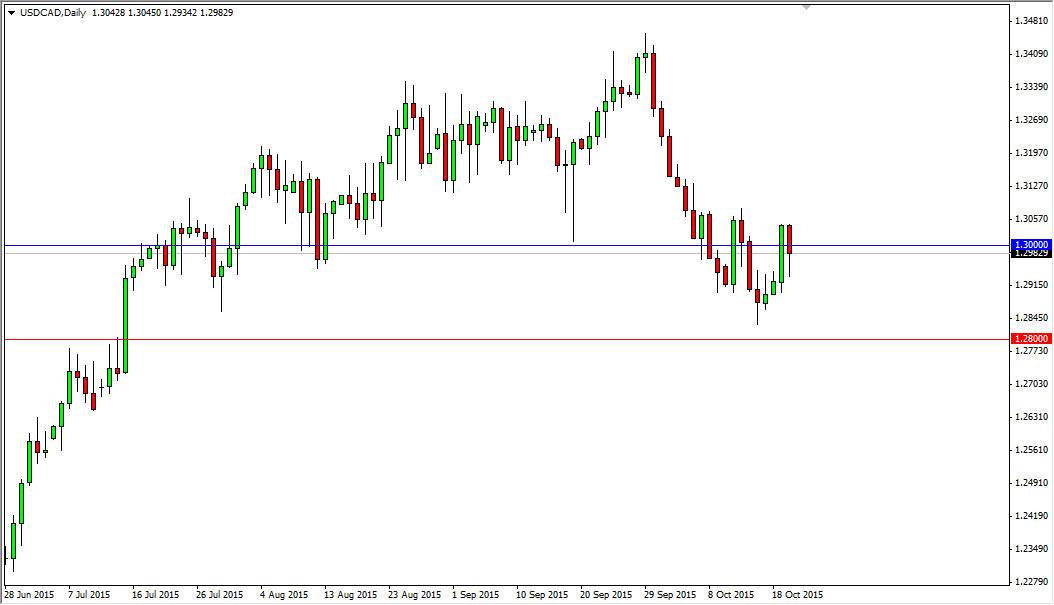

The USD/CAD pair initially fell during the day on Tuesday, but bounced enough to look rather supportive. Do not forget that today we have a Bank of Canada interest-rate announcement. Because of this, I would anticipate seeing quite a bit of volatility in this pair. However, we are sitting in exactly where I would like this pair to be sitting going into this announcement. The reason of course is that I have been harping on about support between the 1.12 level on the bottom and the 1.30 level on the top. With that, it lines up perfectly with the interest-rate decision as I believe the Canadians will try to do what they can in order to bring down the value the Canadian dollar which has seen quite a bit of resurgence lately.

On top of that, oil markets, although better than they once were, don’t exactly look extraordinarily strong at the moment. With this, I feel that the Canadians will continue to err on the side of caution, meaning that they will speaking dovish tones when it comes to interest-rate expectations and of course the outlook for the Canadian economy.

USA slowing down?

Although it is a bit counterintuitive, this pair tends to rise when the US economy is softening. We have seen 2 months of bad jobs numbers coming out of the United States, and that of course brings in the possibility of the slowing US economy. If that’s the case, the value of oil will more than likely struggle as there will be less demand. On top of that, people buy the US dollar in order to buy treasury notes, which are essentially a safe haven.

Do not discount the fact that Canada sends 85% of its exports into the United States, and if their biggest customer is suddenly broke, it will of course affect the Canadian economy as well. So having said that, I do anticipate a bounce from this area as we should start reaching towards the 1.33 handle.