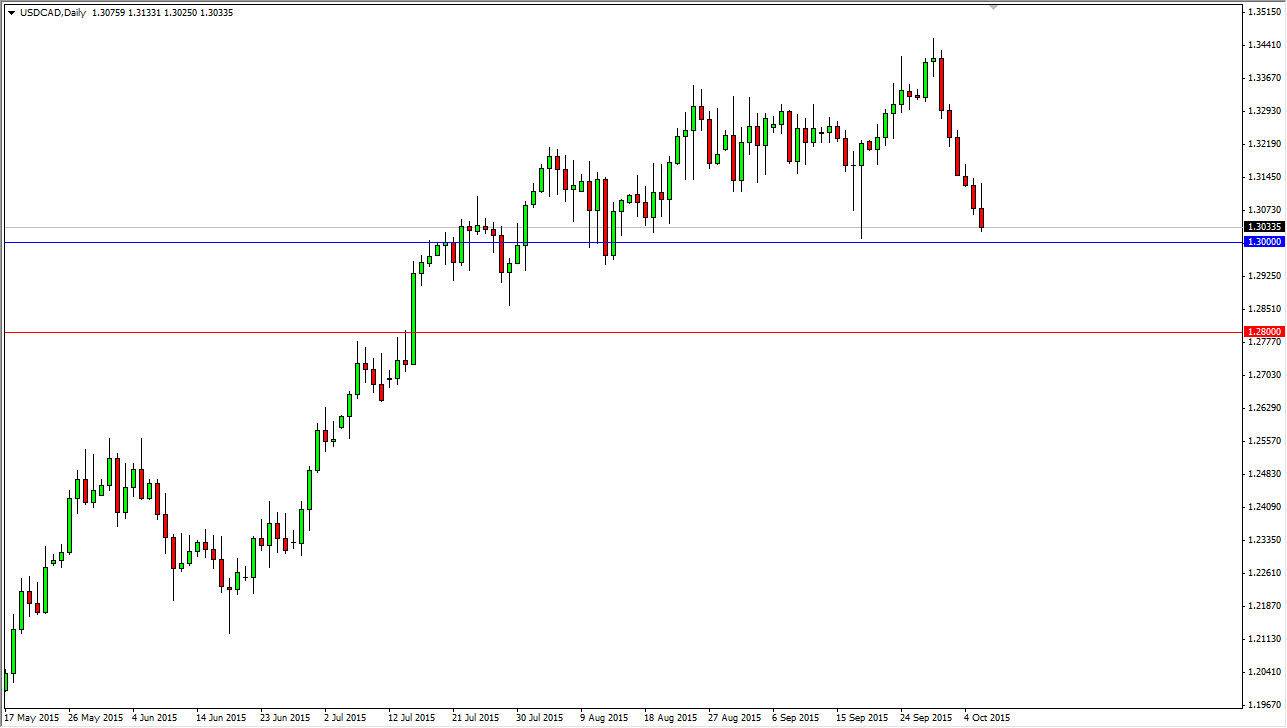

The USD/CAD pair initially rose during the course of the session on Tuesday, but found enough resistance near the 1.3150 level to turn things back around and form a pretty significant looking shooting star. Having said that, the market sits just above the vital 1.30 support level. This was an area that was extraordinarily resistive previously, as seen during the financial crisis. Because of this, I feel that this market will more than likely find buyers sooner or later, but I am the first to admit that we are getting at pretty significant levels now.

I find it difficult to short this market though, because I remember the 1.28 level below being so resistive. With that in mind, I feel that it should now be a support “zone”, as that noise should contribute to “market memory.” On top of that, I recognize that the Canadian economy isn’t exactly soaring along.

Federal Reserve and others

The Federal Reserve has made an absolute mess of the financial markets, and are currently trying to find a way out of their own self-made issues. Quite frankly, the market needs to see higher interest rates for the United States going forward, or we will see the US dollar lose quite a bit of strength. The only thing that’s probably keeping the US dollar off at this point is the fact that the rest the world is doing so poorly. However, we are essentially creating a bubble in the stock market as interest-rate being so low encourage start buying.

On top of all of that, you have the oil markets would suddenly look like they are going to go higher. That of course works in favor of the Canadian dollar, but it doesn’t have to. The Canadian dollar can lose value while oil goes higher. It’s not a 100% correlation, especially considering that the Americans produce much more crude oil than they used to. Because of this, I am cognizant of what the oil markets are doing, but I don’t make that the sole reason to trade this pair.

At this point in time, I am simply looking for a supportive candle that I can buy, or a break above the top of the shooting star for the Tuesday session. I am not selling until we clear the 1.28 handle.